UPDATED: SEPTEMBER 05, 2023 | 3 MIN READ

Navigating the health insurance Marketplace doesn’t have to be confusing. We’re here to simplify the process for you. Whether you are looking for private health insurance in Kentucky or low-income health insurance such as Medicaid and Medicare, many great options are available.

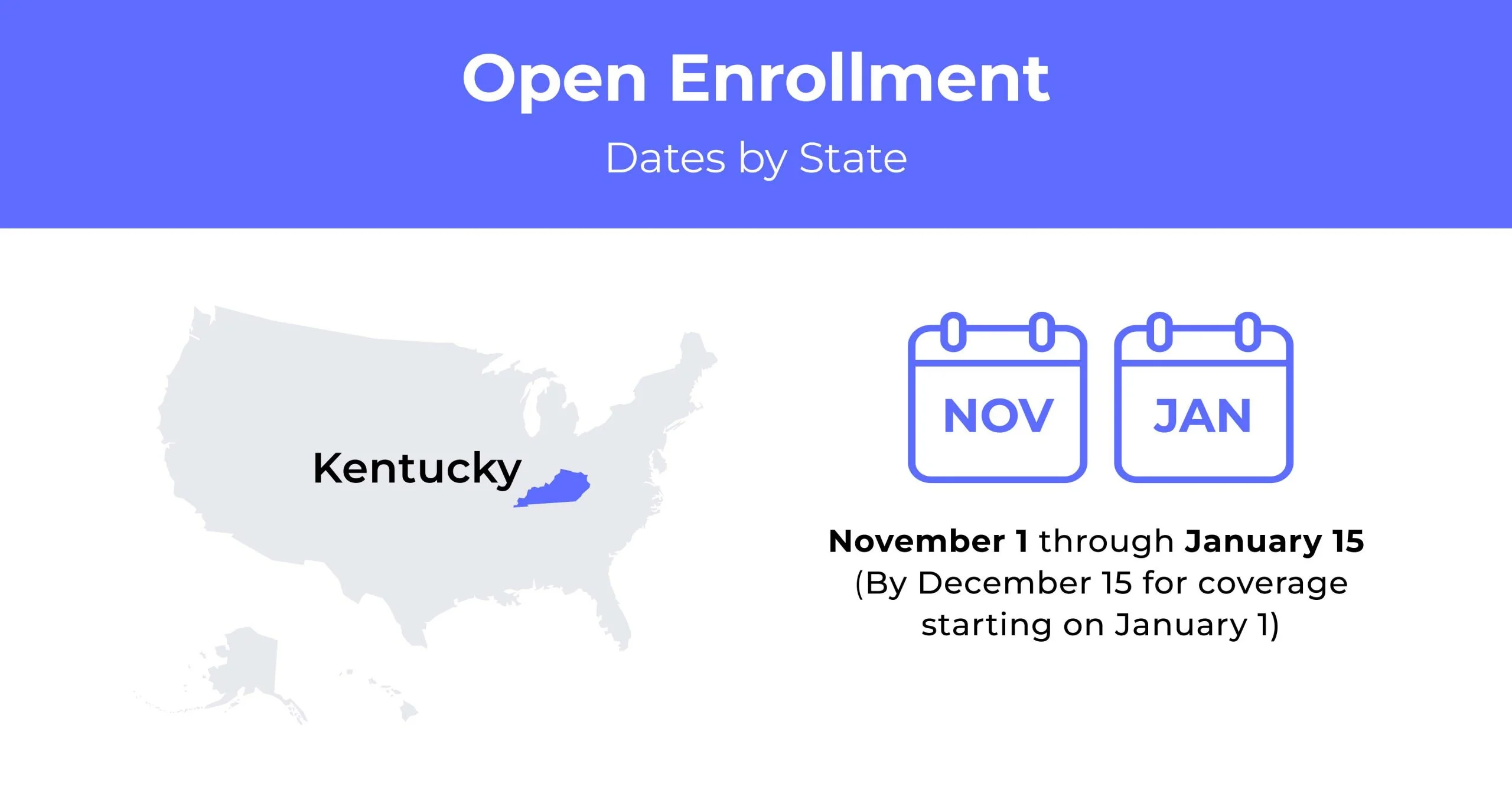

Kentucky Open Enrollment Dates For Health Insurance

Kentucky’s Open Enrollment for health insurance runs each year from November 1st to January 15th.

Kentucky Health Insurance Demographics

Demographics determine insurance rates because of where you live, your age, and your household income. Here are the local demographics for the state of Kentucky.

- Average Household Income: The average household income in Kentucky is $72,318. The median household income is $52,238.

- Median Age Range: The median age in Kentucky is 39 years of age.

- Education: Kentucky is amongst the least educated of the 50 states. Kentucky ranked 47th for the percentage of adults 25 and older with bachelor’s degrees.

What Type Of Marketplace Does Kentucky Have?

Kentucky has a state-run health insurance exchange. They can use Kynect to enroll in health coverage instead of HealthCare.gov.

How many people are insured through the Kentucky Marketplace?

Affordable health insurance is possible through the exchange. As of 2017, over 81,000 residents enrolled in the health insurance Marketplace in Kentucky.

Did Kentucky implement the ACA’s Medicaid expansion?

Kentucky made the Medicaid expansion effective as of January 1, 2014. As of 2013, 606,805 people enrolled in Kentucky’s Medicaid/CHIP program.

When can you purchase ACA health insurance in Kentucky?

The Open Enrollment Period for the Affordable Care Act is November 1st, 2022 to December 15th, 2022.

Types of ACA Plans In Kentucky

There are many Affordable Care Act plan types available in Kentucky. Four carriers offer plans in 2023, and the details are below.

What carriers offer ACA health insurance in Kentucky?

