UPDATED: SEPTEMBER 05, 2023 | 1 MIN READ

The cost of health insurance in Hawaii depends on the tier you choose in the private market. Cheaper plans don’t always provide the best options for coverage. They usually have higher deductibles and don’t cover as many medical costs. This article analyzes all you need to know about health insurance in Hawaii.

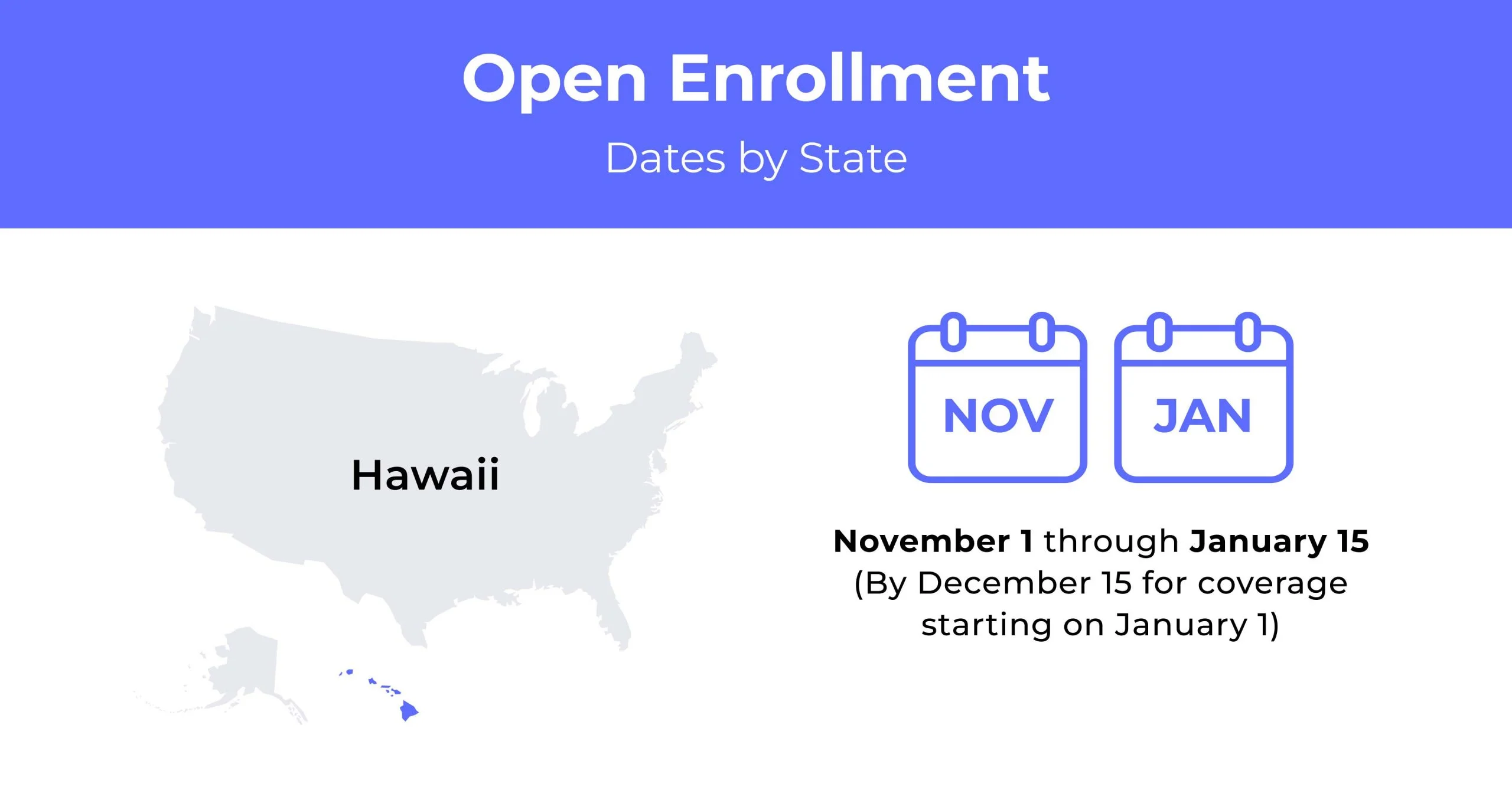

Hawaii Open Enrollment for health insurance dates

Hawaii Open Enrollment for health insurance runs from November 1st to January 15th each year.

