UPDATED: SEPTEMBER 05, 2023 | 3 MIN READ

Maryland runs its own health insurance coverage exchange called the Maryland Health Connection. Three insurance providers provide coverage policies to its population of 6.25 million people. The state is also piloting an initiative that offers additional subsidies to people up to the age of 34. It’s not mandatory to have health insurance in Maryland.

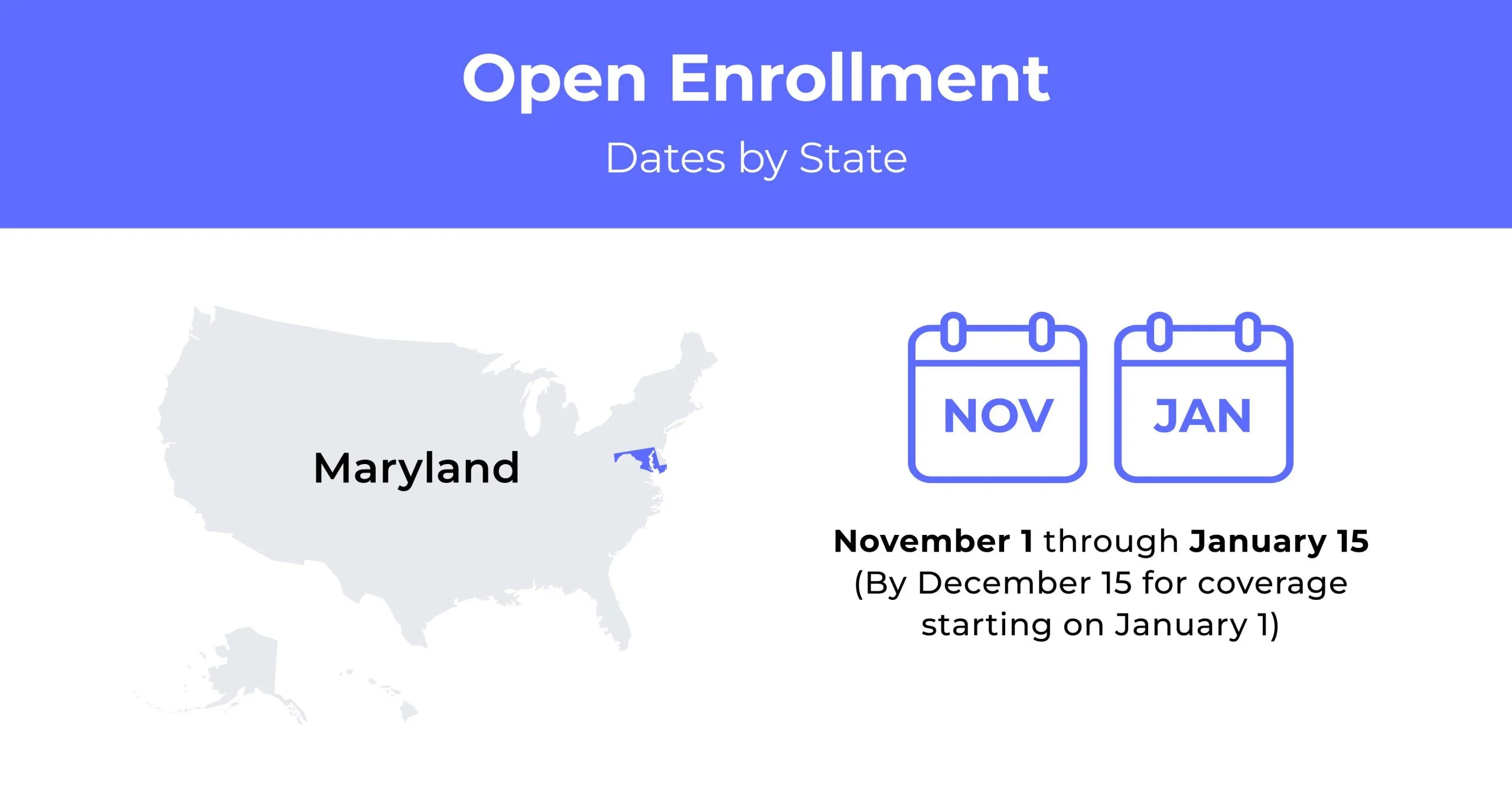

Maryland Open Enrollment Dates For Health Insurance

Maryland’s Open Enrollment dates for health insurance run from November 1st to January 15th each year.

