UPDATED: SEPTEMBER 05, 2023 | 3 MIN READ

Choosing health insurance in Ohio may present many questions regarding coverage. Copays, deductibles, and even the whole enrollment process can feel overwhelming.

However, purchasing health insurance can be easier than you think. This article has everything you need to know to help you find the best health coverage plan in Ohio.

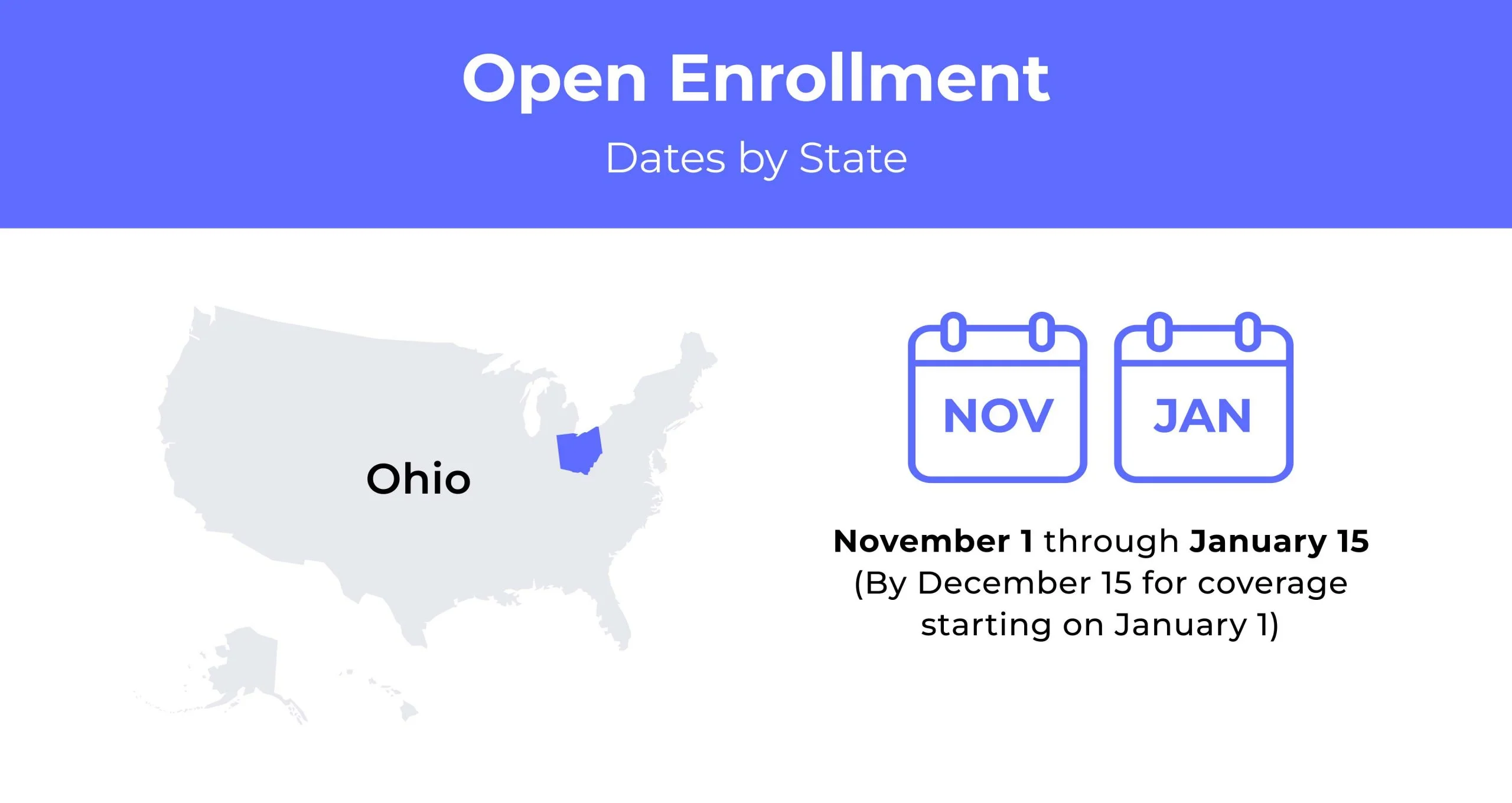

Ohio Open Enrollment Dates For Health Insurance

In Ohio, the Open Enrollment period for health insurance runs from November 1st to January 15th.

Ohio Health Insurance Demographics

Demographics play a significant factor in insurance premiums. Below are some of the standard demographics in Ohio:

- Average Household Income: Only 5% of households in Ohio are high-income. The average household income is $78,797.