Hawaii health insurance demographics

One key factor in health insurance premiums is demographics. Hawaii residents rate household income, age, and education.

- Average household income: Many homes in Hawaii are considered high-income. The average household income is $107,348.

- Median age range: The median age range in Hawaii is 39.6 years old.

- Education: Hawaii ranks 48 out of 52 in the nation (near the bottom). Hawaii is the only state which doesn’t use property taxes to fund public education. Around 62% of people aged 25 and up have a college education.

What type of Marketplace does Hawaii have?

Hawaii’s health insurance Marketplace is federally run, with two participating carriers. Residents can enroll in private individual-market plans through the state’s exchange. The state oversees all of the plans sold within the exchange.

How many people are insured through the Hawaii health insurance Marketplace?

In 2021, there were just over 22,900 residents in Hawaii insured with private market plans. It is one of the few states where enrollment grew in 2019.

Did Hawaii implement the ACA’s Medicaid expansion?

Hawaii did adopt Medicaid expansion through the Affordable Care Act. It extends eligibility for Medicaid to adults with income up to 138% of the poverty level. The expansion took effect in 2014.

When can you purchase ACA health insurance in Hawaii?

Open enrollment for choosing health insurance runs from November 1st to January 15th. You can sign up, renew, or change your ACA Health insurance plan. It is easy to enroll online through the federal government’s site.

Types of ACA plans in Hawaii

There are six health insurance plans in Hawaii for health insurance under the Affordable Care Act. These tiers include:

- Catastrophic

- Bronze

- Expanded Bronze

- Silver

- Gold

- Platinum

The monthly premiums can vary depending on location, age, and more. Coverage increases along with your monthly premium when the plan tier is higher.

What carriers offer ACA health insurance in Hawaii?

Two health insurance carriers offer individual health insurance under the ACA in Hawaii. They are the Hawaii Medical Service Association (HMSA) and the Kasier Foundation Health Plan Inc. (KFHP).

How much does health insurance cost in Hawaii?

Your coverage tier, family size, and age affect your monthly health insurance premium. Insuring children remains a flat fee until they turn 15 years old. The monthly premiums increase as they get older.

For example, the average cost of the Silver Plan for a family of three with two 40-year-old parents and a child younger than 14 is $1,274 in Hawaii. With each additional child, the policy cost goes up by $294.

Cheapest health insurance by Metal Tier in Hawaii

Health insurance rates vary by the coverage level you have. Below are the cheapest individual health plans rates by tier.

| Metal Tier | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|

| Catastrophic | $200 | $8,700 | $8,700 |

| Bronze | $315 | $7,000 | $8,650 |

| Bronze Expanded | $360 | $6,500 | $8,650 |

| Silver | $470 | $4,000 | $8,500 |

| Gold | $450 | $1,000 | $8,550 |

| Platinum | $530 | $0 | $7,150 |

Cheapest health insurance by county

Your location can dictate insurance rates. However, Hawaii residents in the five largest cities pay the same rates. The table below shows the lowest rates for individual and family plans. Rates may differ slightly in other areas of the state.

| County Name | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|

| Hawaii | $470 | $940 | $1,220 |

| Honolulu | $470 | $940 | $1,220 |

| Kalawao | $470 | $940 | $1,220 |

| Kauai | $470 | $940 | $1,220 |

| Maui | $470 | $940 | $1,220 |

Are subsidies available in Hawaii?

There are health insurance subsidies available in Hawaii. The Compact of Free Association (COFA) allows Hawaii residents to be eligible for premium subsidies. Eligibility is available even if your income is below the poverty level.

Can you purchase off-exchange insurance coverage in Hawaii?

You can purchase health insurance privately or off-exchange in Hawaii. You can purchase directly from an insurance provider through a broker.

These plans also comply with ACA, ensuring minimum coverage and essential health benefits. You get a more first-hand experience with available health plans, and providers can offer more options.

Can you purchase short-term insurance in Hawaii?

