UPDATED: SEPTEMBER 05, 2023 | 2 MIN READ

Trying to find health insurance in Michigan can feel confusing and overwhelming. There are many options for coverage, and finding an affordable plan can seem impossible. Here is all you need to know about getting the best health insurance in Michigan.

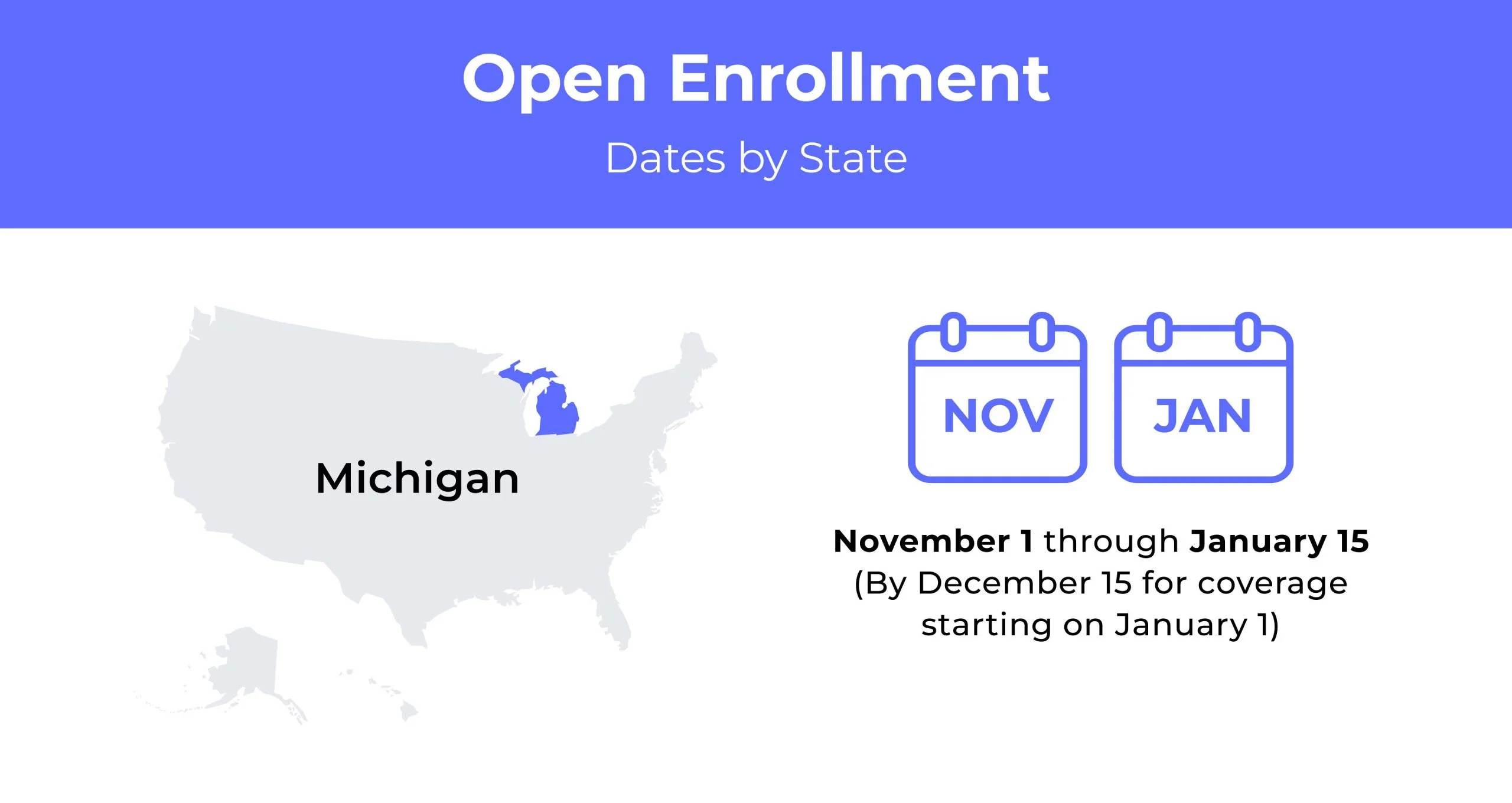

Michigan Open Enrollment Dates For Health

Michigan’s health insurance Open Enrollment period runs from November 1st to January 15th each year.

