UPDATED: SEPTEMBER 05, 2023 | 2 MIN READ

On average, Illinois residents pay $507 for individual health insurance plans. To find the best coverage for your needs, you’ll need to consider how often you visit the doctor, your prescription costs, and more. Learn more about health insurance in Illinois below, so you’ll be more informed on the coverage offered and expected costs.

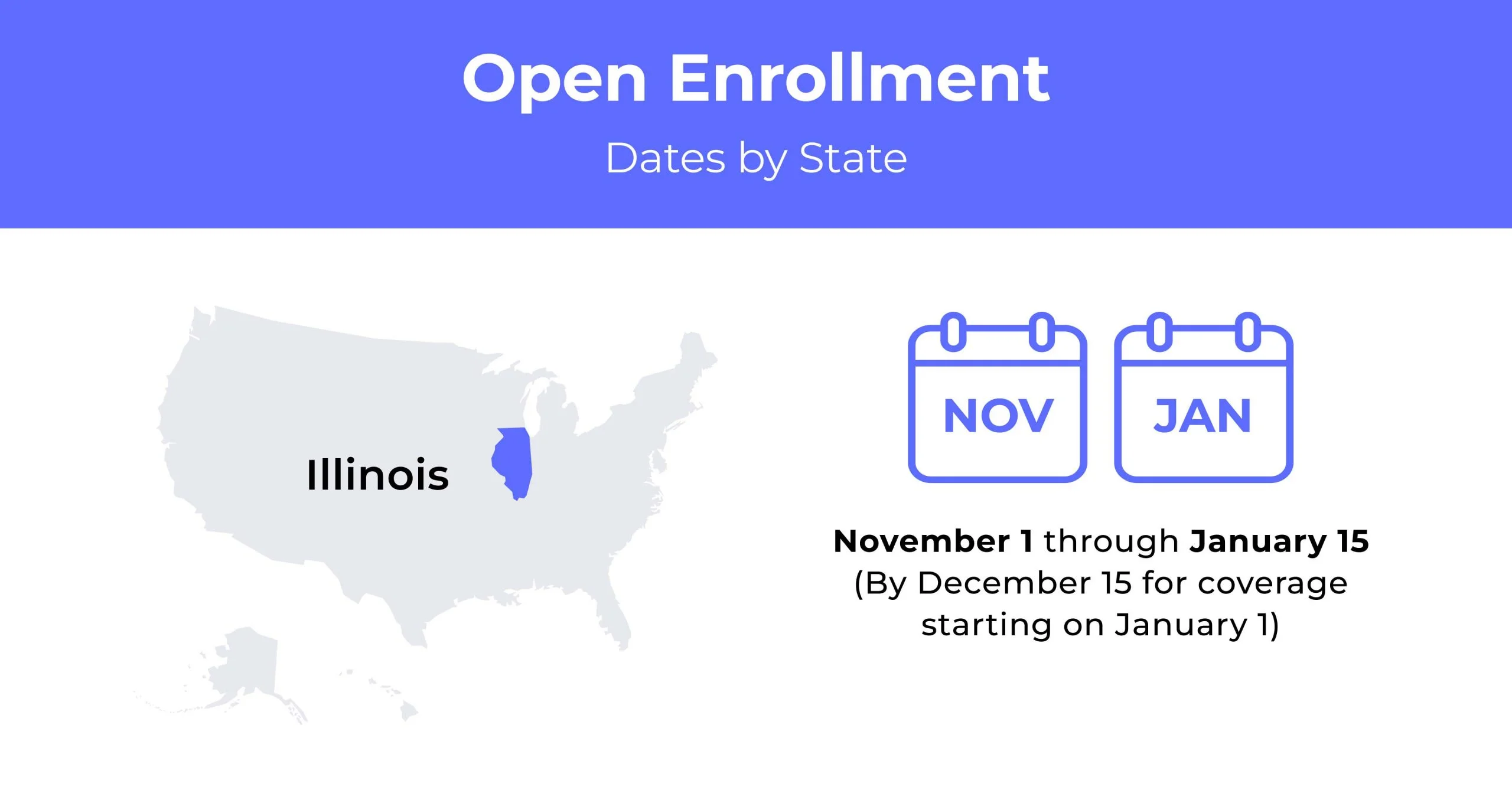

Illinois health insurance Open Enrollment dates

In Illinois, the Open Enrollment for health insurance runs from November 1st to January 15th each year.

