UPDATED: SEPTEMBER 05, 2023 | 2 MIN READ

Oregon plans to offer a public option for health insurance and is currently studying its options. The Oregon health insurance Marketplace will offer the public option at a cheaper rate if approved. Here’s what you need to know about Oregon health insurance.

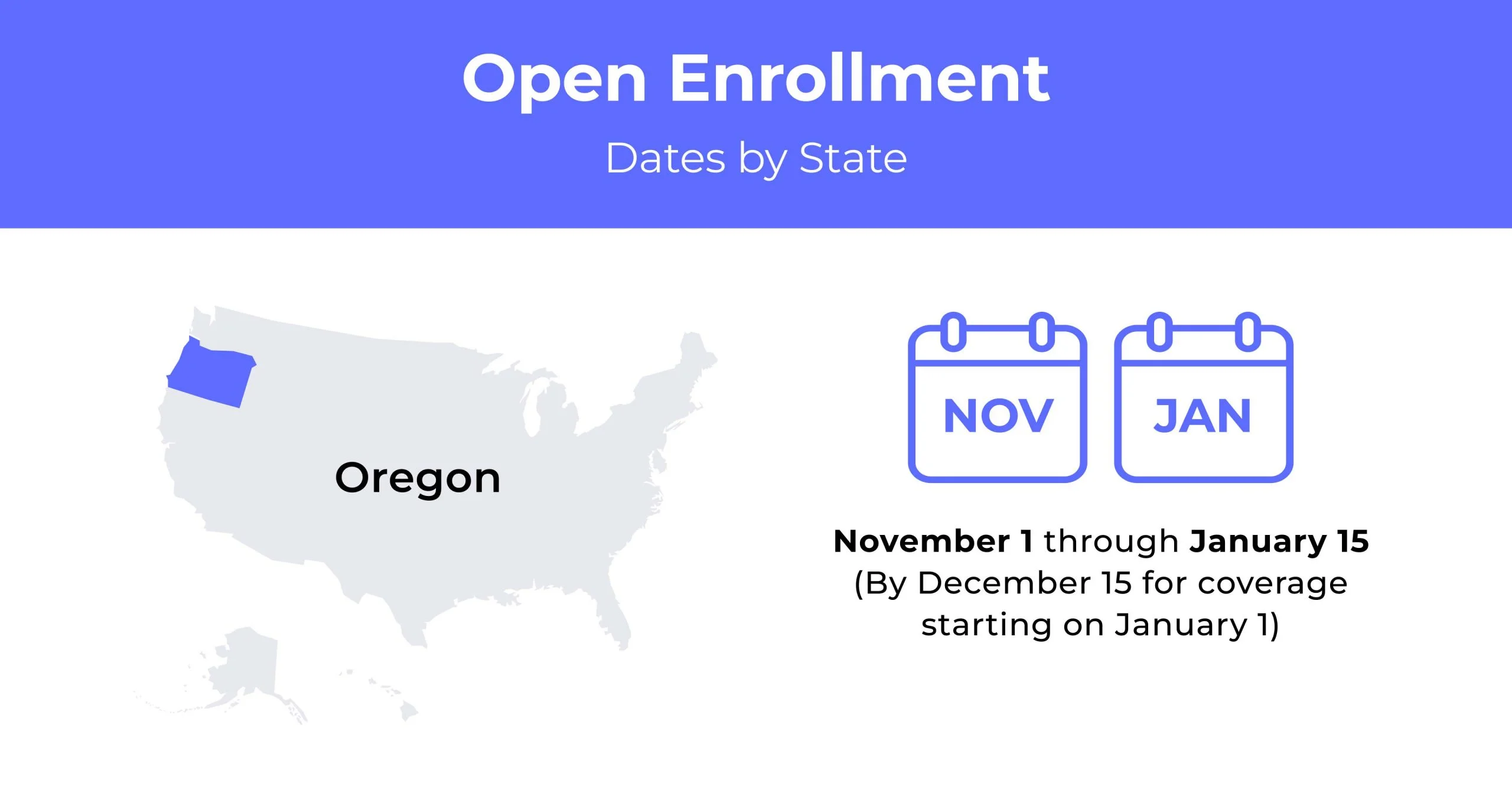

Oregon Open Enrollment dates for health insurance

Oregon’s Open Enrollment period runs annually from November 1st to January 15th.

Oregon health insurance demographics

Oregon’s demographics help shape health insurance premium costs. Degrees earned, average income, and age range all affect carrier rates.

