UPDATED: SEPTEMBER 05, 2023 | 1 MIN READ

Suppose you are not eligible for government programs like Medicare and Medicaid and do not have health insurance through an employer. In that case, private plans are available through the New Mexico insurance exchange. Looking for cheap health insurance in New Mexico is easier than you think.

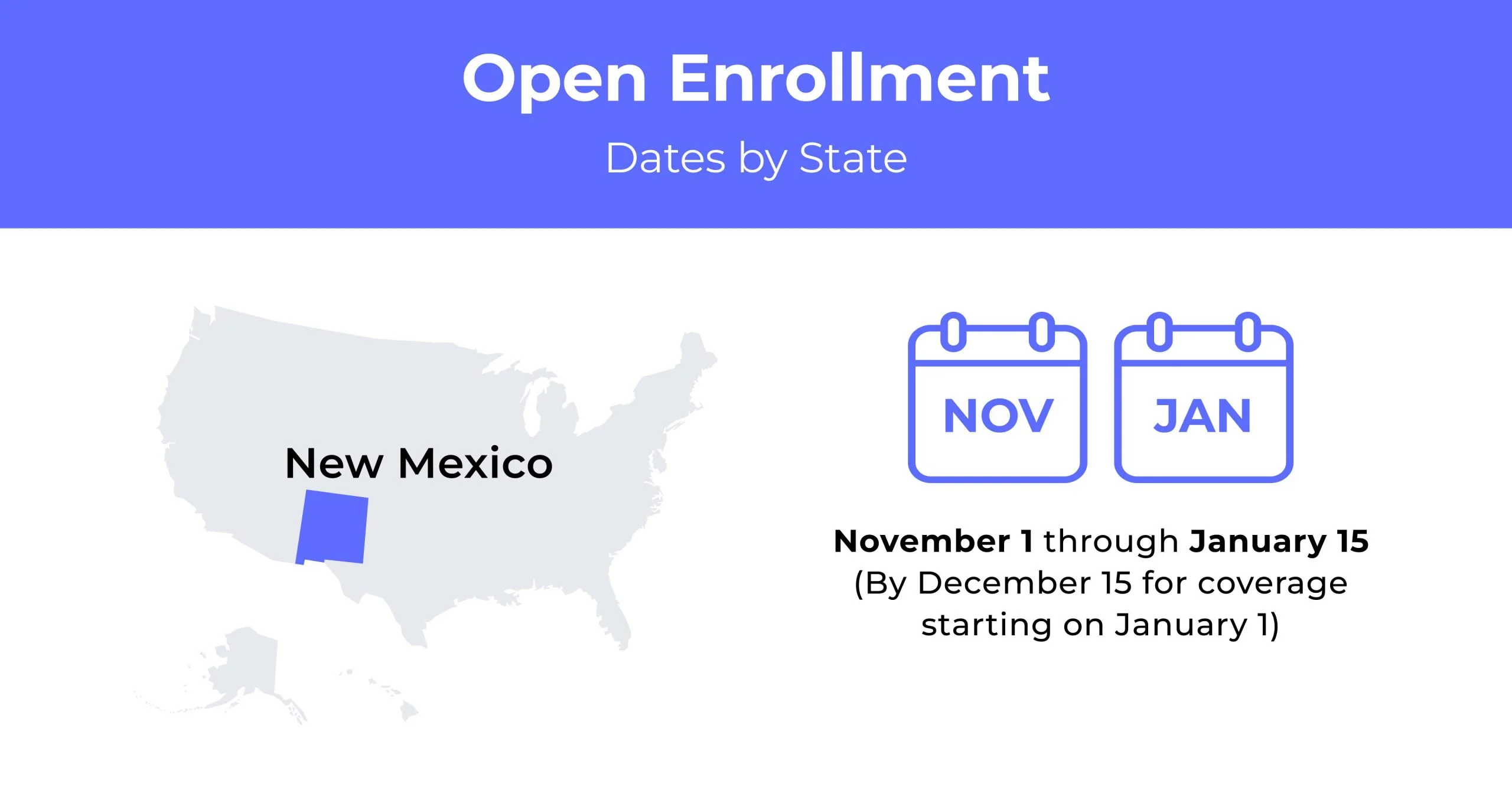

New Mexico Open Enrollment Dates For Health Insurance

Open Enrollment dates for New Mexico’s health insurance run from November 1st to January 15th each year.

New Mexico Health Insurance Demographics

Many health insurance demographics help determine the cost of your health insurance in New Mexico.

- Average Household Income: The average household income in New Mexico is $70,241. The median household income is $51,243.

- Median Age Range: The median age is 38.1 years of age.

- Education: Twenty-six percent of residents in New Mexico have a bachelor’s degree or higher.

What Type Of Health Insurance Marketplace Does New Mexico Have?

New Mexico has a state-run exchange called beWellnm or the New Mexico Health Insurance Exchange. As of November 2021, New Mexico runs its exchange platform and no longer uses HealthCare.gov.

How many people are insured through the New Mexico health insurance marketplace?

There was a peak enrollment in 2016, but it declined by 22% over the next four years. In 2022, 45,664 people enrolled in New Mexico’s exchange compared to 34,966 in 2014.

Did New Mexico implement the ACA’s Medicaid expansion?

As of January 1, 2022, New Mexico implemented Medicaid Expansion for adults aged 19-64 with income below 138%. Adults eligible for NM’s Medicaid Expansion receive Medicaid through Centennial Care.

When can you purchase ACA health insurance in New Mexico?

New Mexico’s insurance exchange enrollment opens from November 1, 2022, to January 15, 2023. You need a qualifying event outside the open enrollment to change your coverage or enroll.

