UPDATED: AUGUST 25, 2023 | 3 MIN READ

COBRA, also known as the Consolidated Omnibus Budget Reconciliation Act of 1985, is a vital resource ensuring individuals maintain health insurance after experiencing specific life events that would otherwise jeopardize their coverage. By understanding the ins and outs of COBRA insurance, you can navigate the complexities of job transitions, loss of employment, or other qualifying events while safeguarding your healthcare needs.

In this comprehensive guide, we will delve into the key aspects of COBRA insurance, shedding light on its benefits, limitations, and considerations. From eligibility requirements to coverage duration, we will equip you with the knowledge necessary to make informed decisions regarding your healthcare options. Whether you are a recently terminated employee, considering a career change, or seeking information for a loved one, this guide aims to demystify COBRA insurance and its implications.

By delving into the provisions and intricacies of COBRA, you can confidently explore how this federal law impacts your healthcare continuity. We will address the advantages of maintaining your existing coverage, the potential drawbacks associated with cost and limited duration, and alternative options that may better suit your needs. With a clear understanding of COBRA insurance, you will be empowered to make sound choices regarding your health and well-being during times of transition.

What is COBRA insurance?

COBRA health insurance kicks in when an employee no longer qualifies for group health coverage provided by their employer. This may be because an employee was fired, quit, or no longer works enough hours.

COBRA rights dictate that employers allow past employees to keep their health insurance benefits for at least 18 months. This gives the employee time to find another job or purchase low-cost individual health insurance.

COBRA is a federal law. So, it’s a benefit employers can offer if they have 50 or more employees. But once you no longer work for that employer, the company doesn’t have to continue paying some of your health insurance costs. When you have continuation coverage, you’re responsible for paying 100% of your COBRA premium.

Eligibility for COBRA insurance: Who Qualifies?

To be eligible for COBRA insurance, you must have been enrolled in a group health insurance plan through your employer. This means that if you were covered under your employer’s health insurance policy and encounter a qualifying event, you may have the right to continue your coverage through COBRA.

Qualifying events that may make you eligible for COBRA insurance include job loss, reduction in work hours, retirement, divorce, legal separation, or the covered employee’s death. However, it’s important to note that not all situations will qualify for COBRA coverage. For instance, if you were terminated from your job due to gross misconduct, your former employer may not be required to offer you COBRA continuation coverage.

Additionally, it’s crucial to understand that COBRA insurance only applies if you had enrolled in the health insurance plan provided by your employer before the qualifying event occurred. If your employer changes the health plan after your job loss or other qualifying event, you generally have the right to continue coverage under the same plan.