Maryland Health Insurance Demographics

The biggest proportion of the state’s population is insured through their employer—they account for 57.8% of the total population. The state has one of the lowest rates of uninsured at 4.3%, and this is due to its competitive premiums. Just nine percent of people live below the poverty level in the state.

- Average Household Income: The median household income is $87,063. This is over $20,000 above the national median income level of $64,994.

- Median Age Range: The median age is 38.3 years of age. Of this, 51.6% are females, and 48.4% are males.

- Education: 90.6 percent of residents have a high school education, while 40% have graduated from college.

What Type Of Marketplace Does Maryland Have?

The Maryland Health Connection is an active purchasing exchange system. For those looking for insurance, the system exchanges information with insurance providers and decides what plans can be offered for sale. The system has three insurance providers. Each provider can offer up to four plans at each metal level.

How many people are insured through the Maryland health insurance Marketplace?

Premiums have decreased over the past three years, with a minor increase in 2022. This, along with a new incentive for adults up to 34 years old, has seen enrollment reach its highest levels. In 2022, 181,000 people enrolled.

Did Maryland implement the ACA’s Medicaid expansion?

Yes. Maryland was one of the first to implement the expansion. The decision to expand was finalized in May 2013, with a start date of January 1, 2014. The expansion meant that low-income individuals could afford an insurance policy. Its introduction has drastically reduced the number of uninsured in the state.

When can you purchase ACA health insurance in Maryland?

When enrollment opens for Maryland health insurance, consumers can shop around and decide to keep their current policy or choose a new one. The enrollment period begins on November 1, 2022, and finishes on February 28, 2023. It’s good to check the exchange website for changes to the enrollment period year-on-year.

Types of ACA Plans In Maryland

Those looking for health insurance in Maryland can choose from different plans in four metal tiers. Insurance coverage is available on Bronze, Silver, Gold, and Platinum tiers.

Bronze has the lowest monthly premium yet the highest out-of-pocket expenses and deductibles, making this a good option if you’re healthy and don’t expect many health issues. Gold has the next lowest monthly premium. Regardless of the tier chosen, there’s no difference in the quality of care.

What carriers offer ACA health insurance in Maryland?

Residents of Maryland have three ACA insurance providers to choose from. All plans under ACA cover ten essential benefits and must include emergency care, maternity and childbirth, and drugs under prescription. The three insurance carriers in Maryland are:

- CareFirst

- United Healthcare

- Kaiser Permanente

How Much Does Health Insurance Cost In Maryland?

Maryland health insurance policies can cost an average of $312 per person. This can vary depending on your chosen carrier and if you’re in good health with no pre-existing conditions. The bronze tier has the cheapest monthly premium of $265, while the platinum tier costs $370 per month.

What makes Maryland unique is that prices remain the same across all counties for individuals aged 40 and couples aged 40.

Cheapest Health Insurance By Metal Tier In Maryland

The table below shows the least expensive individual plan for each metal tier.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | KP MD Bronze 6900 | $235 | $6,900 | $6,900 |

| Silver | KP MD Silver Virtual Forward 4000 | $320 | $4,000 | $8,550 |

| Gold | KP MD Gold Virtual Forward 2000 | $295 | $2,000 | $5,000 |

| Platinum | KP MD Platinum | $370 | $0 | $4,000 |

Cheapest Health Insurance By County

Health insurance rates can vary by location. The table below shows individual, and family plan costs for the five biggest counties in the state.