Types of ACA Plans In New Mexico

A few different options are available for Affordable Care Act health insurance plans. There are plans such as Medicaid and Medicare available for low-income people and plans within the health insurance exchange.

What carriers offer ACA health insurance in New Mexico?

There are six insurers offering plans on the New Mexico exchange:

- Molina

- Blue Cross Blue Shield of New Mexico

- Western Sky Community Care

- Friday Health Plans

- Presbyterian Health Plan

How Much Does Health Coverage Cost In New Mexico?

Purchasing health insurance in New Mexico comes from five options of metal tiers to choose from. Some tiers have low monthly premiums, but the trade-off is high out-of-pocket maxes. You can select Catastrophic, Bronze, Expanded Bronze, Silver, or Gold tier plans in New Mexico.

Cheapest Health Insurance By Metal Tier In New Mexico

The metal tier you choose helps determine your premium. Below are the most affordable plans for each metal tier in the state.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | Ind HMO Bronze 2 | $305 | $8,700 | $8,700 |

| Bronze Expanded | Friday Bronze Plus | $240 | $8,700 | $8,700 |

| Silver | Ambetter Silver Balanced Care 31 | $325 | $5,450 | $6,450 |

| Gold | Friday Gold | $295 | $2,300 | $8,250 |

Cheapest Health Insurance By County

Health insurance rates can also vary by county. The table below shows the most affordable options for Silver-tier plans in each of the state’s five largest counties.

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 |

|---|---|---|---|

| Bernalillo | Ambetter Silver Balanced Care 31 | $325 | $650 |

| Dona Ana | Constant Care Silver 7 | $415 | $825 |

| San Juan | Constant Care Silver 7 | $395 | $790 |

| Sandoval | Ambetter Silver Balanced Care 31 | $325 | $650 |

| Santa Fe | Ind HMO Silver 4 | $380 | $755 |

Are Subsidies Available In New Mexico?

Nearly eight out of ten ACA enrollees in New Mexico received subsidies called Advanced Premium Tax Credits in 2020. The average subsidy was $374 monthly.

Can You Purchase Off-Exchange Health Insurance Coverage?

Residents can select a plan off-exchange from a different insurer or through beWellnm. Enrollment is between November 1, 2022, and January 2023.

Can You Purchase Short-Term Insurance In New Mexico?

New Mexico only allows short-term health insurance plans to have terms up to three months at a time. No renewals are permitted and aren’t given to people who have had short-term coverage in the past 12 years. After new regulations took effect, insurers stopped offering short-term insurance plans.

Health Coverage Options For Low-Income People In New Mexico

A couple of great options are available in the form of Medicare and Medicaid. Depending on your age and income, you might qualify for health insurance in Mexico with one of those options.

What Medicare Options Are Available In New Mexico?

New Mexico residents over the age of 65 qualify for Medicare. It offers medical coverage but may require payment of a portion of the premium. Whether you have Part A, B, or D plans determines your coverage and whether you pay a premium.

Medicare supplements are available to fill the gap between the medical care you need and what the government provides. Medicare Part D helps pay for prescription drugs.

New Mexico Medicaid income limits

Medicaid is free for qualified people in New Mexico. It’s a free program that is based on income alone. You qualify for the Medicaid program if your income is below 138% of the federal poverty level. In 2023, the limit for single individuals is $914 and $1,371 for couples.

Cheapest Health Plans In New Mexico

There are a few great options for low-cost individual health insurance plans in the state that have you saving money. Cheap insurance is possible, depending on the coverage you’re looking for.

Cheapest health plan in New Mexico with low out-of-pocket maximums

High-premium individual and family plans with low out-of-pocket maximums are the best options for residents with high medical expenses. You reach your limit quicker with low out-of-pocket costs, and your insurer covers your medical expenses. The cheapest plan costs $354 monthly with Molina Healthcare. The out-of-pocket maximum is listed as $4,500.

Cheapest health plan in New Mexico with high out-of-pocket maximums

High out-of-pocket family and individual plans are great for those that don’t have a lot of medical expenses. The premiums are low, and you only pay out-of-pocket when you need medical care. The cheapest plan is available through Friday Health Plan at $194 monthly. The high out-of-pocket maximums are roughly $8,250.

Cheapest health plan in New Mexico with an HSA option

A health savings plan (HSA) is the best option for someone with low medical expenses. The premiums are low; if you don’t use the funds on medical expenses, they go into your savings. Friday Health Plans have the lowest premiums at $284 monthly.

Cheapest HMO/PPO/POS health plans in New Mexico

HMO is the only type of health insurance in New Mexico. They are typically very affordable but have limited flexibility as you are restricted to a specified network of providers. The cheapest HMO is Constant Care Silver 1 by Molina Healthcare at $343 monthly.

New Mexico Health Insurance FAQs

Does New Mexico have free healthcare?

Medicaid offers free healthcare to qualified low-income persons.

Is healthcare in New Mexico good?

According to the nonpartisan Commonwealth Fund, New Mexico ranks last in the nation for healthcare affordability and access.

Do you need health insurance in New Mexico?

New Mexico residents aren’t required to have health insurance.

Who qualifies for NM Medicaid?

New Mexico Medicaid is based on income, so low-income persons qualify for Medicaid.

Can adults get Medicaid in New Mexico?

The only requirement to qualify for Medicaid is if your income is below 138%.

What are the income limits for Medicaid in NM?

The Medicaid limits in NM depend on if you are single or married. In 2023 for Married couples in New Mexico, the income needs to be less than $1,371 monthly. For single individuals, the income limit is $914 monthly.

How To Buy Cheap Health Insurance In New Mexico

To find cheap health insurance in New Mexico, compare coverages and rates for multiple plans. Use our online quoting tool to see your options quickly.