The duration of COBRA coverage

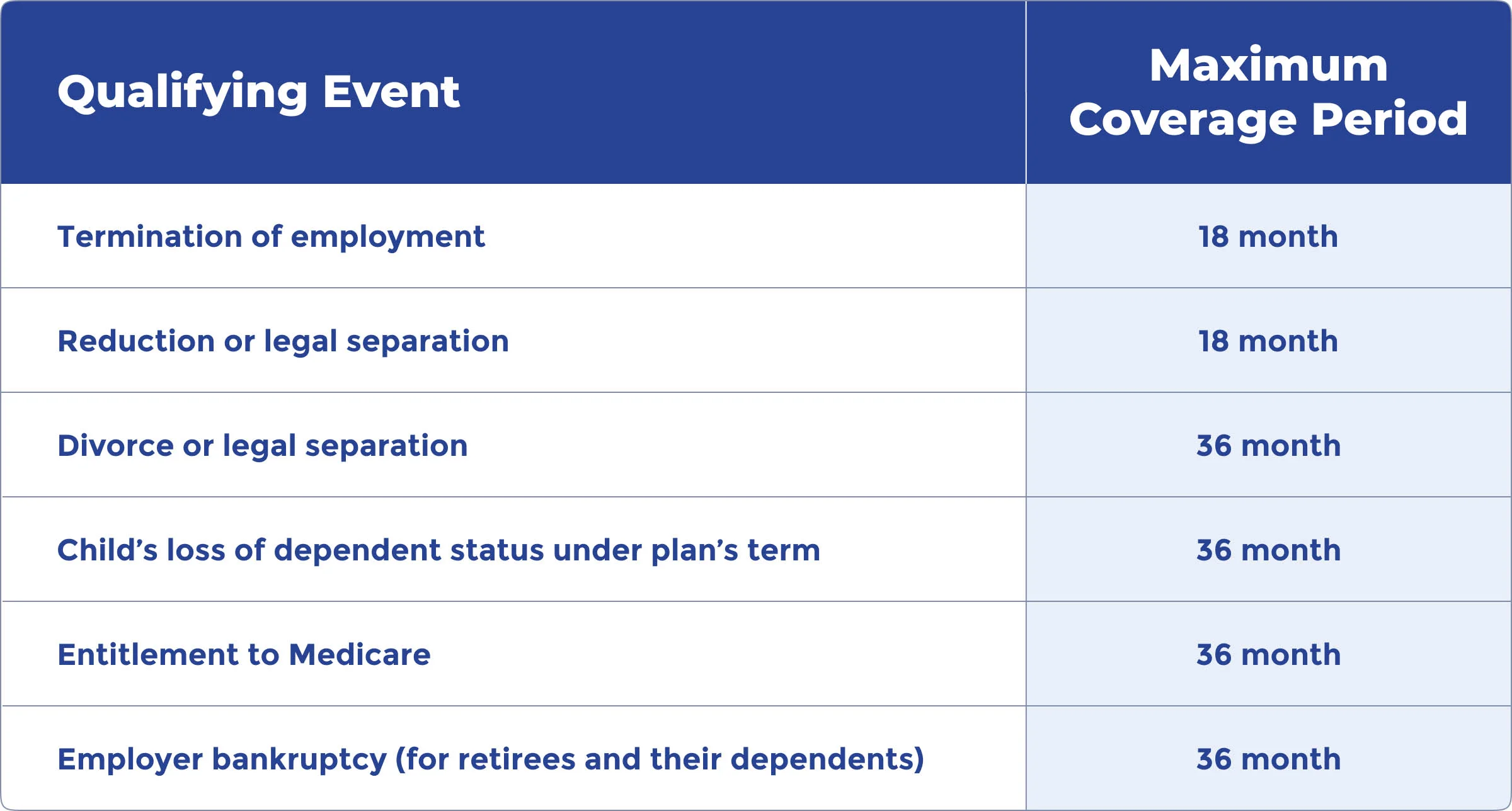

One important aspect to understand when considering COBRA insurance is its coverage duration. COBRA allows you to maintain your health insurance coverage for a limited period after experiencing a qualifying event.

In most cases, COBRA coverage lasts 18 months from the qualifying event date. This applies to individuals who have lost their job, had their work hours reduced, or experienced other qualifying events. However, it’s essential to note that certain life events may extend the duration of COBRA coverage.

For instance, if you are a qualified beneficiary and experience a second qualifying event, such as the death of the covered employee, divorce or legal separation from the covered employee, or the loss of dependent child status, you may be eligible for an extension of COBRA coverage. In these cases, COBRA coverage can be extended up to a total of 36 months from the date of the initial qualifying event.

It’s crucial to be aware of the duration of COBRA coverage and plan accordingly. During the coverage period, exploring alternative insurance options, such as employer-sponsored plans, individual health insurance plans, or government programs like Medicaid or the health insurance Marketplace is advisable. This will help ensure you have seamless coverage once your COBRA coverage expires.

Benefits and coverage

If you meet the COBRA insurance eligibility requirements, your employer must provide the same coverage the employer offers current employees. If there are any changes to the group health plan benefits for active employees, it also applies to former employees. You have at least 60 days to choose whether or not you want to continue coverage.

Understanding COBRA premium costs: Financial considerations

When evaluating COBRA insurance, one crucial aspect is the associated premium costs. COBRA coverage ensures the continuation of your health insurance plan, but it comes with significant financial responsibility.

When you elect to continue your coverage through COBRA, you become responsible for paying the full premium amount. This includes the portion previously covered by your employer and your contribution, along with a 2% administration fee. It’s important to note that the administration fee is added to help cover the administrative costs of maintaining COBRA coverage.

Since your employer is no longer contributing to the premium costs, the amount you pay under COBRA can be significantly higher than you were accustomed to paying while employed. This sudden increase in cost can pose challenges, particularly if you are transitioning between jobs or facing financial strain due to job loss.

It’s essential to carefully assess your budget and financial situation to determine if COBRA premium costs are affordable. While the higher costs can be burdensome, COBRA insurance may still be viable if you value the continuity of your current healthcare coverage, particularly if you have ongoing medical needs or pre-existing conditions.