- Median Age Range: The median age range in Ohio is 38.9 years old.

- Education: Over 90% of Ohio age 25 and older have graduated high school. And almost 29% of those over 25 hold a Bachelor’s degree or higher.

What Type Of Marketplace Does Ohio Have?

Ohio utilizes a federally facilitated health insurance exchange. It is also one of seven states participating in plan management and the Qualified Health Plan (QHP) certification process.

How many people are insured through the Ohio health insurance marketplace?

Approximately, 259,900 people are enrolled in the Ohio health place market exchange. It has increased by 29% from 2021.

Did Ohio implement the ACA’s Medicaid expansion?

Ohio accepts applications for Medicaid expansion for those eligible under the Affordable Care Act (ACA). The expansion provides eligibility to 138% of the Federal Poverty Level (FPL) and includes adults without children under 65.

When can you purchase ACA insurance in Ohio?

You can purchase ACA health insurance during the Open Enrollment Period. It runs from November 1st to January 15th in Ohio. A qualifying event is necessary if changing coverage outside of this period, such as the birth of a child.

Types of ACA Plans In Ohio

There are six metal tiers for ACA health insurance plans in Ohio. They are as follows:

- Catastrophic

- Bronze

- Expanded Bronze

- Silver

- Gold

- Platinum

The premiums and cost-sharing levels vary, depending on the type of health plan selected.

What carriers offer ACA health insurance in Ohio?

There are ten insurers offering health insurance plans through Ohio’s exchange. The plans available include:

- CareSource

- Molina

- Medical Health Insurance Corp. of Ohio (Medical Mutual)

- Community Insurance Company (Anthem Blue Cross Blue Shield)

- AultCare

- Ambetter (Buckeye Community Health Plan)

- Oscar Insurance Corporation of Ohio

- Paramount

- Summa

- Oscar Buckeye State Insurance Corporation

All but two counties within the state have at least three participating carriers. Twenty counties have six or more carriers.

How Much Does Health Insurance Cost In Ohio?

The average cost of health insurance in Ohio is $435 for an individual of 40 years old. Residents can find affordable plans through the exchange. Health premiums depend on multiple factors, so compare companies before you purchase a plan.

Cheapest Health Insurance By Metal Tier In Ohio

The table below shows the cheapest individual health insurance plan options for each metal tier in Ohio.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Catastrophic | Market HMO Young Adult Essentials | $210 | $8,700 | $8,700 |

| Bronze | Market HMO 8700 | $340 | $8,700 | $8,700 |

| Bronze Expanded | SummaCare Bronze | $300 | $8,700 | $8,700 |

| Silver | SummaCare Silver | $355 | $6,000 | $8,700 |

| Gold | SummaCare Gold | $440 | $2,000 | $8,700 |

Cheapest Health Insurance By County

Health coverage costs often vary by location. However, in Ohio, the price for the cheapest individual and family plans stays the same throughout the five biggest counties.

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|---|

| Cuyahoga | Constant Care Silver | $375 | $745 | $965 |

| Franklin | Constant Care Silver | $375 | $745 | $965 |

| Hamilton | Constant Care Silver | $375 | $745 | $965 |

| Montgomery | Constant Care Silver | $375 | $745 | $965 |

| Summit | SummaCare Silver 6000 | $355 | $710 | $925 |

Are Subsidies Available In Ohio?

Depending on your income, you may qualify for health insurance subsidies in Ohio. Subsidies help lower your monthly premiums and make your health plan more affordable. You can check eligibility online or by calling your local exchange marketplace.

Can You Purchase Off-Exchange Health Coverage In Ohio?

You can enroll in a private health plan outside of the marketplace exchange. These pans by private insurers are not available in the regular marketplace. You s to register during the allotted period and are not eligible for tax credits or savings.

Can You Purchase Short-Term Insurance In Ohio?

You can purchase short-term health insurance in Ohio for 11 months or more. It is beneficial if you are in-between health plans or employment or need to enroll outside the regular period.

Health Coverage Options For Low-Income People In Ohio

For low-income Ohio residents, there are a few options to help make health insurance more affordable. Medicare and Medicaid for those eligible can make health insurance far less expensive.

What Medicare Options Are Available In Ohio?

Medicare is available to residents of Ohio who are 65 years old. You are eligible to receive it sooner if you have a disability, End-Stage Renal Disease (ESRD), or ALS. The options for Medicare include:

- Part A – this insurance covers hospital stays and other related care.

- Part B – this insurance covers regular office visits, medical supplies, and preventative care.

- Part C – Medicare Advantage, which combines parts A&B through private insurance companies.

- Part D – this covers prescription drugs.

