UPDATED: SEPTEMBER 05, 2023 | 2 MIN READ

Purchasing health insurance in West Virginia doesn’t have to be stressful, and we’ll make it even easier for you. We provide you with the options you want, so you’re not left to wade through the paperwork alone. Finding West Virginia health insurance has never been easier.

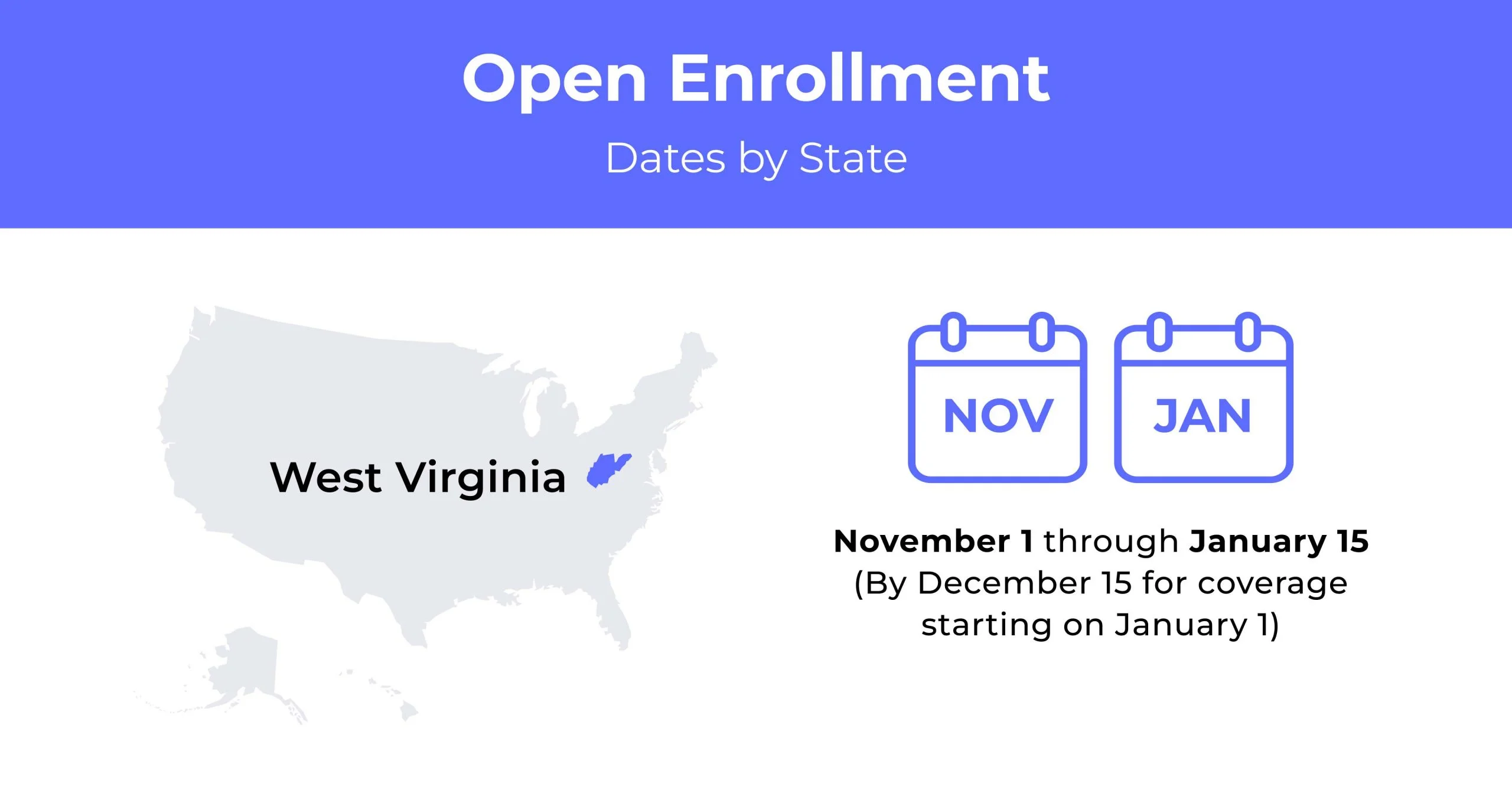

West Virginia Open Enrollment Dates For Health Insurance

West Virginia’s health insurance Open Enrollment period runs annually from November 1st to January 15th.

West Virginia Health Insurance Demographics

When obtaining health insurance in West Virginia, specific demographics are considered when getting a quote.

- Average Household Income: The average household income is $65,332. The median household income is $48,037.

- Median Age Range: The median age is 42.7 years of age.

- Education: In 2020, 502,110 residents in West Virginia aged 25 and older had a high school degree as the highest level of education. Also, 232,760 residents had some college but no degree.

What Type Of Marketplace Does West Virginia Have?

West Virginia health insurance is found through the partnership health insurance exchange. Residents enroll through HealthCare.gov. There are multiple insurers available that offer coverage that fits your needs.

How many people are insured through the West Virginia health insurance Marketplace?

From 2016 to 2021, enrollment dropped for private individual market plans. It dropped roughly 48% in West Virginia, which was high compared to other states. In 2022, enrollment exploded, reaching 21,435 residents, which was higher than any previous enrollment period.

Did West Virginia implement the ACA’s Medicaid expansion?

West Virginia opted to expand Medicaid under the Affordable Care Act (ACA). The program started on January 1, 2014, providing coverage for low-income people.

When can you purchase ACA insurance in West Virginia?

Open enrollment for the exchange runs from November 1, 2022, to January 15, 2023. You need a qualifying event outside open enrollment to change or enroll for coverage.

