UPDATED: JULY 13, 2023 | 3 MIN READ

The upcoming Medicaid coverage redetermination process has generated much interest and anxiety among Americans. With the proposed changes, millions of low-income individuals and families could lose healthcare benefits, significantly impacting their lives.

The potential loss of coverage could devastate vulnerable groups, such as the elderly, children, pregnant women, and people with disabilities.

Additionally, the proposed changes could cause a ripple effect on health insurance plans, healthcare providers, and the economy, as they may see a decrease in revenue and an increased burden on emergency services.

What is Medicaid redetermination?

Medicaid redetermination is reviewing a recipient’s eligibility for Medicaid benefits. This occurs periodically, typically once a year, to ensure that individuals are still eligible for their benefits.

The redetermination process involves collecting information on income, assets, and other factors affecting a recipient’s eligibility. It’s an essential step in maintaining the integrity of the Medicaid program and ensuring that benefits are only provided to genuinely eligible people.

For recipients, responding to redetermination requests promptly and providing accurate information is important to avoid any benefits interruptions. Medicaid redetermination helps ensure that the program remains sustainable and continues to provide critical healthcare coverage to those who need it most.

Information collected for Medicaid redetermination

- Income

- Assets

- Household size

What makes this Medicaid redetermination different from previous years?

Amidst the COVID-19 pandemic, Congress implemented the Families First Coronavirus Response Act (FFCRA), which included a provision requiring Medicaid programs to maintain uninterrupted enrollment of individuals until the end of the public health emergency. This provision was incentivized through federal funding enhancements.

10 things to know about the unwinding of the medical continue enrollment provision

Several items will be affected by the continuous enrollment unwinding. Between 5 and 14 million Americans will lose Medicaid once they go through the prequalification process. The largest impact is expected on adults in the ACA program and children under 19.

The new unwinding will eliminate the continuous enrollment provision, and each state has its own plans and provisions for unwinding. Streamlined renewal processes have resulted in states obtaining temporary waivers to support their unwinding plans.

Specific groups are more likely to lose Medicaid than others, and states can partner with MCOs and others for outreach to let Americans know their status. The unwinding will use timely data, and the number of uninsured individuals could increase.

Medicaid redetermination in 2023: Who will it affect the most?

The upcoming Medicaid redetermination process will significantly impact many individuals who rely on this program as their primary healthcare means. This process will particularly affect low-income families and individuals, elderly populations, and people with disabilities.

These Americans are disproportionately vulnerable to changes in Medicaid eligibility requirements due to their financial and health-related challenges.

The redetermination process will require individuals to provide updated information on their income, household size, and other factors determining their Medicaid eligibility. This could result in some losing access to essential healthcare services.

Policymakers must carefully consider the potential impact of this process on these vulnerable populations and take necessary measures to ensure that they are not left without access to vital healthcare services.

While many Medicare beneficiaries will not lose their Medicaid eligibility because they will still be under the Medicaid income and asset guidelines, the most affected individuals will be low-income families.

Who’s affected?