Michigan Health Insurance Demographics

Insurers look at demographics within an area to determine premium costs and risks. Below are some key demographics found within the state of Michigan:

- Average Household Income: Michigan has a very low percentage of high-income households. The average income is $80,803.

- Median Age Range: Over 18% of Michigan residents are over 65. The median age range in the state is 35.5 years.

- Education: 91% of adults in Michigan hold a high school diploma or GED. Also, 1.36 million of the population aged 25 and older have a bachelor’s degree.

What Type Of Marketplace Does Michigan Have?

The Health Insurance Marketplace in Michigan is a state-federal partnership exchange. The state oversees plan management, but the federal exchange is for enrollment. Individuals and families can purchase online at healthcare.gov or call to compare and buy health plans.

How many people are insured through Michigan’s Marketplace?

There are 303,550 people enrolled in health plans through the exchange for this year. It is the highest enrollment since 2017.

Did Michigan implement the ACA’s Medicaid expansion?

Michigan adopted the expansion of Medicaid eligibility to those earning up to 138% of the Federal Poverty Level (FPL). The expansion became effective with the creation of the Healthy Michigan Plan (HMP).

When can you purchase ACA insurance in Michigan?

You can purchase your ACA health insurance plan during the Open Enrollment Period. The period runs from November 1st to January 15th of each year. Exceptions to enrolling outside of the period require a specific life event, such as the birth of a baby.

Types of ACA Plans In Michigan

There are six types of health insurance plans available in the Michigan Health Insurance Marketplace. The tiers are as follows:

- Catastrophic

- Bronze

- Expanded Bronze

- Silver

- Gold

- Platinum

Premiums vary depending on tier, as well as other factors.

What carriers offer ACA insurance in Michigan?

Ten carriers offer exchange plans in Michigan. Plan availability may vary from one location to another:

- Blue Cross Blue Shield of Michigan

- Blue Care Network

- Meridian (merged with Ambetter)

- Molina

- Priority Health

- Physicians Health Plan

- UnitedHealthcare

- McLaren Health Plan

- Oscar Health

- US Health and Life Insurance Company

How Much Does Health Insurance Cost In Michigan?

Health insurance costs in Michigan vary. Premiums can be lower if you are in good health. The average cost of an individual plan is around $406 monthly.

Cheapest Health Insurance By Metal Tier In Michigan

Each plan tier has specific coverage, deductibles, and out-of-pocket maximums, and the pricing reflects this. The table below shows the cheapest individual health coverage options for each coverage level.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Catastrophic | Blue Cross Select | $220 | $8,700 | $8,700 |

| Bronze | Ambetter Essential | $220 | $8.600 | $8,600 |

| Bronze Expanded | Ambetter Essential | $240 | $6,900 | $6,900 |

| Silver | Ambetter Balanced Care | $290 | $6,100 | $6,100 |

| Gold | Ambetter Secure Care | $320 | $750 | $7,500 |

| Platinum | Sparrow PHP | $533 | $500 | $3,000 |

Cheapest Health Insurance By County

Rates can also vary depending on your location. In Michigan, the cheapest individual and family health insurance plans stay the same across the five largest counties. However, rates may still vary slightly in other areas of the state.

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|---|

| Genesee | Ambetter Balanced Care | $290 | $580 | $750 |

| Kent | Ambetter Balanced Care | $290 | $580 | $750 |

| Macomb | Ambetter Balanced Care | $290 | $580 | $750 |

| Oakland | Ambetter Balanced Care | $290 | $580 | $750 |

| Wayne | Ambetter Balanced Care | $290 | $580 | $750 |

Are Subsidies Available In Michigan?

You can qualify for a health insurance subsidy depending on your income. Subsidies help lower your monthly premiums and make your health insurance more affordable. Check your eligibility online or by calling your local exchange Marketplace.

Can You Purchase Off-Exchange Insurance Coverage In Michigan?

You have the option to enroll in a private health plan outside of the Marketplace exchange. However, you still have to register during the allotted period and are not eligible for tax credits or savings.

Can You Purchase Short-Term Insurance In Michigan?

You can buy a short-term health insurance plan in Michigan. Most initial durations are up to 185 days without renewal. You can’t have more than 185 days of short-term coverage from a single insurer within a year.

Health Coverage Options For Low-Income People In Michigan

For low-income people, there are some options for health insurance providing the coverage you need. Below are Medicare and Medicaid health insurance options available.

What Medicare Options Are Available In Michigan?

