UPDATED: SEPTEMBER 05, 2023 | 3 MIN READ

As a Delaware state resident, you can expect to pay an average of $531 for an individual health insurance plan. Prices will vary based on health and other factors. To help you find the best Delaware health insurance for your needs, here is what you need to know about the health insurance Marketplace in Delaware, types of plans, costs, and more.

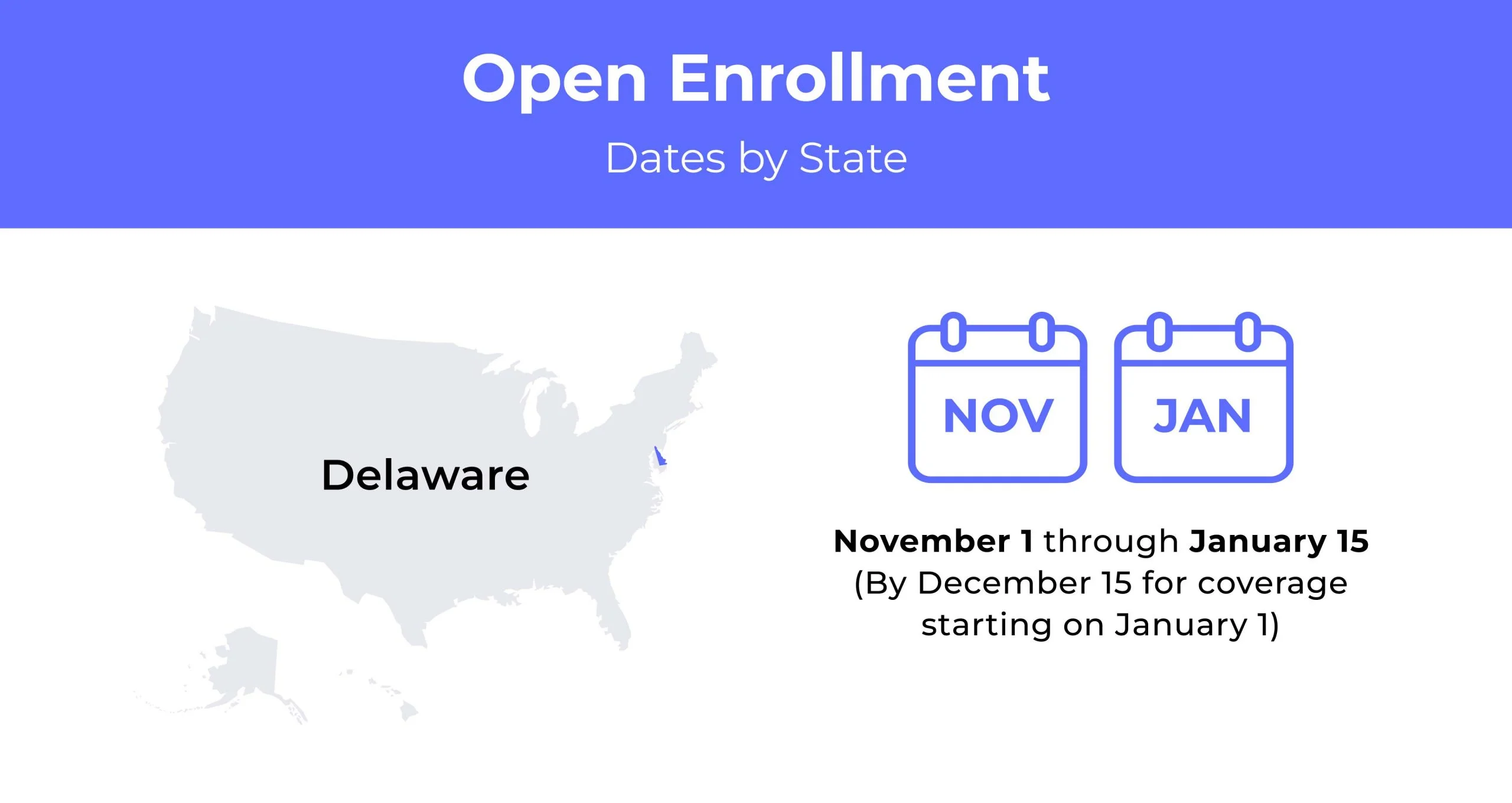

Delaware health insurance Open Enrollment dates

Delaware’s annual health insurance Open Enrollment period runs from November 1st to January 15th.