- Elderly Americans

- Children

- Low-income individuals and families

- Individuals with disabilities

How many individuals will lose Medicaid due to the unwinding provisions

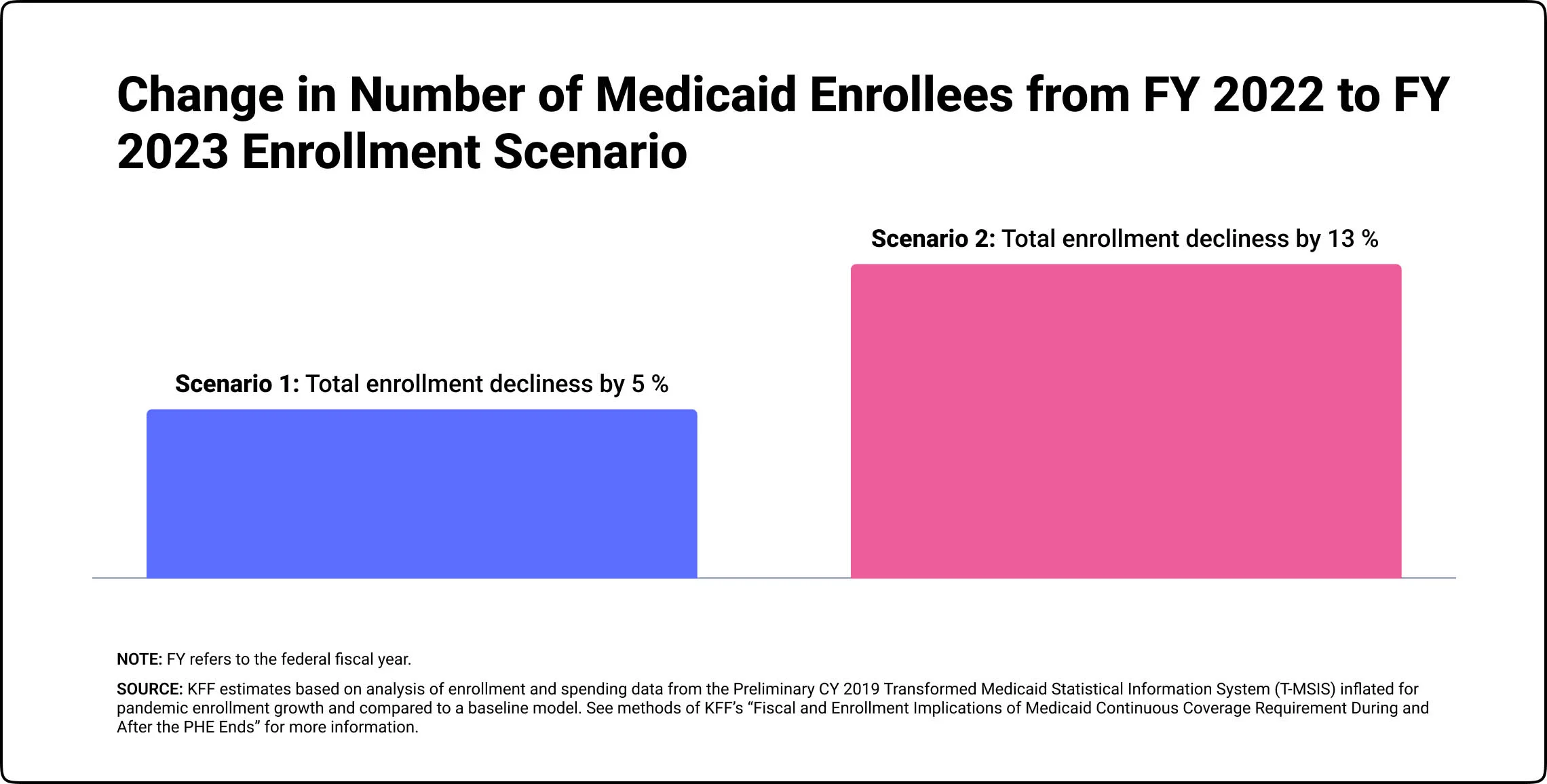

The potential number of Medicaid enrollees who may face disenrollment during the unwinding period can’t be precisely determined.

However, current estimates suggest that between 5.3 million to 14.2 million individuals may experience a decline in Medicaid coverage, resulting in a 5% to 13% drop in enrollment over the 12 months.

These projected coverage losses align with the previous estimates by the Department of Health and Human Services, indicating that approximately 15 million individuals may experience disenrollment, including 6.8 million who are still likely eligible.

COVID-19 impacts on Medicaid redetermination

However, with the recent implementation of the Consolidated Appropriations Act in 2022, the requirement of continuous enrollment is no longer tied to the public health emergency. As a result, this provision will expire on March 31, 2023.

This provision will expire on March 31, 2023.

Consolidated Appropriations Act of 2023 (CAA)

Congress signed the CAA into law on December 29, 2022. It removed the continuous Medicaid enrollment portion from the public health emergency to allow states to resume disenrollments from Medicaid as of March 31, 2023.

States must comply with specific regulations to be eligible for the gradual reduction in the enhanced Federal Medical Assistance Percentage (FMAP).

These regulations prohibit states from restricting eligibility standards, methodologies, or procedures and raising premiums as mandated in the Families First Coronavirus Response Act.

Furthermore, states must adhere to federal guidelines for the renewal process and ensure that contact information for enrollees is accurate and up-to-date.

States must also make reasonable efforts to notify enrollees before disenrollment in the event of returned mail.

The Consolidated Appropriations Act (CAA) provides for a gradual reduction of the increased federal Medicaid matching funds until December 2023.

Families First Coronavirus Response Act (FFCRA)

Congress enacted the FFCRA to pause the redetermination of Medicaid until the end of the COVID-19 public health emergency. They allowed many Americans to have continuous enrollment without re-qualifying for Medicaid health coverage.

This continuous enrollment clause allowed many Americans to remain on Medicaid that otherwise wouldn’t have been re-qualified.