Types of ACA Plans In West Virginia

There are many types of plans available in West Virginia. The plans are listed as metal tiers, and each level has different options.

What carriers offer ACA health insurance in West Virginia?

In 2022, two insurers offer coverage on the exchange for West Virginia:

- Highmark

- CareSource

In 2015, the exchange only had one carrier, but in 2016 CareSource joined the exchange.

How Much Does Health Insurance Cost In West Virginia?

The average monthly West Virginia health insurance across all tiers is $723. It represents a 7% increase over the past year.

Cheapest Health Insurance By Metal Tier

West Virginia has four metal-tier plans available. The table below lists low-cost individual health insurance options for each level.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Catastrophic | my Blue Access WV Major Events EPO 8700 | $495 | $8,700 | $8,700 |

| Bronze Expanded | CareSource Marketplace Bronze First | $630 | $7,700 | $8,700 |

| Silver | CareSource Marketplace Low Premium Silver | $760 | $6,500 | $8,700 |

| Gold | my Blue Access WV EPO Gold | $880 | $0 | $7,500 |

Cheapest Health Insurance By County

Health insurance costs often vary between counties. However, prices for the cheapest Silver-level individual plan in West Virginia’s five largest counties are the same.

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|---|

| Berkeley | CareSource Marketplace Low Premium Silver | $760 | $1,520 | $1,970 |

| Cabell | CareSource Marketplace Low Premium Silver | $760 | $1,520 | $1,970 |

| Kanawha | CareSource Marketplace Low Premium Silver | $760 | $1,520 | $1,970 |

| Monongalia | CareSource Marketplace Low Premium Silver | $760 | $1,520 | $1,970 |

| Wood | CareSource Marketplace Low Premium Silver | $760 | $1,520 | $1,970 |

Are Subsidies Available In West Virginia?

As of 2021, roughly 17,000 residents without health insurance are eligible for tax credits to help with premium costs under the Affordable Care Act. Approximately 3,900 of those residents qualify for fully-subsidized coverage that covers the cost of the premiums.

Can You Purchase Off-Exchange Insurance Coverage In West Virginia?

There are two options for West Virginia health insurance: On-Exchange (ACA) and Off-Exchange (Other plans that don’t follow the ACA regulations). Residents enroll in the ON-Exchange during open enrollment.

Can You Purchase Short-Term Insurance?

Short-term health insurance in West Virginia is available for terms up to 364 days, with the option to renew for up to 36 months. In 2022, five insurers offer short-term health insurance in West Virginia.

Health Coverage Options For Low-Income People In West Virginia

There are some great options available for low-income people in West Virginia. Medicare and Medicaid are excellent choices for coverage.

What Medicare Options Are Available In West Virginia?

Medicare is available for residents 65 years or older or with a disability. You may have to pay part of the premium, but it’s still significantly lower than private plans. Coverage comes in three sections:

- Part A: Hospital stays, nursing care, home service care

- Part B: Outpatient, in-doctor services, and medical supplies

- Part D: Prescription drugs and vaccines

Medicaid In West Virginia

Medicaid is free health insurance in West Virginia available for qualifying residents. Qualified residents have an income below 138% of the federal poverty level.

Cheapest Health Insurance Plans In West Virginia

There are many affordable individual and family health insurance options in West Virginia. Whether you’re looking for low premiums or out-of-pocket expenses, there are great options.

Cheapest health plan with low out-of-pocket maximums

If your medical expenses are typically high, getting a plan with higher premiums and low out-of-pocket costs is the best option. You pay more upfront, but recurring expenses help you to reach your limit faster. Once that happens, your insurer is responsible for costs. The cheapest plan is Highmark Blue Cross Blue Shield West Virginia at $873 per month, with the out-of-pocket max at $6,000.

Cheapest health plan with high out-of-pocket maximums

Young residents with low medical expenses typically opt for a low premium plan with high out-of-pocket costs. The premium is lower, and you only pay the out-of-pocket fees if you have medical treatment. The cheapest plan in West Virginia is my Blue Access WV Major Events EPO 8550 from Highmark Blue Cross Blue Shield, West Virginia. The monthly premium is $386 with an out-of-pocket max of $8,250.

Cheapest health plan with an HSA option

Health Savings Accounts (HSA) are great for residents with low medical expenses. It allows for savings for medical costs and acts as pre-tax contributions if you don’t use it. The cheapest plan is CareSource Marketplace, HSA Eligible Bronze, at $731 monthly.

Cheapest HMO/PPO/POS health insurance plans

HMOs and EPOs are available for West Virginia health insurance. HMOs are cheaper than EPOs, but with HMOs, you have to stay within a network of providers. The most affordable HMO is CareSource Marketplace Low Premium Silver at $632 monthly. My Blue Access WV EPO Silver 3450 HAS plan is the cheapest EPO at $731 monthly.

FAQs

What kind of insurance does West Virginia have?

Two programs provide health insurance in West Virginia for low-income residents. Medicaid, Medicare, and CHIP are available, and CHIP covers children in low-income households.

What is the income limit for WV Medicaid?

A single individual qualifies if they have a total income of $18,754 or lower.

Do you have to have health insurance in WV?

According to the Affordable Care Act, you’re required in West Virginia to have health insurance.

What does West Virginia Medicaid cover?

West Virginia Medicaid covers pregnancy tests, STI tests, family planning, counseling, birth control visits, pap smears, lab tests, and maternity care.

Does WV medical card cover dental for adults?

Medicaid recipients are eligible for $1,000 in dental care coverage each year.

How To Buy Affordable Health Insurance In West Virginia

Purchasing affordable health insurance in West Virginia is as easy as comparing rates for multiple companies and choosing the best option. Use our online quoting tool to select an option that fits your budget and healthcare needs.