Delaware health insurance demographics

Delaware’s cost of health insurance varies based on zip code, gender, age, and other factors. Below are relevant statistics surrounding healthcare coverage in Delaware:

- Average household income: The median household income in Delaware is $69,110, around 6% more than the United States median household income of $64,994.

- Median age range: The median age range in Delaware is 55-64 years old at 14%. The state’s largest age range is 35–54 at 24.2%.

- Education: About 91% of Delaware adults are high school graduates, while almost 33% have college degrees. Around 5% of Delaware residents are currently enrolled in college.

What type of Marketplace does Delaware have?

Delaware’s health insurance exchange, Choose Health Delaware, is federally run. As of 2022, Highmark is the only carrier offering exchange plans through the Delaware health insurance Marketplace. This is the only state with just one participating exchange insurer.

How many people are insured through the Delaware health insurance Marketplace?

Due to coverage demand during the COVID-19 pandemic, enhanced federal subsidies, and the state’s reinsurance program keeping steady premium costs, Delaware’s Health Insurance Marketplace for 2022 set an all-time high, increasing 26.8% over last year’s enrollment total.

During the 2020 Open Enrollment Period, 25,320 people enrolled in medical plans through Delaware’s health insurance Marketplace. Additionally, almost 5,900 enrolled in coverage during the COVID/American Rescue Plan Special Enrollment Period for six months in 2021.

Did Delaware implement the ACA’s Medicaid expansion?

Effective January 1, 2014, Delaware expanded Medicaid eligibility to adults under 65 with incomes up to 138% of the federal poverty level. The federal government paid the total cost of expanding coverage to the newly eligible group through 2016. Now states pay 10% of the price.

When can you purchase ACA insurance in Delaware?

Delawareans may purchase ACA health insurance during the Open Enrollment Period. In 2022, the open enrollment window in Delaware ran from November 1, 2021, through January 15, 2022. You will need a qualifying event or a plan change to enroll outside the annual period window.

Types of ACA plans In Delaware

ACA health insurance plans in Delaware are broken down into five different tiers: Platinum, Gold, Silver, Bronze Expanded, and Catastrophic:

- Gold and Platinum health insurance plans typically have the highest premiums but are generally the best if you expect large or frequent medical expenses.

- Silver health plans benefit the average consumer with lower premiums and deductibles.

- Bronze Expanded and Catastrophic plans are the cheapest but have large deductibles and out-of-pocket maximums. They’re best for very healthy people that don’t need routine care.

What carriers offer ACA health insurance in Delaware?

Highmark Blue Cross Blue Shield Delaware is the only provider in the state, but the company offers a variety of policies, so you can choose a plan that fits your needs. For 2023, Highmark will offer 13 plans: four gold, three silver, three bronze, two platinum, and one catastrophic.

How much does health insurance cost in Delaware?

For 2022, the average cost of health insurance in Delaware is $506 for a 40-year-old person. This is a 4% increase in price for 2021 across all plan tiers.

Cheapest health insurance by Metal Tier in Delaware

With five Metal Tiers, finding cheap individual health insurance in Delaware is not difficult. Below are the most affordable plans and rates for each tier level.

| Metal Tier | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|

| Catastrophic | $310 | $8,700 | $8,700 |

| Bronze Expanded | $415 | $3,800 | $8,700 |

| Silver | $540 | $3,250 | $6,900 |

| Gold | $530 | $0 | $7,500 |

| Platinum | $670 | $0 | $5,000 |

Are health insurance subsidies available in Delaware?

Enhanced federal subsidies will continue for 2023. Delaware residents seeking coverage, especially those who have lost insurance, can shop for 2023 coverage through the Health Insurance Marketplace.

Can you purchase off-exchange insurance coverage in Delaware?

Highmark Blue Cross Blue Shield Delaware is the only health insurance provider on the state exchange. However, there are many dental and life insurance carriers, such as Delta Dental, Humana, and Ameritas Life Insurance Corp.

Can you purchase short-term insurance in Delaware?

Delaware allows short-term individual and family health plans for up to three months. Remember that you can’t extend your policy or enroll in a new plan more than once a year.

Short-term health insurance isn’t for everyone. However, it can be a good option if you’re seeking to save on costs and only need minimal coverage. Consider the risks and your unique needs before choosing your plan.

Health coverage options for low-income people in Delaware

The Delaware Medicaid program offers medical assistance to eligible low-income families and blind and/or disabled people whose income is insufficient to meet the cost of necessary care. This includes doctor visits, prescription drugs, mental health, hospital care, labs, transportation, routine vaccinations for children, chiropractic services, and substance abuse services.