Medicaid enrollment increased dramatically during the pandemic

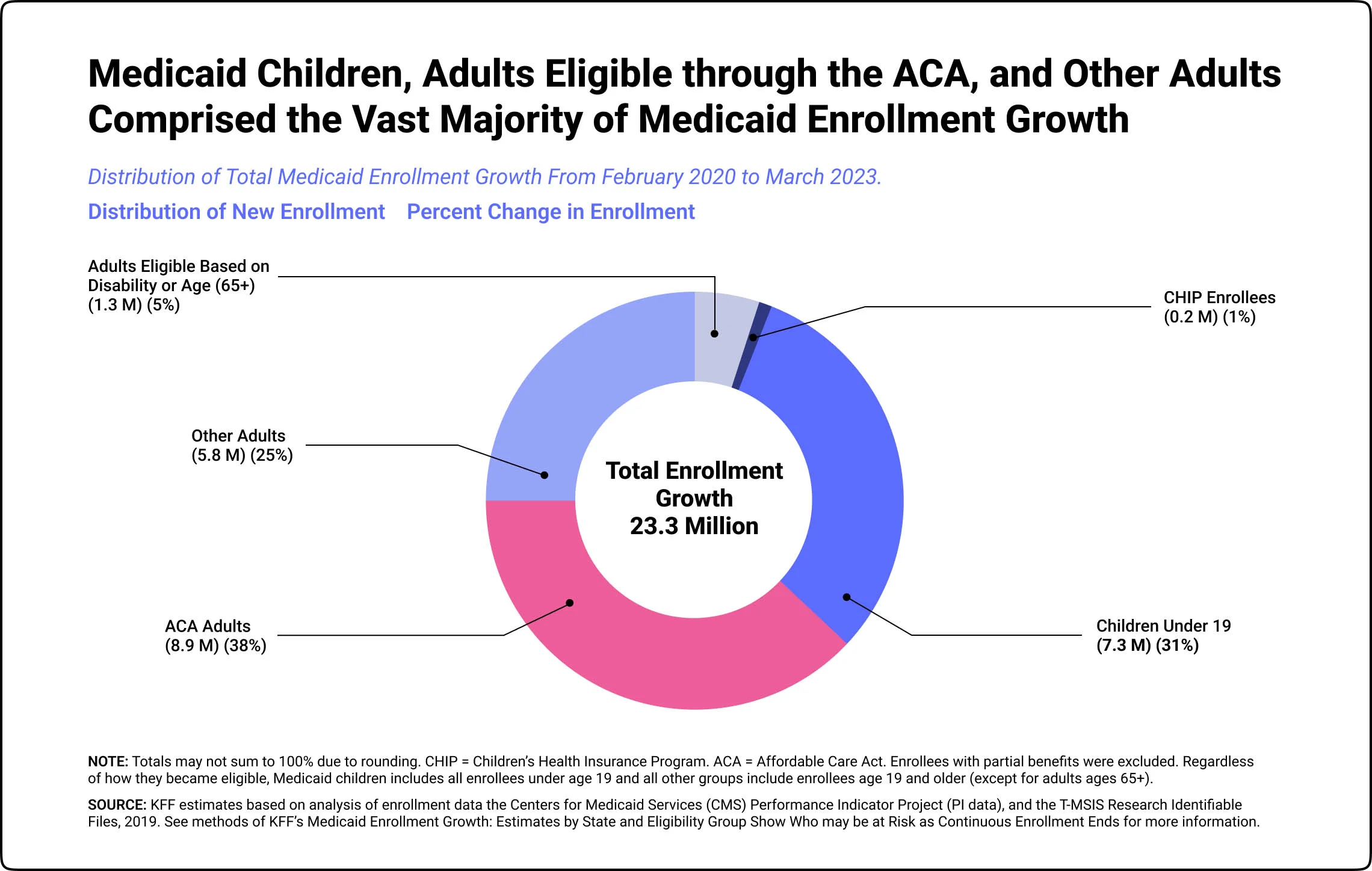

These changes allowed Medicaid to be rolled over to Americans without re-qualification. Thus causing significant growth in the number of people receiving Medicaid benefits.

The largest growth occurred with adults enrolled in an affordable care act plan, followed closely by children under 19.

What options do I have if I lose coverage due to Medicaid redetermination?

Should you become ineligible for Medicaid due to reassessments, alternative options are available for securing economically feasible coverage.

These options include subsidized plans offered through the ACA Marketplace, employer-provided plans, or Medicare. Exploring these options is advisable to ensure you maintain adequate healthcare coverage.

