UPDATED: SEPTEMBER 05, 2023 | 3 MIN READ

If you’re shopping for health insurance in Wyoming, you have many options. The options can make it challenging to find the best plan for your medical needs. Here is all you need to know about Wyoming health insurance to find the best plan.

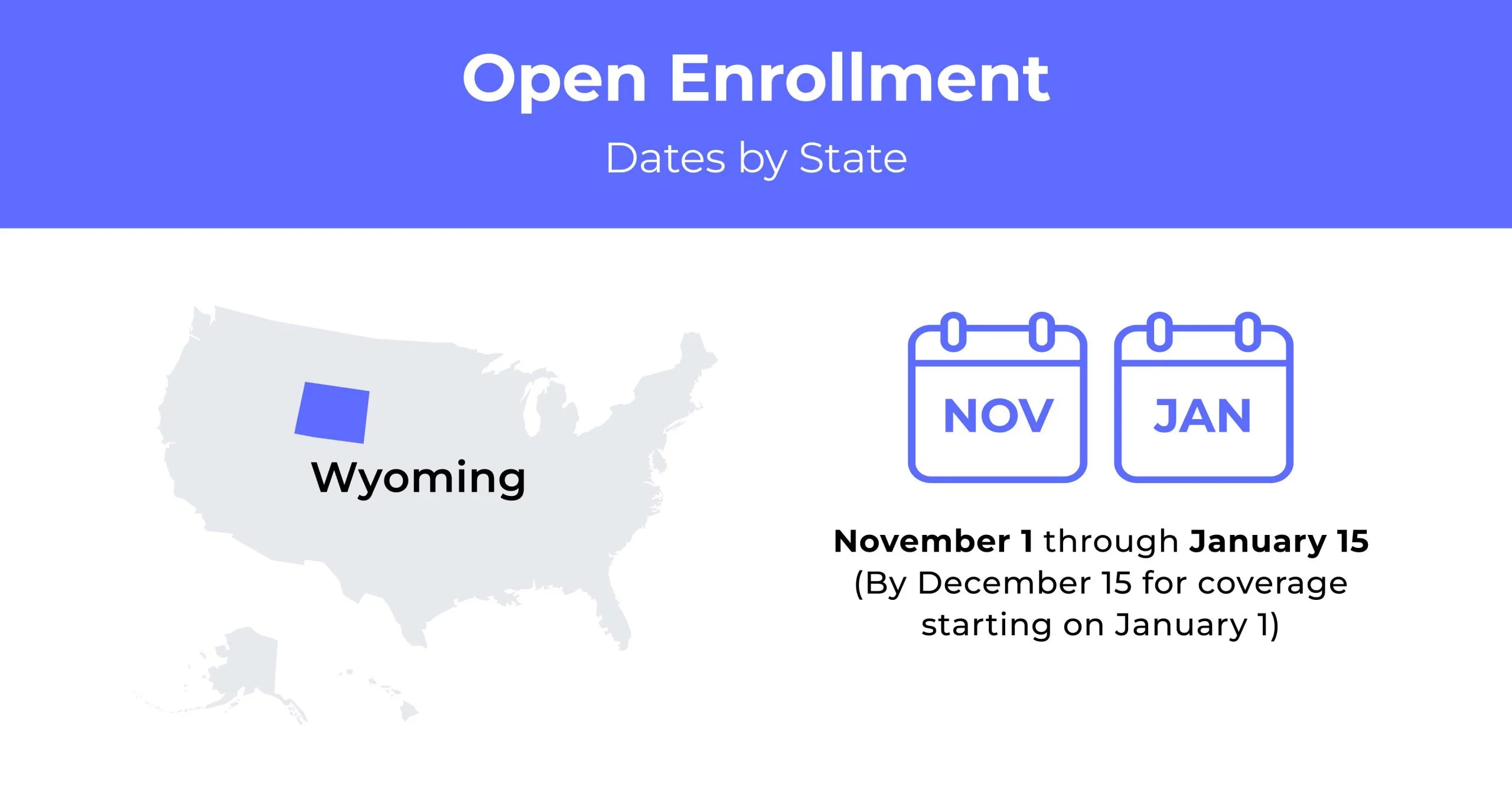

Wyoming Open Enrollment Dates For Health Insurance

Wyoming’s Open Enrollment period for health insurance runs from November 1st to January 15th each year.