What Medicare options are available in Delaware?

Delaware’s Medicare Advantage program offers four plans: Health maintenance organization (HMO), preferred provider organization (PPO), private fee-for-service (PFFS), and special needs plan (SNP).

Each plan offers different levels of in-network flexibility and varies in cost. All Medicare Advantage plans provide the same coverage as Original Medicare, but additional benefits may come with a higher premium.

Medicaid In Delaware

The Delaware Division of Medicaid & Medical Assistance (DMMA) administers the Medicaid program in Delaware, called the Diamond State Health Plan. The long-term care program is the Diamond State Health Plan Plus.

To be eligible for Delaware Medicaid, you must be a Delaware resident needing health care/insurance assistance whose financial situation is low or very low.

You must also be one of the following:

- Have a disability or a family member in your household with a disability, or

- Blind, or

- Pregnant, or

- Responsible for a child 18 years of age or younger, or

- Be 65 years of age or older.

Annual pre-tax household income restrictions also apply.

Cheapest health insurance plans in Delaware

If you’re shopping for cheap health insurance in Delaware, you’ll find the best individual policies on the state insurance exchange. The cheapest plan for the average consumer is my Blue Access PPO Silver 3250 HSA.

Cheapest health plan in Delaware with low out-of-pocket maximums

If your health expenses are high, it’s best to choose a plan with higher monthly costs but low out-of-pocket maximums. It costs more each month, but if you have frequent prescription drug costs or doctor visits, you’ll reach your out-of-pocket limits, and your provider will begin to cover your expenses.

Highmark Blue Cross Blue Shield, Delaware, is the most affordable plan with low out-of-pocket maximums. The Shared Cost Blue EPO Platinum 0 plan costs an average of $665 monthly for a 40-year-old.

Cheapest health plan in Delaware with high out-of-pocket maximums

If you’re a younger buyer, a low-cost plan with high out-of-pocket maximums may be a good option. You will have to spend more if you have a medical emergency, but the monthly premiums are cheap.

For the average 26-year-old, the most affordable Delaware health insurance plan with a high OOP maximum is Major Events Blue EPO 8550 — 3 Free PCP Visits from Highmark Blue Cross Shield Delaware. Its premium costs average $243 per month.

Cheapest health plan in Delaware with an HSA option

Another option is getting a Health Savings Account (HSA) plan. They’re generally inexpensive and allow you to make pre-tax contributions. They also earn you savings unless you use them for approved expenses.

HSA plans are available for the Delaware Expanded Bronze and Silver tiers. The cheapest plans for each are:

- Expanded Bronze: Health Savings Embedded Blue EPO Blue 6900 HSA by Highmark Blue Cross Blue Shield Delaware costs an average of $405 monthly.

- Silver: Health Savings Embedded Blue EPO Silver 3450 HSA by Highmark Blue Cross Blue Shield Delaware averaging $522 monthly.

Remember that HSA plans have high deductibles, which may result in you using a part of your savings to pay for any major medical costs.

FAQs

Does Delaware have free healthcare?

Delaware Medicaid provides free or low-cost health coverage to those eligible.

Is it mandatory to have health insurance in Delaware?

Per the Affordable Care Act (ACA), Delaware residents must have health insurance coverage, although there are no individual penalties for failure to do so.

Who is eligible for Delaware Medicaid?

Children ages 1-6 can qualify for Medicaid benefits when household income is at or below 133% of the Federal Poverty Level. Pregnant women and infants under one qualify for Medicaid with family income at or below the 200% Federal Poverty Level, and pregnant women count as 2 (or more) family members.

What’s the income limit for Medicaid in Delaware?

To be eligible for Medicaid in Delaware, you must have an annual household income (before taxes) that ranges from a one-person household income of $18,075 to an 8-person household income of $62,018. Add $6,277 per additional person for households with more than eight people.

How many people in Delaware have health insurance?

About 25,320 people enrolled in 2021 medical insurance plans through Delaware’s health insurance Marketplace. As of January 2021, 217,211 Delaware residents were enrolled in Medicare, 22% of the state’s population.

How to buy Delaware health insurance

You can purchase individual health insurance in Delaware during open enrollment. If you’ve missed open enrollment, you may still be eligible to apply for coverage if you have a qualifying life event (such as having a child or losing coverage).

Use our health insurance quote tool to compare rates and plans.