Four insurers offer plans for 2022 through Kynect, Kentucky’s state-run Marketplace. The following insurers offer plans in the Kentucky exchange for 2022. Plan availability varies from one place to another:

- Caresource

- Anthem

- Molina

- Ambetter/Wellcare

Anthem is only available in 14 counties in Kentucky.

How Much Does Health Insurance Cost In Kentucky?

There is a metal tier system for health insurance in Kentucky. Some metals determine low costs and metals that determine high costs. You will pay higher deductibles if you want a plan with lower premiums. If you have a higher deductible, you pay lower monthly premiums.

Cheapest Health Insurance By Metal Tier In Kentucky

Costs for individual and family plans vary depending on tier level. Kentucky offers four tier levels; the cheapest plans are listed in the table below.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | Ambetter Essential Care | $290 | $8,600 | $8,600 |

| Bronze Expanded | Anthem Bronze Pathway X | $310 | $6,800 | $7,050 |

| Silver | Ambetter Balanced Care | $355 | $6,100 | $6,100 |

| Gold | Ambetter Secure Care | $415 | $750 | $7,500 |

Cheapest Health Insurance By County

Your health insurance costs also depend on your location. Below are the prices for the cheapest plan in Kentucky’s five largest counties.

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 |

|---|---|---|---|

| Boone | Anthem Silver Pathway | $475 | $950 |

| Fayette | Anthem Silver Pathway | $405 | $805 |

| Jefferson | Anthem Silver Pathway | $360 | $720 |

| Kenton | Anthem Silver Pathway | $475 | $950 |

| Warren | Anthem Silver Pathway | $420 | $840 |

Are Subsidies Available In Kentucky?

Over 81,000 residents enrolled in the health insurance Marketplace in Kentucky. Of those residents, 79 percent of them were able to receive subsidies that helped lower the monthly premiums. The average premium for health insurance in Kentucky is $605.

Can You Purchase Off-Exchange Insurance Coverage In Kentucky?

As of 2021, they were one of the states that expanded Medicaid. Kentucky has a state-run health insurance exchange. Window shopping debuted on the Kynect platform on October 15th.

Can You Purchase Short-Term Insurance In Kentucky?

There is short-term health insurance in Kentucky. The plans run up to 12 months for as little as 30 days. You can apply for the policy for up to three years.

Health Coverage Options For Low-Income People In Kentucky

Options for low-income people in Kentucky vary depending on how much money you make and where you live. There are two types of health insurance for low-income people: Medicare and Medicaid.

What Medicare Options Are Available In Kentucky?

Regardless of your income, you can apply for Medicare if you are over 65. You also qualify for Medicare if you have a disability. Medicare Supplement plans and prescription drug coverage is also available in Kentucky.

Medicaid In Kentucky

Medicaid coverage is available for children under the age of 19, low-income adults between the ages of 19 to 64, parents and caretaker relatives, and foster children between the ages of 18 and 26 who are not receiving Medicaid in another category. As of 2021, 1.5 million people are enrolled in Medicaid.

Cheapest Health Insurance Plans In Kentucky

There are plenty of low-cost individual health insurance plans in Kentucky. Some plans offer low premiums but have high out-of-pocket costs, while others offer low out-of-pocket costs but high premiums. Below are some excellent options to choose from.

Cheapest health plan in Kentucky with low out-of-pocket maximums

If you have more medical costs than the average person, you might want to opt for a plan with a higher premium with low out-of-pocket costs. Regular doctor visits and prescriptions help you reach your maximum limit sooner. Your insurance carrier begins to cover your expenses faster, which saves you money. CareSource Marketplace Gold has a monthly premium of $542 and out-of-pocket costs of $4,250.

Cheapest health plan in Kentucky with high out-of-pocket maximums

If you rarely go to the doctor, you may opt for cheap health insurance in Kentucky with high out-of-pocket maximums. You only pay the costs when you have a medical emergency. The most affordable plan is Anthem Catastrophic Pathway Transition X HMO 8550, with a monthly premium of $221 and a maximum out-of-pocket expense of $8,250.

Cheapest health plan in Kentucky with an HSA option

If you don’t go to the doctor frequently, a Health Savings Account is an excellent option. It’s cheaper, and you can make pre-tax contributions towards health expenses. The cheapest HSA expanded Bronze plan costs an average of $360 per month.

Cheapest HMO/PPO/POS health plans in Kentucky

Plans in Kentucky are HMOs (Health Maintenance Organizations). It’s cheaper than other types, but it requires you to stay within their provider network for covered services. The cheapest HMO Silver Plan is Anthem Silver Pathway X Transition HMO 4650 for HAS costs, on average, $454.

FAQs

What’s the average cost of health insurance in Kentucky?

The average premium for health insurance in Kentucky is $605.

Is there free healthcare in Kentucky?

Medicaid provides free or low-cost health insurance in Kentucky to eligible people.

How do I get Obamacare in Kentucky?

Obamacare has been available in Kentucky since October 1, 2021. You don’t enroll in coverage through HealthCare.gov. Instead, you’ll use Kynect.ky.gov.

How much is Obamacare in Kentucky?

The Affordable Care Act has health insurance for $605 per month or $7,260 per year.

Who qualifies for free healthcare in Kentucky?

The Kentucky Medicaid program provides health insurance for low-income people. The income limit is $217, and the resource limit is $2,000 for an individual.

How do students in Kentucky access health insurance?

There are a few options that Kentucky students can use to access health insurance. Many colleges have student health insurance options. They could also use the ACA Marketplace to enroll in health insurance.

How To Buy Affordable Health Insurance In Kentucky?

Affordable individual and family health insurance plans are available in Kentucky. Use our health insurance quote tool to compare rates and find the cheapest plan available.