- Average Household Income: Oregon’s average household income is $88,137, and the median income is $65,667.

- Median Age Range: The median age in Oregon is 39.1, and the median age range is 45-64.

- Education: Oregon’s population features 21.30% of its residents with a Bachelor’s degree and 13.10% with a Graduate degree.

What type of health insurance Marketplace does Oregon have?

Oregon operates its state-run Marketplace with Healthcare.gov. Residents start on the website OregonHealthcare.gov to browse plans and options, then complete their enrollment at Healthcare.gov.

How many people are insured through the Oregon health insurance marketplace?

Oregon’s enrollment numbers have ebbed over the years. For 2022 coverage, the state saw 147,783 residents enroll, which marks the highest number in years.

Did Oregon implement the ACA’s Medicaid expansion?

Oregon did implement the Affordable Care Act (ACA) Medicaid expansion, which adds eligibility to more residents than ever. More than 1 million Oregonians are covered by Medicaid thanks to the new eligibility set at 138% of the poverty level. The percentage of individuals without Oregon health insurance greatly decreased thanks to the expansion.

When can you purchase ACA health insurance in Oregon?

You may purchase ACA Oregon health insurance plans during Open Enrollment. This government-set period runs from November 1 to January 15. You may be eligible for Special Enrollment if you recently had a life change. If you qualify, you can enroll for health insurance through the ACA up to 60 days or 60 days after the qualifying event. Such events include:

- Death of an enrolled family member

- Marriage

- Divorce or legal separation where you lose spousal health insurance

- The birth, fostering, or adoption of a child

- Aging off a parent’s health plan at 26

- Moving to a new location for school or seasonal work

- Moving to a new zip code

- Loss of health insurance due to changing careers

- Becoming a U.S. citizen

Types of ACA plans in Oregon

ACA Oregon health insurance features four metal tiers: Bronze, Silver, Gold, and Catastrophic.

- Bronze plans offer low premiums but only cover 60% of your care costs

- Silver plans often come with higher premiums and offer more coverage at 70% of the costs paid

- Gold plans have the highest premiums but pay more at 90% of care costs, plus they have a lower deductible

- Catastrophic plans are for people younger than 30 or those with a hardship; these plans are only available in limited areas.

What carriers offer ACA health insurance in Oregon?

Six carriers offer health insurance in Oregon through the ACA marketplace. PacificSource offers statewide plans, as do Bridgespan, Providence, and Regence.

- BridgeSpan

- Kaiser

- Moda

- PacificSource

- Providence

- Regence

How much does health insurance cost in Oregon?

The average cost for Oregon health insurance plans is $397 a month. Your premium amount varies based on age, gender, location, and carrier.

Cheapest health insurance by metal tier in Oregon

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum-Out-of-Pocket |

|---|---|---|---|---|

| Catastrophic | PacificSource Navigator Catastrophic | $230 | $8,700 | $8,700 |

| Bronze Expanded | Providence Health Plan Connect 8700 | $310 | $8,700 | $8,700 |

| Silver | Kaiser KP OR Silver 4500/40 | $405 | $4,500 | $8,550 |

| Gold | Kaiser KP OR Gold 2000/30 | $430 | $2,000 | $7,900 |

Cheapest health insurance by county

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|---|

| Clackamas | Kaiser KP OR Silver | $405 | $810 | $1,015 |

| Lane | Kaiser KP OR Silver | $405 | $810 | $1,015 |

| Marion | Kaiser KP OR Silver | $405 | $810 | $1,015 |

| Multnomah | Kaiser KP OR Silver | $405 | $810 | $1,015 |

| Washington | Kaiser KP OR Silver | $405 | $810 | $1,015 |

Are health insurance subsidies available in Oregon?

Oregon health insurance subsidies typically help save hundreds off premium costs, with the average enrollee saving $451 a month. This financial assistance is income-based and offered only through the marketplace. You may be eligible for premium tax credits or cost-sharing reductions based on your income.

Can you purchase off-exchange health insurance coverage in Oregon?

Yes, several providers offer Oregon health insurance plans off the exchange.

Can you purchase short-term health insurance in Oregon?

Oregon allows short-term health insurance, but limits plan duration to three months, including renewals. The state stipulates renewals when a person buys a new short-term insurance plan from the same carrier within 60 days of their other policy.