Medicare is available to those within three months of turning 65 years old. You are eligible to receive it sooner if you have a disability, End-Stage Renal Disease (ESRD), or ALS. Options for Medicare include:

- Part A: covers your hospital stays, nursing facility, home health care, or hospice care.

- Part B: covers doctors’ services, outpatient, and home care.

- Part D: prescription drug coverage.

- Medigap: supplemental Medicare insurance is available to buy privately, helping to pay a share of Original Medicare (A&B) costs.

The Medicare Savings Program pays for certain Medicare costs. There is an asset limit, and your income determines your coverage.

The Michigan Department of Health and Human Services (MDHHS) can help pay the following, depending on your income:

- Medicare premiums

- Medicare coinsurance

- Medicare deductible

Medicaid In Michigan

Medicaid is a federal and state-funded health option providing free or low-cost health coverage. You qualify if your income is at or below 133% of the Federal Poverty Level (FPL). You also can’t be enrolled or qualify for Medicare. They offer Traditional Medicaid (TM) and the Healthy Michigan Plan (HMP) in Michigan.

Cheapest Health Insurance Plans In Michigan

Health insurance plans in Michigan can be expensive, depending on the metal tier you choose. Some plans with lower monthly premiums may have higher deductibles or out-of-pocket maximums. Below is a breakdown of some of the most affordable health insurance plans.

Cheapest health plan in Michigan with low out-of-pocket maximums

You may want a higher-cost plan with lower out-of-pocket maximums if you have high medical costs. Your recurring medical expenses get you to your maximum quicker, so your insurance coverage kicks in.

The cheapest plan with the lowest out-of-pocket max is Sparrow PHP Platinum 500 Exclusive. It is by the Physicians Health Plan and costs an average of $546 monthly for a 40-year-old.

Cheapest health plan in Michigan with high out-of-pocket maximums

If you are younger and have little to no medical costs, a plan with a higher out-of-pocket maximum is more beneficial. These plans have lower premiums, so you save on monthly expenses.

Blue Cross Select HMO Value is the most affordable plan in Michigan, with high out-of-pocket expenses. It is by Blue Care Network of Michigan and costs $226 monthly for a 26-year-old.

Cheapest health plan in Michigan with an HSA option

Health Savings Account (HSA) plans are great if you are healthy. You can save money by making pre-tax contributions for healthcare costs. The cheapest plans in Michigan with an HSA option are:

- HSA Expanded Bronze: MyPriority HMO HSA Bronze 700 – St. John Providence Network from Priority Health. The cost averages $241 per month.

- HSA Silver: Ambetter Balanced care 25 HSA, Ambetter from Meridian. It costs about $380 monthly.

Cheapest HMO/PPO/EPO health plans in Michigan

Michigan’s most common health insurance plan is the Health Maintenance Organization (HMO). Carriers also offer Preferred Provider Organization (PPO) and Exclusive Provider Organization (EPO) plans.

The cheapest option for each plan type is:

- HMO Silver Plan: Totally You Value from Total Health Care USA, Inc., costing an average of $305 monthly.

- PPO Silver Plan: Blue Cross Premier PPO Silver Saver HSA, costing an average of $523 monthly.

- EPO Silver Plan: Oscar Silver Saver 2, costing an average of $346 monthly.

FAQs

How much does health insurance cost per month in Michigan?

Residents of Michigan can expect to pay around $406 per month for health insurance. Age, health history, location, and other risk factors can make plan premiums vary in cost.

What’s the average cost of health insurance in Michigan?

Depending on what tier and health insurance carrier you choose, the cost of health insurance can vary. The Bronze tier averages around $400 per month, with Silver at $500 and Gold at $645.

How do I get health insurance in Michigan?

Go online to Healthcare.gov to sign up for your health insurance plan during the Open Enrollment Period. You can compare quotes from multiple plans online. You can also call insurance companies directly for more information.

Does Michigan have free healthcare?

Medicaid is a program offered in Michigan to uninsured people with low income. It provides free or almost-free health care coverage, but you must be eligible for benefits.

How much is Obamacare in Michigan?

Obamacare, or the Michigan Health Insurance Marketplace, offers many plans to provide health insurance. Premiums for plans vary in cost. They depend on your age, coverage extends to family members, where you live, and medical needs.

How To Find the Best Health Insurance In Michigan

Finding the best health insurance in Michigan doesn’t have to be complicated. First, you should determine your or your family’s medical needs. Then, compare multiple quotes from plans to check coverage and rates to select the best option.

Use our online health insurance quoting tool to compare plans today.