- Medigap – supplemental Medicare insurance is available to buy privately, helping to pay a share of Original Medicare (A&B) costs.

You get deductibles, copays, coinsurance, and other care, while Medicare Supplement or Medigap can also cover traveling.

Medicaid In Ohio

The Ohio Department of Medicaid (ODM) is the state’s first Executive-level Medicaid agency. It provides Medicaid services to low-income residents for all who apply. Individuals covered by Medicaid have to renew every twelve months to have eligibility redetermined.

Medicaid covers most health-related services, including hospital stays, laboratory tests and x-rays, and home health services. Optional additional services can provide prescription drug coverage and physical or occupational therapy.

Cheapest Health Insurance Plans In Ohio

Health insurance policies are available depending on your location. Companies also consider other factors, such as age and medical history. It is beneficial to compare policies from multiple companies to find the most affordable plan for you and your family. Here are some of the cheapest plans found in Ohio.

Cheapest health plan in Ohio with low out-of-pocket maximums

Health plans with low out-of-pocket maximums have higher premiums. They are beneficial if you have to visit the doctor frequently or have many medical costs. The cheapest plan in Ohio with low out-of-pocket maximums is AultCare Platinum 1000 No Pediatric Dental from AultCare Insurance. It costs an average of $793 monthly for a 40-year-old male.

Cheapest health plan in Ohio with high out-of-pocket maximums

If you have few medical needs, are younger and are generally healthy, plans with high out-of-pocket maximums are more beneficial. These plans have cheaper premiums but cost more if you need to utilize emergency or more than routine doctor visits.

The most affordable plan with high out-of-pocket maximums is Market HMO Young Adult Essentials – Dayton by MedMutual. It costs an average of $175 monthly for a 26-year-old individual.

Cheapest health plan in Ohio with an HSA option

There are several health insurance plans in Ohio with a Health Saving Plan (HSA). These plans work well if you are healthy, so you can pay less and contribute to pre-tax savings. The savings help to pay for unexpected medical costs or bills.

There are many cheap health insurance plans with HSA options, such as

- Expanded Bronze Plan: Ambetter Essential Care 2 HSA (Ambetter from Buckeye Health). It costs an average of $299 monthly for a 40-year-old male.

- Silver Plan: Market HMO 4000 HSA-Dayton by MedMutual. It costs an average of $469 monthly for a 40-year-old male.

- Gold Plan: AultCare Gold 2500 No Pediatric Dental by AultCare Insurance. The PPO plan costs an average of $665 monthly for a 40-year-old male.

- Platinum Plan: AultCare Platinum 1550 Health Savings 500 No Pediatric Dental by AultCare Insurance. It costs an average of $749 monthly for a 40-year-old male.

Cheapest HMO/PPO/POS health plans in Ohio

The two primary plans available in Ohio are the Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). The cheapest of these two types of policies are:

- HMO Silver Plan: Ambetter Balanced Care 29 (Ambetter from Buckeye Health). It costs an average of $355 monthly for a 40-year-old individual.

- PPO Silver Plan: AultCare Silver 6850 Select No Pediatric Dental (AultCare Insurance). It costs an average of $465 monthly for a 40-year-old individual.

FAQs

What’s the average cost of health insurance in Ohio?

The average price of health insurance in Ohio can vary depending on multiple factors. The average premiums monthly by metal tier are:

- Catastrophic: $271 per month

- Bronze: $342 per month

- Expanded Bronze: $374 per month

- Silver: $471 per month

- Gold: $575 per month

- Platinum: $780 per month

Is healthcare free in Ohio?

You can find free health clinics in Ohio through the Charitable Healthcare Network website or by calling directly. There are 54 free clinics across 76 Ohio counties. Government-assisted medical programs can also provide free or very low-cost healthcare.

Who qualifies for Obamacare in Ohio?

Individuals and families at all income levels can enroll in health insurance under Obamacare. Income between 100% to 400% of the Federal Poverty Level (FPL), you may qualify for a subsidy or tax credit.

Who qualifies for CareSource in Ohio?

CareSource Medicaid health coverage is available for residents of Ohio with:

- Low income

- Pregnant women

- Infants and children

- Older adults

- Individuals with disabilities

What’s the maximum income to qualify for Medicaid in Ohio?

Yearly maximum income limits range from around $18,075 to $36,908 from one individual to a family of four.

How To Find Cheap Health Insurance In Ohio?

To find the most affordable individual or family health insurance plans, you need to do some research. Understand what each insurer offers and evaluate your medical needs to know what coverage is necessary. Then, use our online quote tool to compare premiums from numerous companies to find the best price for your coverage.