Health insurance options for low-income people in Oregon

If you’re low-income, Oregon has good health insurance options for you. Oregon offers a Medicaid program (The Oregon Health Plan) and Medicare. Each program offers free or low-cost healthcare to needy individuals.

What Medicare options are available in Oregon?

Oregon residents who qualify for Medicare have the option of Original Medicare (Part A and B), Medicare Advantage, and Medicare Part D.

Original Medicare – Original Medicare is Parts A and B. Part A is hospital insurance. It covers inpatient care, skilled nursing facilities, home health, and hospice care. Part B is medical insurance for physician visits, ER visits, diagnostic tests, ambulance transport, and other medical needs.

Medicare Advantage – A combination of Parts A and B, Medicare Advantage is also known as Part C plans. These plans often include Medicare Part D or prescription drug coverage.

You’re eligible for Medicare in Oregon if you’re:

- Age 65 or older

- Under 65 on Social Security Disability Insurance (SSDI) income for more than two years

- Diagnosed with end-stage renal disease or ALS

Medicaid in Oregon

Oregon’s Medicaid program, The Oregon Health Plan (OHP), offers medical coverage to low-income residents, including families, seniors, and children. OHP requires applicants to be:

- Pregnant, or the caretaker of a child 17 years or younger

- Have a disability or a family member in your household with a disability.

OHP has several programs:

- OHP Plus covers children 0-18 and adults 19-64

- OHP Plus Supplemental is only for pregnant individuals 21 or older

- OHP with Limited Drug is for adults who qualify for Medicaid and Medicare Part D

Income-based eligibility applies. Adults who earn up to 133% of the Federal Poverty Level (FPL) are eligible, as are children of a family who earn up to 300% of the FPL. The specific income threshold varies by family size.

Cheapest Health Insurance Plans In Oregon

Low out-of-pocket maximums

Low out-of-pocket maximums on your Oregon health insurance plan help you have your insurance company cover your expenses quicker. A low out-of-pocket plan is an excellent choice if you visit the doctor regularly or have expensive medical needs. The PacificSource Health Plans’ Navigator Gold 1500 is ideal at $539 monthly and $5,500 out-of-pocket maximum.

High out-of-pocket maximums

High out-of-pocket maximum plans are for individuals who don’t have a lot of medical expenses. These plans will have low premiums. Just expect to pay more when you seek care. The PacificSource Health Plans’ Navigator Catastrophic is a good plan, available to Oregonians under 30 or those with hardship. The plan costs an average of $195 a month.

Plans with an HSA option

Health Savings Accounts (HSA) help you manage and plan for medical expenses. These tax-free accounts can apply to deductibles, copays, and other medical costs. The amount isn’t taxed if you withdraw from your HSA for medical needs. However, you will pay tax if you use the money for something else. On average, Kaiser Permanente’s KP OR Bronze 6900/0% HSA plan is a good choice at $309 a month.

HMO/PPO/POS

An Exclusive Provider Organization (EPO) plan covers medical services when you stay within the network or if you have a true emergency. Preferred Provider Organization (PPO) plans also have a network; you don’t need a referral for outside providers.

The cheapest EPO in Oregon is Connect 8700 Bronze, which runs $295 a month on average. An affordable choice for a Preferred Provider Organization (PPO) plan is the Navigator Bronze HSA 7000, which is $322 a month.

FAQs

Does Oregon have free healthcare?

Oregon’s Medicaid program, Oregon Health Plan, provides free or affordable healthcare to eligible low-income individuals.

What’s the income limit for the Oregon Health Plan?

Single adult recipients who earn up to $15,800 a year and adults who earn up to $32,500 for a family of four are eligible. Children 0-18 years old whose family earns up to $46,000 for a family of two are also eligible. For children in a family of four, the limit is $70,600.

Who is eligible for Obamacare in Oregon?

You may sign up for Obamacare insurance in Oregon at any income level. Individuals with household incomes between 100% and 400% of the Federal Poverty Level (FPL) may receive subsidies or premium tax credits when they enroll.

How long does it take to get approved for Oregon Health Plan?

The duration for approval can take up to 45 days after you submit your application. If you’re applying based on disability, it may take a bit longer.

Is the Oregon Health Plan the same as Medicaid?

Yes. Oregon Health Plan is the name for Oregon’s Medicaid program.

How to shop individual and family health insurance plans in Oregon

If you want affordable health insurance plans for yourself or your family, browse the Marketplace for your options. You can shop plans in your state from the comfort of your home.

Related Content