Hawaii passed a state law back in 2018 prohibiting the purchase of short-term health plans. You cannot buy short-term plans as long as you are eligible to purchase an ACA-compliant plan. There are types of plans such as fixed indemnity or health care sharing ministry plans available which are non-ACA compliant. But, these are not considered genuine health insurance.

Health coverage options for low-income people in Hawaii

Med-Quest Division (MQD) offers affordable health insurance and long-term care plan for low-income residents of Hawaii. It provides eligible families and individuals access to health and medical coverage through managed care plans.

What Medicare options are available in Hawaii?

Medicare plans are available for those aged 65 and older in Hawaii. The Medicare health options include:

- Original Medicare: Parts A and B

- Medicare Advantage: Part C

- Prescription Drug Coverage: Part D

- Medicare Supplemental insurance: Medigap

Ensure you understand each part of Medicare to obtain the proper coverage for your needs.

Medicaid in Hawaii

Most Medicaid services in Hawaii are delivered through MCO. There are 5 MCO Health plans:

- AlohaCare

- HMSA

- Kaiser Permanente

- ‘Ohana Health Plan

- UnitedHealthcare Community Plan

The UnitedHealthcare Community Plan provides benefits for medical and Long Term Services and Support (LTSS).

Cheapest health insurance plans in Hawaii

Health insurance costs depend on many factors, such as location and age. The cheapest plan in Honolulu County is the KP HI Silver 4000/45 plan offered by Kaiser Permanente, with an average monthly premium of $467.

Cheapest health plan in Hawaii with low out-of-pocket maximums

You can buy higher plans with low out-of-pocket maximums if you have expensive medical costs. Hawaii’s cheapest health insurance plan with low out-of-pocket costs is the KP HI Platinum 0/10 by Kaiser Permanente. The cost is $586 monthly for a 40-year-old.

Cheapest health plan in Hawaii with high out-of-pocket maximums

You can get cheaper health insurance plans if you don’t have high medical costs. These plans have higher out-of-pocket expenses but help lower overall costs. The most affordable plan with high out-of-pocket maximums is the HMSA Catastrophic Plan at $158 monthly for a 26-year-old. These plans are ideal for Hawaiian college students who don’t have other insurance options.

Cheapest health plan in Hawaii with an HSA option

Suppose you’re healthy and don’t need to visit the doctor often. You can opt to get a Health Savings Account (HSA) plan. It gives you a cheaper plan and allows you to use the HSA as a savings account for medical expenses. The cheapest health insurance plan with this option in Hawaii is the Expanded Bronze HMSA PPO HSA. The average cost is $355 monthly for a 40-year-old.

Cheapest HMO/PPO/POS health plans in Hawaii

HMO plans are the cheapest option across Hawaii, but you must stay within your provider network. The other option is a PPO plan. PPO plans allow you to be more flexible but tend to cost more. The cheapest Silver options for each plan are:

- PPO: HMSA Silver PPO 3500 – costs an average of $478/month for a 40-year-old.

- HMO: KP HI Silver 4000/45 by Kaiser Permanente – costs an average of $467/month for a 40-year-old.

FAQs

How expensive is health insurance in Hawaii?

Residents of Hawaii can expect to pay close to $225 per person for individual health insurance plans. Costs vary depending on location, age, and health.

Does Hawaii have free healthcare?

Hawaii has implemented near-universal health insurance. Employers must provide healthcare for employees who work at least 20 hours per week. This requirement, low unemployment, and expanded Medicaid and Medicare insure almost 95% of the state.

Does Hawaii have good health insurance?

There is broad access to health insurance in Hawaii. It contributes to the state’s low uninsured rates.

Who is eligible for QUEST in Hawaii?

To be eligible for QUEST coverage in Hawaii, you must:

- Be a resident of Hawaii, a U.S. Citizen, or a legal immigrant

- Provide proof of citizenship

- Have proof of identity

- Social Security Number

- Under 65 years of age

- Not reside in a public institution

- Not blind or disabled

- Not eligible to receive health insurance from an employer

- Meet an income test

- Meet an asset test

How do I apply for QUEST insurance in Hawaii?

You can apply online or call by phone for QUEST insurance healthcare.

How to buy Hawaii health insurance

Hawaii health insurance isn’t difficult to purchase. Once you have a general idea of the coverage type you want, use our health insurance tool to compare rates and find the best deal.