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 |

|---|---|---|---|

| Anne Arundel | KP MD Silver Virtual Forward 4000 | $320 | $635 |

| Baltimore | KP MD Silver Virtual Forward 4000 | $320 | $635 |

| Baltimore City | KP MD Silver Virtual Forward 4000 | $320 | $635 |

| Montgomery | KP MD Silver Virtual Forward 4000 | $320 | $635 |

| Prince George’s | KP MD Silver Virtual Forward 4000 | $320 | $635 |

Are Subsidies Available In Maryland?

Subsidies available depend on your income. Tax credits are available, along with cost-sharing reductions. When looking for insurance coverage, you can apply for the premium tax credit to lower your premium. Cost-sharing helps reduce what people have to pay for deductibles, coinsurance, and copayments.

Policymakers in the state introduced a program piloted to help adults up to 34 years old get health insurance in Maryland. Adults in this age bracket qualify for this scheme if their income doesn’t go past 400% of the federal poverty level. This initiative subsidizes what they have to pay.

Can You Purchase Off-Exchange Insurance Coverage In Maryland?

Residents in the state that don’t want to purchase on Maryland’s Health Connection can purchase health insurance in Maryland off-exchange. People between 19 and 64 can purchase an off-exchange policy through an agency or health care company.

Under Obamacare, full health insurance plans must include coverage for pre-existing conditions and mental health difficulties. However, the differing factor is that those purchased on the Health Connection can avail of tax credits and other deductibles. At the same time, those who purchase off-exchange can’t avail of these incentives.

Can You Purchase Short-Term Insurance In Maryland?

Maryland has one of the strictest policies around short-term health insurance coverage. Three months is the maximum period they’re allowed to run. They’re also non-refundable. Short-term coverage is available to residents taking up work in the state and waiting for their employer’s policy to begin. It’s a good option to consider providing cover for this period.

Applicants can be denied short-term coverage if they have a pre-existing condition. Often, short-term plans don’t include the same level of essential coverage as those offered under the ACA.

Health Coverage Options For Low-Income People In Maryland

Maryland was one of the first states to introduce the expansion of Medicaid, which helps people with a low income get access to a range of medical services.

Under Medicaid, you may get low-cost or free health coverage. With this option, you can get access to coverage for prescription drugs, pregnancy and childbirth care, emergency care, and preventative treatments. When Medicaid was expanded in 2014, adults under 65 with an income below 138% of the FPL could qualify for this option.

The Children’s Health program in the state helps children under the age of 19 get coverage. You and your family may qualify if the household income is below 211% of the federal poverty level.

Another option for health insurance in Maryland is Medicare. Anyone under 65 entitled to Social Security benefits or a disability payment under the Railroad Retirement scheme may qualify. Other factors that help qualify include kidney disease or being diagnosed with Lou Gehrig’s Disease. If you or your spouse worked and paid Medicare for ten years, you’re entitled to premium-free Medicare Part A.

What Medicare Options Are Available In Maryland?

Many Medicare options are available when looking for Maryland health insurance. If you’ve reached 65, you qualify for Medicare. If you’ve worked or your spouse has worked and paid Medicare for ten years, you’re eligible for premium-free health coverage under the scheme. You might still qualify if you didn’t pay into Medicare during your working life, so it’s worth investigating.

These are other Medicare options. Medicare Part B is an option worth considering as the monthly payment for this add-on is taken from your Social Security or your Railroad Retirement payment. If you need help paying copayments and deductibles, the Medicare Supplement can help. Private companies sometimes offer Medicare Advantage. These can consist of combined elements of Medicare Part A and B. Medicare Part D may also be included. This coverage is a standalone coverage for prescription drugs.

Medicaid In Maryland

Maryland health insurance options provide free or low-cost health insurance to people and families if their income comes under a threshold. Medicaid offers coverage for preventative care, childbirth and pregnancy care, prescription medicines, and emergency care.

Since it introduced the Medicaid expansion in 2014, adults under 65 with an income below or at 138% of the federal poverty level can qualify for coverage. For example, a family with one member in the household will qualify if their income is below $17,774. The income threshold for a household with two members increases to $24,039.To qualify for health insurance in Maryland under Medicaid, you need to be a state resident.

Cheapest Health Insurance Plans In Maryland

Maryland health insurance options include four metal tiers: Bronze, Silver, Gold, and Platinum. The Bronze and Gold options are the cheapest insurance plans in the state.

The five counties in the state all offer health insurance coverage at the same price for individuals aged 40 and for couples aged 40. The cheapest plan is the KP MD Silver Virtual Forward 4000, priced at $320 for an individual and $635 for a couple.

Cheapest health plan in Maryland with low out-of-pocket maximums

Out of the four metal tiers for health insurance in Maryland, the Gold one has the lowest out-of-pocket maximums. The monthly premium is $295, and its out-of-pocket maximum is $5,000. This plan is the KP MD Gold Virtual Forward 2000.

Cheapest health plan in Maryland with high out-of-pocket maximums

The silver metal tier offered in the state has one of the lowest premiums at $320. This plan has the highest out-of-pocket maximum of $8,550. This plan is the KP MD Silver Virtual Forward 4000.

Cheapest health plan in Maryland with an HSA option

If you’re in good health and don’t expect to have many medical problems, an HSA is a valid option. This option sets up your insurance coverage payments, so they are paid out before you pay your income tax.

Maryland doesn’t offer a Gold metal plan with an HSA. However, Bronze and Silver are available. If you’re 40 years old, these are the approximate payments you can expect to make:

- Bronze: BlueChoice HMO HSA Bronze $6,150 by CareFirst BlueChoice

- Silver: KP MD Silver 3200/20%/HSA/Vision by Kaiser Permanente is priced at an average of $339 per month.

Cheapest HMO/PPO/POS health plans in Maryland

When choosing health insurance coverage, weighing up all your options is important. HMO plans are the most popular among Maryland residents. They offer low monthly premium payments along with easy access to insurance providers. The only downside is that you need a referral to see a medical specialist. Maryland also offers PPO plans. Often, these are more expensive, but one of their advantages is that they offer flexibility, and you don’t have to be referred to a medical specialist.

The Silver metal tier is the cheapest plan. These are your options if you’re a resident of Maryland and are 40 years of age:

- HMO: KP MD Silver 3200/20%/HSA/Vision by Kaiser Permanente has a monthly premium average of $339 per month.

- PPO: BluePreferred PPO HSA Silver $3,000 VisionPlus by CareFirst BlueCross BlueShield – PPO has a monthly premium average of $571 per month.

FAQs

What’s the income limit for Maryland Health Connection?

This depends on the number of people in your household. For one adult, the income limit is $1,564. With children, it’s $2,391. For two people in a household, the income limit for adults is $2,106. With children in a two-person household, it’s $3,220. Check the eligibility requirements for the income limit before applying.

Can you buy private health insurance in Maryland?

Residents of Maryland can buy private health insurance coverage from several providers or purchase it through the Maryland Health Connection.

Maryland’s Health Connection offers four metal tiers, with the Bronze usually having the lowest monthly premium payments yet higher out-of-pocket maximums. The Gold and Platinum tiers have higher monthly premiums with lower out-of-pocket expenses.

How much does Obamacare cost in Maryland?

The lowest cost is the Bronze Plan and which has a monthly premium of $222.

The Silver plan is over 100 dollars more expensive, with an average monthly price of $342.

Is it mandatory to have health insurance in Maryland?

It’s not mandatory to have health insurance in Maryland. Despite this, the state has the highest number of insured people in the nation. This is due to its competitively priced premiums and the plans offered. Fifty-seven percent of the state’s population is insured through their employer.

How much is the average monthly cost of health insurance in Maryland?

Health insurance in Maryland is competitive, offering one of the lowest monthly premium options for residents. For an adult aged 40, the average monthly payments are $338.

How To Find AffordableMaryland Health Insurance

Maryland offers a number of affordable options when it comes to purchasing health insurance coverage. With three insurance providers on the Marketplace and four metal tiers, there are options to suit many budgets.

Use our quoting tool to compare plans and rates to find the best option.