Illinois health insurance demographics

Illinois health insurance costs vary based on gender, zip code, age, and other factors. Below is a quick rundown of state statistics that may impact your healthcare costs:

- Median household income: Illinois’ median household income is $68,428, around 5% more than the country’s median household income of $64,994.

- Median age range: The state’s median age range is 25-34, and its largest age range is 35-54.

- Education: About 90% of Illinois residents graduated high school. Almost 36% graduated from college. The state reports that about 5% of its residents are currently enrolled.

What type of Marketplace does Illinois have?

Private companies offer all insurance plans in Illinois, but the state’s Marketplace is federally run. The state Department of Insurance runs Gets Covered Illinois, which includes a website, help desk, and in-person help. State residents will then use Healthcare.gov to apply for coverage, compare plans, and enroll.

As of 2022, 11 insurers offer exchange plans in Illinois. The newest additions are Oscar, Molina, and UnitedHealthcare.

How many people are insured through the Illinois health insurance marketplace?

Like other states that use Healthcare.gov, Illinois enrollment peaked in 2016 and declined through 2020. In 2021, enrollment dropped again. These numbers rebounded in 2022, with 323,427 people signing up for coverage.

Did Illinois implement the ACA’s Medicaid expansion?

Illinois opted to expand Medicaid eligibility in July 2013, effective January 1, 2014. As of May 2021, there are 3,331 614 Illinoisans enrolled in Medicaid/CHIP.

When can you purchase ACA insurance in Illinois?

The Open Enrollment Period for 2023 coverage was from November 1, 2022, to January 15, 2023. Eligible consumers may enroll or change their plans during a Special Enrollment Period. These periods usually need a qualifying life event, except for enrollment opportunities for Native Americans or people earning under 150% of the poverty level.

Types of ACA plans in Illinois

Illinois’ ACA plans are split into five metal tiers: Catastrophic, Bronze, Bronze Expanded, Silver, and Gold:

- Catastrophic and Bronze plans are good if you are generally healthy and have emergency savings. The monthly premiums are cheap, but the costs are much higher if you experience unexpected medical expenses.

- Silver plans are best for those with average medical costs. These plans have affordable monthly premiums and out-of-pocket costs.

- Gold plans are best if you have high medical costs. The monthly premiums are expensive, but the variable prices are low.

What carriers offer ACA insurance in Illinois?

As of 2022, 11 insurers offer a total of 275 plans in Illinois, with plan availability varying by location:

- Bright Health

- Celtic Insurance Co. (Ambetter)

- Cigna

- Health Alliance Medical Plans, Inc. (HAMP)

- Health Care Service Corporation (HCSC, Blue Cross Blue Shield of Illinois)

- MercyCare HMO

- Molina

- Oscar

- Quartz

- SSM Health Plan (WellFirst Health)

- UnitedHealthcare

How much does health insurance cost in Illinois?

As an Illinois resident, you can expect to pay $507 for a major medical individual health insurance plan. Your actual rate will depend on age, zip code, gender, and other factors.

Cheapest health insurance by Metal Tier in Illinois

The table below shows the cheapest individual insurance plans for each tier available in Illinois.

| Metal Tier | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|

| Catastrophic | $270 | $8,700 | $8,700 |

| Bronze | $340 | $8,650 | $8,650 |

| Bronze Expanded | $275 | $7,400 | $8,700 |

| Silver | $332 | $6,500 | $8,400 |

| Gold | $400 | $1,450 | $6,300 |

Cheapest health insurance by county

Individual and family health insurance costs are the same across Illinois’ five largest counties. However, they may differ in other areas of the state.

| County Name | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|

| Cook | $340 | $665 | $865 |

| DuPage | $340 | $665 | $865 |

| Kane | $340 | $665 | $865 |

| Lake | $340 | $665 | $865 |

| Will | $340 | $665 | $865 |

Are subsidies available in Illinois?

The federal government expanded subsidies and removed the max income for premium tax credits in 2021. Based on the benchmark plan price, you’re not expected to pay more than 8.5% of your annual household income on health insurance. The subsidies cover any remaining balance.

Can you purchase off-exchange insurance coverage in Illinois?

Illinois residents may purchase a standard individual health insurance plan from private insurers during the Open Enrollment Period. Some may be eligible to enroll or make changes during a Special Enrollment Period with a qualifying life event.

Can you purchase short-term insurance in Illinois?

Short-term insurance can be a great option if you’re between jobs or waiting for group coverage to start. In Illinois, short-term health insurance plans offer health care coverage for up to 6 months (less than 181) days. No renewals are permitted within 365 days from the end of the individual’s coverage.

Health coverage options for low-income people in Illinois

Medicaid and CHIP cover about 20% of Illinois’s 12.5 million residents. Due to Illinois’ Medicaid expansion, about 20% of those covered are eligible for Medicaid under the Affordable Care Act (ACA). As of August 2021, there were 789,974 state residents covered under expanded Medicaid.

What Medicare options are available in Illinois?

Illinois state residents with an income below 138% of the federal poverty level can apply for Medicare. In November 2020, more than three million people were enrolled in Medicaid.

Medicaid in Illinois

Those over 65 and/or with a qualifying disability or illness may be Medicare-eligible. Medicare covers specific medical services made up of the following parts:

- Part A is hospital insurance that covers hospice care, in-patient stays, and care in a nursing facility.

- Part B is medical insurance that pays doctor’s fees, outpatient-related care, preventative services, and medical supplies.

- Part D helps cover the cost of vaccines and prescription drugs.

For more information on applying for Medicaid in Illinois, contact the Health Benefits Hotline at 1-800-843-6154.

Cheapest health insurance plans in Illinois

The cheapest health plans in Illinois will vary by zip code, among other factors. The most affordable Silver health insurance plan for most people is the Health Alliance 2022 POS 3000 Elite. This is the cheapest option in 53% of the counties in the state. Blue Choice Preferred Silver PPO is the most affordable option in 20% of the counties.

Cheapest health plan in Illinois with low out-of-pocket maximums

The best health insurance plan in the state with high premiums and low out-of-pocket costs is the MercyCare HMO Gold Option C plan by MercyCare Health Plans. This costs an average of $469 per month for 40-year-olds.

Cheapest health plan in Illinois with high out-of-pocket maximums

The cheapest health insurance in Illinois with a high out-of-pocket cost is the Blue FocusCare Bronze 209 by Blue Cross and Blue Shield of Illinois. This Expanded Bronze-tier plan costs an average of $215 for a 26-year-old.

Cheapest health insurance plan in Illinois with an HSA option

Based on the cost for a 40-year-old, the most affordable plans in Illinois for all available metal tiers with an HSA option include the following:

- Expanded Bronze: The WellFirst Bronze HSA-E 6850X plan by WellFirst Health, at an average of $357 per month.

- Silver: The WellFirst Silver HSA-E 4500X plan by WellFirst Health is priced at $490 monthly.

- Gold: The MercyCare HMO Gold Option C plan by MercyCare Health Plans at around $469 each month.

Cheapest HMO/PPO/POS health plans in Illinois

For a 40-year-old, the cheapest health insurance in Illinois under the Silver tier is:

- HMO: The Blue FocusCare Silver 210 plan by Blue Cross and Blue Shield of Illinois costs about $357 per month.

- PPO: The Blue Choice Preferred Silver PPO 203 plan by Blue Cross and Blue Shield of Illinois at an average cost of $580 each month.

- POS: The 2021 POS 3000 Elite Silver plan by Health Alliance costs about $570 per month.

FAQs

What’s the average cost of health insurance in Illinois?

Illinois residents can expect to pay $507 for an individual health insurance plan.

Does Illinois have affordable health care?

As part of the Affordable Care Act (ACA), uninsured Illinoisans have options for health coverage through the state’s Medicaid program or the Marketplace.

How much is Obamacare in Illinois?

Prices will vary depending on your plan, zip code, health, gender, and other factors. As of 2022, the cheapest coverage plans range from $215-$580.

How do I get health insurance without a job in Illinois?

You can get health insurance without a job. If you recently lost your job, you may enroll for COBRA benefits, sign on to your spouse’s plan, buy your plan on the Marketplace, or apply for Medicaid.

Are there health insurance options for students attending college in Illinois?

Students can use the ACA Marketplace to enroll in insurance. However, many universities in Illinois provide students access to health insurance.

How to buy health insurance in Illinois?

You can buy individual and family health coverage in Illinois during open enrollment. If you’ve missed that time window, you still may be eligible to apply if you have a qualifying life event. Use our online quote tool to find the best coverage and the cheapest rate.