Coverage options: After the loss of Medicaid

There are several coverage options available to individuals that lose Medicaid. Losing coverage triggers special enrollment periods, allowing people to enroll in other health insurance.

Alternative coverage options for individuals losing Medicaid:

- Medicare Advantage

- Medicare Part D

- Medicare Supplement

- Affordable Care Act – Marketplace plans

- Employer group coverage – Spousal employer coverage

Medicaid statistics

From February 2020 to the end of March 2023, there has been a significant increase in Medicaid/CHIP enrollment, with a growth of 23.3 million individuals, bringing the total number to almost 95 million.

This substantial rise in enrollment can be attributed to a range of factors, including the economic impact of the pandemic, the implementation of Medicaid expansion in certain states (NE, MO, OK), and the inclusion of the continuous enrollment provision in the FFCRA.

The continuous enrollment provision mandates that states maintain continuous coverage for Medicaid enrollees to receive increased federal funding.

This has not only helped to preserve coverage during these unprecedented times but also increased state spending for Medicaid.

However, it is worth noting that the KFF has estimated that the enhanced federal funding, which results from a 6.2 percentage point increase in the federal match rate (FMAP), has offset the higher state costs.

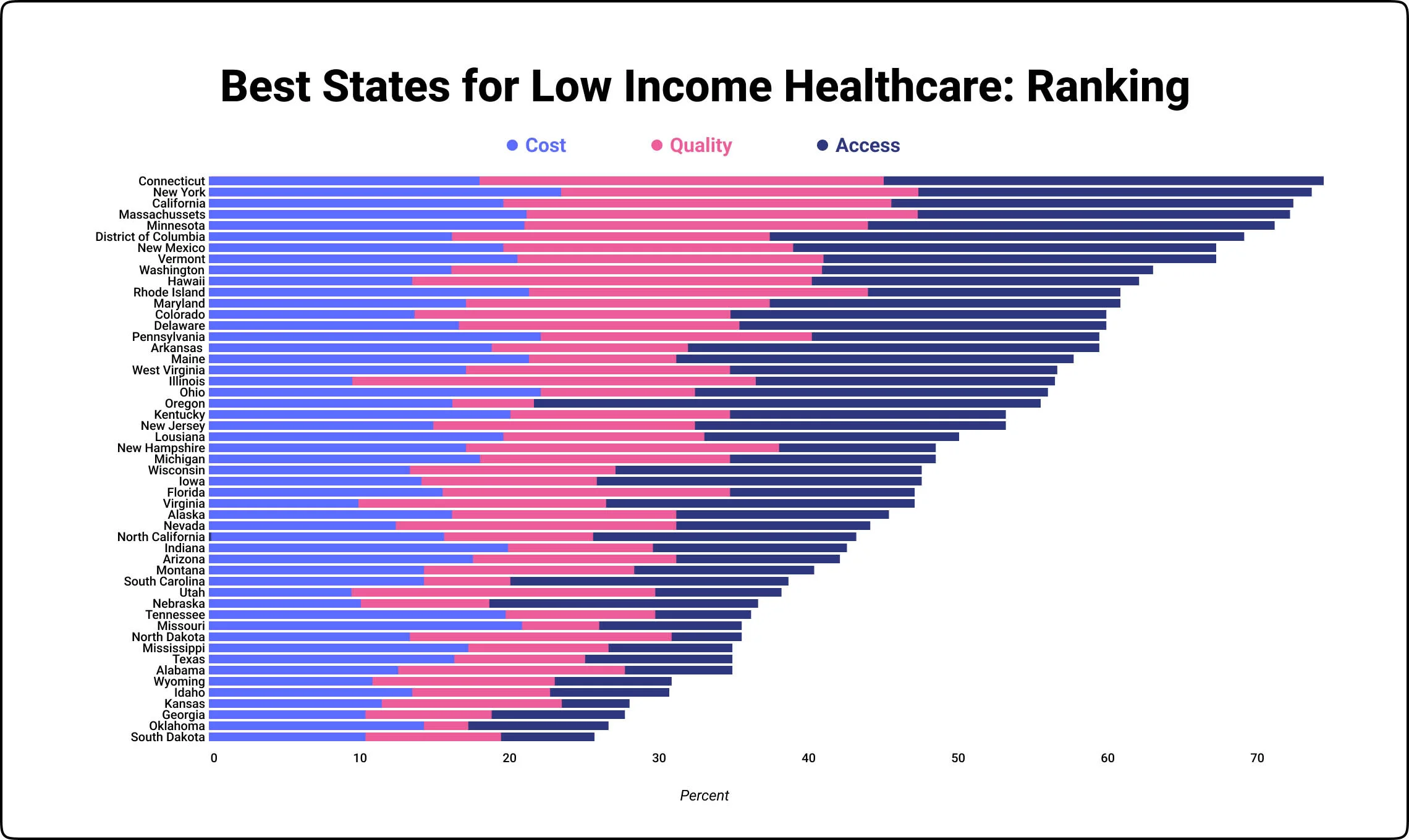

Best states for low-income healthcare

Medicaid and the Children’s Health Insurance Program (CHIP) have been established through state and federal funding to offer health insurance coverage to individuals who are financially disadvantaged and lack appropriate resources to purchase it independently.

Each state has distinct eligibility criteria and policies in place.

Some states do a better job than others regarding healthcare for low-income Americans. The categories used to determine and derive the illustrations below were based on cost, quality, and access.

Within each category, we looked at specific data:

Concerning costs, studies showed2 that regarding Medicaid spending per capita, Washington, DC ranked best, while Utah ranks worst. When looking at the Federal Medicaid contributions, New Mexico was the best, while Wyoming was the worst. While reviewing the State Medicaid contribution, the best and worst states flip-flopped, with Wyoming being the best and New Mexico being the worst.

Regarding quality, Connecticut ranks the best in child immunization quality, while Wyoming ranks the worst, for public hospital system quality Hawaii ranks best, while Louisiana ranks worst. Hawaii also ranks best for Medicaid expansion, while Louisiana ranks worst.

Regarding access, Iowa was the best regarding pregnant women’s eligibility, and South Dakota ranks worst. Washington, DC, ranks best for adult Medicaid eligibility, with Texas ranking worst. Concerning children’s access to Medicaid, Washington, D.C. ranks best while Wyoming ranks worst. As for total Medicaid enrollment, New Mexico ranks best, with North Dakota ranking worst.