Wyoming Health Insurance Demographics

One of the factors insurers examine when determining insurance premiums is demographics. Below are some demographics for Wyoming.

- Average Household Income: Only 5% of households in Wyoming are high-income. The average household income is $83,583.

- Median Age Range: The median age range in Wyoming is 38.1 years.

- Education: Just over 30% of residents in Wyoming 25 or older have a high school degree or equivalency.

What Type Of Health Insurance Marketplace Does Wyoming Have?

Wyoming has a federally run exchange through Healthcare.Gov. This year, both of Wyoming’s marketplace insurers are decreasing their average premiums in the state.

How many people are insured through the Wyoming health insurance marketplace?

The number of residents through Wyoming’s health insurance marketplace has increased steadily. This year there are 34,762 people enrolled, up from 26,728 in 2021, which was high.

Did Wyoming implement the ACA’s Medicaid expansion?

Wyoming is among some of the states where Medicaid has not been expanded. The state refuses federal funding to allow coverage for 34,000 low-income residents.

When can you purchase ACA insurance in Wyoming?

Open enrollment to buy health insurance in Wyoming runs from November 1 to January 15. You need a qualifying event to enroll outside of the enrollment period. Such events include getting married or divorced, becoming a US citizen, or having a baby.

Types of ACA Plans In Wyoming

The types of plans available through the Affordable Care Act (ACA) in Wyoming are four separate tiers:

- Bronze

- Expanded Bronze

- Silver

- Gold

In Wyoming, the Silver Tier is more expensive than the Gold tier on average. Gold plans are beneficial for those with high or multiple medical costs. Bronze and Expanded Bronze plans are for those who are younger and healthier.

What carriers offer ACA insurance in Wyoming?

Only two insurance companies offer low-cost individual and family plans in Wyoming’s marketplace. Both carriers have statewide coverage areas:

- Blue Cross Blue Shield (BCBS) of Wyoming

- Mountain Health CO-OP (Montana Health CO-OP)

How Much Does Health Insurance Cost In Wyoming?

Wyoming has one of the highest average monthly premiums for health insurance nationwide. The average premium is $618 monthly for a 40-year-old. Depending on age, location, and medical needs, Premiums can vary in cost. Below are charts showing the cheapest plans by tier and county.

Cheapest Health Insurance By Metal Tier In Wyoming

Wyoming health insurance plans are divided by metal tiers. Below are the cheapest individual health insurance plans for each tier in the state.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | BlueSelect Bronze Basic | $500 | $8,550 | $8.550 |

| Bronze Expanded | BlueSelect Bronze Core | $520 | $6,000 | $7,000 |

| Silver | BlueSelect Silver Balance | $755 | $6,000 | $8,550 |

| Gold | BlueSelect Gold Core | $625 | $1,500 | $7,000 |

Cheapest Health Insurance By County

Where you live also affects your health insurance premiums. However, as you can see below, the five largest counties in the state have the same cheapest plan and premiums for both individual and family plans.

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|---|

| Campbell | BlueSelect Silver Balance | $755 | $1,510 | $1,960 |

| Fremont | BlueSelect Silver Balance | $755 | $1,510 | $1,960 |

| Laramie | BlueSelect Silver Balance | $755 | $1,510 | $1,960 |

| Natrona | BlueSelect Silver Balance | $755 | $1,510 | $1,960 |

| Sweetwater | BlueSelect Silver Balance | $755 | $1,510 | $1,960 |

Are Subsidies Available In Wyoming?

There are subsidies available in Wyoming to help lower the cost of your insurance premiums. Once subsidies are applied, residents can get Bronze and Gold plans at little to no cost, depending on their income.

Can You Purchase Off-Exchange Health Coverage In Wyoming?

You can find alternative insurance plans in Wyoming off-exchange, meaning the marketplace doesn’t list or offer them. You can find these plans through insurance companies, agents, or online sellers. With these plans, you are not eligible for tax credits or other savings when purchasing off-exchange.

Can You Purchase Short-Term Insurance In Wyoming?

Short-term health insurance plans are available in Wyoming. The duration is 364 days, and you can renew policies for up to 36 months. This year, at least five insurers are offering short-term plans in Wyoming.

Health Insurance Options For Low-Income People In Wyoming

You may qualify for other federally-assisted health insurance programs in Wyoming if you have a low income. Children without insurance, for instance, can get coverage through the Children’s Health Insurance program. Below are options for Medicare and Medicaid throughout the state.

What Medicare Options Are Available In Wyoming?

Medicare plans are available in Wyoming. You can get Medicare if you are 65 years old or older or have a qualifying disability. The options are as follows:

- Original Medicare (Parts A and B): This basic Medicare plan covers in-patient and out-patient stays, including hospitals, doctor visits, nursing home stays, at-home care, hospice, and preventative care.

- Medicare Advantage (Part C): These plans are alternatives to Original Medicare, including both A&B coverage, except for hospice care.

- Prescription Drug Coverage (Part D): Adding Part D to Medicare is helpful if you have a Medicare Advantage plan without drug coverage.

- Medigap (Medicare Supplement Insurance): These plans help fill the gaps Original Medicare doesn’t cover.

Medicaid In Wyoming

Medicaid in Wyoming is a joint federal and state government program for low-income individuals and families. It covers a wide range of care, including ambulance services, mental health, chiropractic, family planning, hearing, dental, and more. You must meet income requirements to qualify based on the Federal Poverty Level (FPL).

Cheapest Health Insurance Plans In Wyoming

Health insurance plans vary in cost depending on many factors. These aspects include metal tier, age, location, and your individual or family’s medical needs. Below is a breakdown of some of Wyoming’s cheapest health plans.

Cheapest health plan in Wyoming with low out-of-pocket maximums

You can benefit from a plan with lower out-of-pocket maximums if you have expensive medical costs. Your insurer then pays for more of your medical expenses.

The cheapest plan in Wyoming with low out-of-pocket maximums is High Plains Gold from Mountain Health CO-OP. It costs an average of $720 monthly for a 40-year-old male.

Cheapest health insurance plan in the state with high out-of-pocket maximums

You can benefit from a health plan with higher out-of-pocket maximums if you don’t have many medical expenses. These insurance plans typically have lower monthly premiums.

The cheapest health insurance plan with high out-of-pocket maximums is BlueSelect Bronze Basic from Blue Cross Blue Shield. It costs an average of $408 monthly for a 26-year-old.

Cheapest health plan in Wyoming with an HSA option

Insurance plans with a Health Savings Account (HSA) are helpful if you don’t have to go to the doctor often. You can convert premiums into savings and make pre-tax contributions.

The most affordable plans in Wyoming with HSA options by tier:

- Gold: BlueSelect Gold Core by BCBS at $633 monthly.

- Silver: High Plains Silver Plus from Mountain Health CO-OP at $583 monthly.

- Expanded Bronze: BlueSelect Bronze Core from BCBS at $527 monthly.

Cheapest HMO/PPO/POS health plans in Wyoming

Wyoming only has Preferred Provider Organization (PPO) plans available across the state. They are the baseline plan type for individuals buying health insurance.

The cheapest health insurance for PPO is High Plains Silver Plus from Mountain Health CO-OP. It costs an average of $583 monthly for a 40-year-old male.

FAQs

What is the average cost of health insurance in Wyoming?

The average price of health insurance for a 40-year-old in Wyoming is $618 per month.

Does Wyoming require health insurance?

Residents of Wyoming are not required to have health insurance at the state level. However, under the Affordable Care Act (ACA) at the federal level, US residents do have to provide proof of health insurance.

How much is family health insurance in Wyoming?

The average monthly cost of a health plan for a family in Wyoming is $1,222 per month.

Is HealthCare free in Wyoming?

You can receive low or free health coverage through Medicaid and CHIP in Wyoming.

What is the income limit for Medicaid in Wyoming?

For an individual, the maximum income level is $18,075. For a family of 4, the maximum income is $36,908.

How To Buy Affordable Individual and Family Health Insurance Plans In Wyoming

Since Wyoming has high premiums, finding an affordable health plan can be challenging. It’s essential to do research and determine the coverage you need first. Then, compare premiums across many insurers to find the best price for your coverage. Use our online health insurance quote tool to compare your options quickly.