It’s also worth exploring alternative options, such as health insurance marketplaces, individual plans, or government programs like Medicaid, as they may provide more cost-effective choices for obtaining healthcare coverage. Comparing the costs and benefits of different insurance options can help you make an informed decision that aligns with your financial circumstances and healthcare needs.

Pros and cons Of COBRA insurance?

There are both pros and cons to having COBRA insurance. You must weigh the pros and cons to determine if the plan is right for you.

Pros of COBRA insurance

- Continuation of Familiar Coverage: One of the main advantages of COBRA insurance is that it allows you to maintain the same health insurance plan you had while employed. This means you can keep the same network of healthcare providers, including your preferred doctors and specialists. It can be especially beneficial if you have pre-existing conditions or ongoing medical treatments.

- Coverage for Pre-existing Conditions: COBRA insurance ensures that your pre-existing conditions continue to be covered without interruption. This can be crucial for individuals who require ongoing medical care or expensive treatments, as they can avoid potential coverage gaps or exclusions that might come with switching to a new insurance plan.

- Protection Against Unexpected Medical Expenses: COBRA insurance can protect against high medical costs. Maintaining continuous coverage makes you less likely to face financial burdens associated with unexpected medical emergencies or major procedures. This can provide peace of mind during transitional periods, such as job loss or career changes.

Cons of COBRA insurance

- Cost: One of the significant drawbacks of COBRA insurance is the cost. Choosing COBRA means covering the full premium, including your employer’s previous contribution. This can be considerably more expensive than what you were paying as an employee, as you will now be covering both the employee and employer share, plus an administration fee.

- Limited Duration of Coverage: COBRA insurance is not a long-term solution. COBRA coverage lasts 18 months after a qualifying event but can be extended for certain life events or disabilities. After COBRA coverage ends, seek alternative options like employer plans, individual policies, or government programs for continued insurance.

- Lack of Flexibility: COBRA insurance restricts your options when choosing healthcare plans. COBRA restricts you to your previous plan, limiting access to potentially better or more affordable alternatives. Lack of flexibility with COBRA can be a drawback if your employer changes providers or the plan becomes inadequate.

Consider personal circumstances and priorities when evaluating the pros and cons of COBRA insurance.

Comparison with other options: Is COBRA the best option

Explore alternatives to COBRA for the best health coverage fit for your situation. Here, we’ll explore three common alternatives: health insurance marketplaces, Medicaid, and individual plans. Each option carries its own advantages and disadvantages when compared to COBRA insurance.

Health Insurance Marketplaces

Health insurance marketplaces, often known as exchanges, offer a range of health insurance plans from various insurers. These platforms, such as healthcare.gov, allow individuals to compare and purchase coverage. Here are some key points to consider,

Advantages:

- Potential Cost Savings: Marketplace plans often offer subsidies or tax credits based on income, which can help lower premium costs for eligible individuals.

- Flexibility in Plan Selection: Marketplaces provide a variety of plans with different levels of coverage, allowing you to choose a plan that aligns with your specific healthcare needs and budget.

- Extended Coverage: Marketplace plans can be purchased outside of the annual open enrollment period if you experience a qualifying life event, providing flexibility in securing coverage.

Disadvantages:

- Limited Provider Networks: Some marketplace plans may have narrower networks of healthcare providers compared to the broader networks available under COBRA insurance.

- Transition Challenges: Switching from your current COBRA coverage to a marketplace plan may involve adjusting to new benefits, copayments, deductibles, and provider networks.

- Income Eligibility: Not everyone may qualify for subsidies or tax credits, meaning marketplace plans may still present higher costs for individuals with higher incomes.

Medicaid

Medicaid is a government program that provides health coverage to individuals and families with limited income. Consider the following aspects of Medicaid when comparing it to COBRA insurance:

Advantages:

- Low or No Cost: Medicaid can offer comprehensive coverage at little to no cost for eligible individuals, making it an affordable option for those with limited incomes.

- Broader Eligibility: Medicaid may have more inclusive eligibility criteria compared to COBRA insurance, potentially accommodating individuals who may not qualify for COBRA.

- Comprehensive Benefits: Medicaid typically covers essential healthcare services, including doctor visits, hospital stays, prescriptions, and preventive care.

Disadvantages:

- Income Restrictions: Eligibility for Medicaid is based on income thresholds, meaning not everyone will qualify for this government program.

- Provider Network Limitations: Medicaid plans may have limited provider networks, which could impact access to specific doctors or specialists.

- Varying Coverage: Medicaid benefits can differ from state to state, so your coverage may vary depending on where you live.

Individual plans:

Individual health insurance plans are policies purchased directly from insurers outside of employer-sponsored options. Here are some considerations when comparing individual plans to COBRA insurance:

Advantages:

- Customization: Individual plans allow you to select coverage options that align with your specific healthcare needs and budget, providing a more tailored approach than COBRA insurance.

- Portability: Individual plans are not tied to employment, providing flexibility if you anticipate job changes or self-employment.

- Potential Cost Variations: Depending on factors such as your age, location, and desired coverage level, individual plans may offer competitive pricing options.

Disadvantages:

- Pre-existing Condition Exclusions: Individual plans may impose waiting periods or exclusions for pre-existing conditions, whereas COBRA insurance ensures continuity of coverage for pre-existing conditions.

- No Employer Contribution: With individual plans, you are responsible for the entire premium cost, whereas COBRA insurance allows for continuing employer contributions (though at a higher cost).

- Limited Enrollment Periods: Individual plans generally have specific open enrollment periods during which you can apply for coverage. Outside these periods, you may need to wait for a qualifying life event to be eligible for enrollment.

Ultimately, choosing COBRA insurance and alternative options depends on your circumstances, healthcare needs, and budget considerations. Evaluating the advantages and disadvantages of each option will help you make an informed decision that provides the most suitable coverage and financial viability for you and your eligible dependents.

FAQs

Is COBRA worth it?

COBRA insurance is an excellent option for health insurance after you leave your job. However, you pay 100% of the premium payment with a COBRA plan. This means your insurance costs will be higher than when you still had full employee benefits.

On the plus side, if you elect continuation coverage, you have health coverage t pay your medical expenses until the year’s Open Enrollment Period or until you find another job.

What does COBRA stand for, and what does it do?

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. It is a federal law that allows individuals no longer employed, including former employees, retirees, and their dependents, to temporarily maintain their health coverage.

How does COBRA work?

When you elect COBRA coverage, you are responsible for paying the full premium amount, including your portion and any contributions previously made by your employer. This means that you assume the entire cost of the premium to continue your health insurance coverage.

Why is COBRA important?

COBRA is crucial because it provides a bridge of continuity in health coverage during transitional periods. It allows individuals and their dependents to maintain the same health insurance plan they had while employed, providing peace of mind and continued access to medical services.

Who is eligible for COBRA coverage?

Former employees, retirees, and their dependents are generally eligible for COBRA coverage if they were enrolled in a health insurance plan through their employer and experienced a qualifying event, such as job loss or reduced work hours.

How long can you keep COBRA insurance?

Typically, COBRA coverage lasts for a limited duration, temporarily continuing health insurance. The standard duration is 18 months, although certain circumstances, such as a second qualifying event, may extend coverage up to 36 months.

What are the costs associated with COBRA coverage?

When you choose COBRA coverage, you are responsible for paying the entire premium amount, including any portion previously covered by your employer. This ensures the continuation of your health insurance but may result in higher costs than when you were employed.

Can I find alternative health insurance options instead of COBRA?

Alternative options, such as health insurance marketplaces, Medicaid, or individual plans, are available. These alternatives may have different advantages and disadvantages, including potential cost savings or variations in coverage.

What’s the difference between COBRA and Medicare?

Medicare is your primary insurance, while COBRA is secondary. Medicare covers the majority of your healthcare costs, so it’s one that you should keep.

Can I still get it later if I waive COBRA coverage during the election period?

You can apply for coverage again through COBRA insurance after waiving it as long as it’s within the election period. You have to revoke your waiver and elect continuation coverage.

Can COBRA coverage be terminated for any reason?

Termination of COBRA insurance happens in the following cases:

- An employer failing to maintain any group health insurance

- Failure to pay premiums on time

- A qualified beneficiary obtaining coverage with another employer, becoming eligible for Medicare, or engaging in fraud

Can I extend my COBRA insurance coverage?

Only two circumstances would allow you to extend your COBRA coverage. First, if a family member is disabled, you may get an extension of 11 months. The other circumstance is the death of a covered employee, a divorce of a covered employee and spouse, or the loss of a child.

Find affordable health insurance alternatives to COBRA

COBRA health insurance doesn’t last forever, but you need to maintain a reliable health insurance plan. Get health insurance quotes today to find an option that fits your needs.