FAQs

What’s the highest income to qualify for Medicaid?

The criteria for determining parental eligibility are expressed as a proportion of the 2023 Federal Poverty Level (FPL) for a family of three, currently valued at $24,860.

Meanwhile, the standards for determining the eligibility of single adults with no dependents are measured as a percentage of the 2023 FPL for an individual, presently set at $14,580.

What states have the highest Medicaid income limits?

Alaska and Hawaii are two states in the United States that have distinct Federal Poverty Line (FPL) thresholds for individuals. The FPL for individuals in Hawaii is $14,380, while in Alaska, it is $15,600.

Washington, DC, has the highest income limits for families and individuals. Therefore, if you reside in the Washington, D.C. area, a family of three can qualify for Medicaid if their income is 221% of the FPL.

What is the highest income to qualify for healthcare.gov?

Experts estimate that a household of four will earn between $27,750 and $111,000 in 2022. It’s important to note that Alaska and Hawaii may have higher income limits due to a greater federal poverty level.

The American Rescue Plan Act of 2021 expanded subsidy eligibility to individuals earning over 400% of the federal poverty level. This legislative action serves to increase accessibility to healthcare subsidies and support those in need.

Who uses Medicaid the most?

The demographic composition of Medicaid beneficiaries comprises children, elderly individuals, and those with disabilities. Children make up nearly half of all Medicaid beneficiaries, with over 35 million enrolled in the program.

Medicaid also serves as a safety net for elderly individuals, with over 9 million beneficiaries aged 65 and older enrolled in the program.

Additionally, Medicaid provides critical healthcare coverage for those with disabilities, with over 10 million beneficiaries enrolled in the program.

What are the biggest problems with Medicaid in the US?

Looking forward, Medicaid faces three critical issues requiring urgent attention in the year’s remaining months.

These challenges encompass the need for improved eligibility criteria and bolstered state supervision, the upcoming expiration of temporary coverage enacted in response to the pandemic, and the lack of widespread public support, which poses a significant barrier to advancement.

Although Medicaid will start a redetermination period again, it doesn’t mean affordable healthcare options exist. Reviewing healthcare options is easy.

Sources: AgileRates extracted and analyzed data from the following to provide data in this article.

- “10 Things to Know About the Unwinding of the Medicaid Continuous Enrollment Provision” (Kaiser Family Foundation)

- “Federal Medical Assistance Percentages or Federal Financial Participation in State Assistance Expenditures (FMAP)” (Department of Health and Human Services)

- “What is Medicaid redetermination?” (HealthInsurance.gov)

Related content: