UPDATED: SEPTEMBER 05, 2023 | 3 MIN READ

Health insurance is necessary for all residents in Rhode Island. It helps people cover their medical expenses and ensures they aren’t left in the lurch when they fall ill or get injured.

Health insurance is important because it protects individuals from financial ruin due to medical bills or catastrophic health events. It also gives them peace of mind and access to quality care.

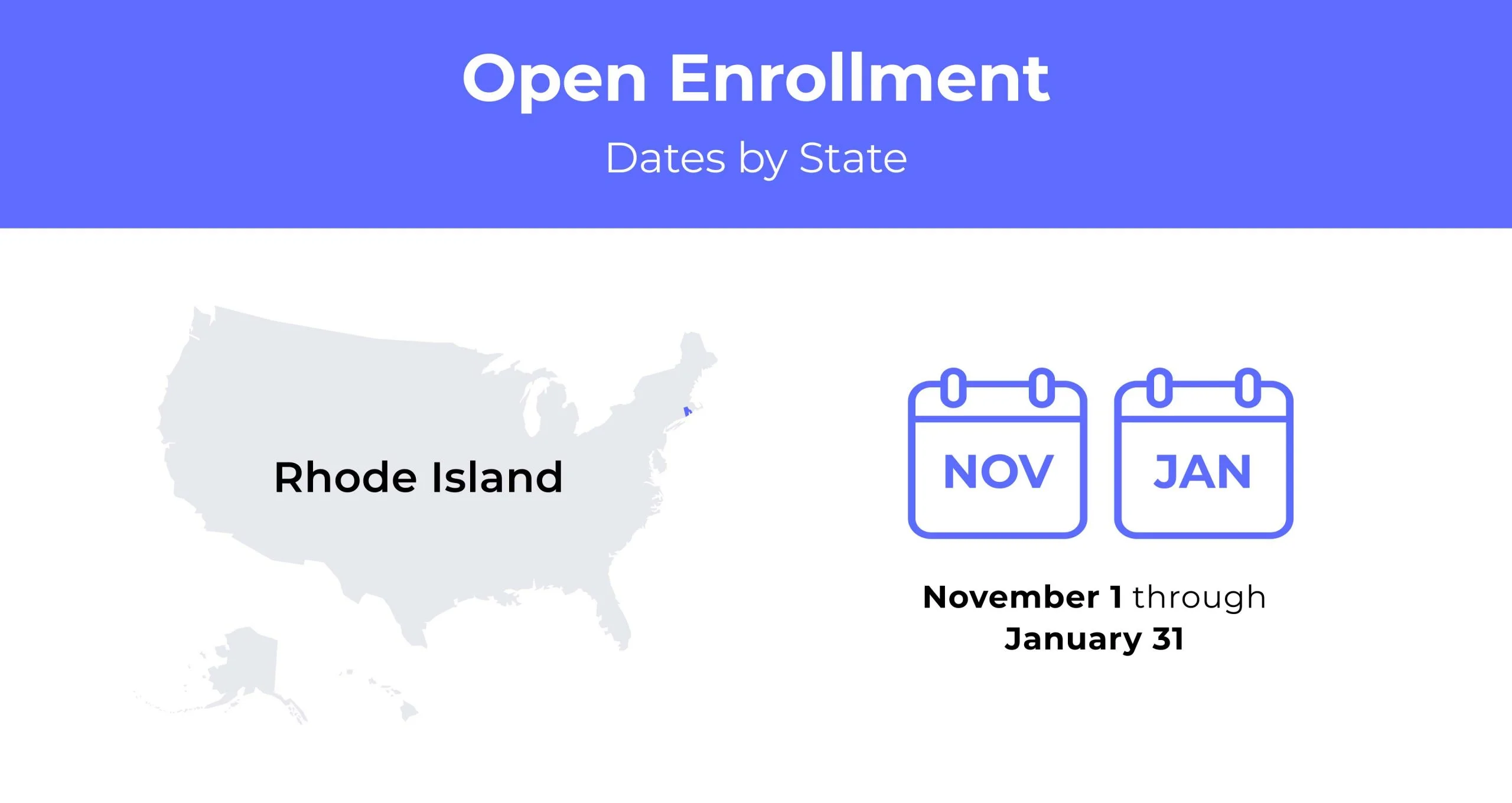

Rhode Island Open Enrollment dates for health insurance

The Rhode Island Open Enrollment period for health insurance runs annually from November 1st to January 31st.

Rhode Island health insurance demographics

The state’s health insurance rates are based on age, gender, and health status. The older you get, the more affordable your health insurance will be. Women also have lower premiums compared to men. Lastly, if you’re healthy and under a certain age, you can expect to pay less than those who are not as healthy or over a certain age.

- Average Household Income: The median household income in Rhode Island is $70,305. This is slightly higher than the United States median household income of $64,994.

- Median Age Range: The median age range of Rhode Island residents is 39.9.

- Education: More than 89% of Rhode Island residents have graduated high school, with 35% having college degrees. The state has about 7.1% of residents working through college.

What type of health insurance Marketplace does Rhode Island have?

The state-run health insurance exchange is called HealthSource RI. It is utilized by residents to get coverage on the marketplace.

How many people are insured through the Rhode Island health insurance marketplace?

In 2021, 31,174 people were enrolled. This is a drop compared to the 34,634 people enrolled in 2020.

Did Rhode Island implement the ACA’s Medicaid expansion?

Medicaid is a health insurance program for Americans with low incomes and limited resources. It provides coverage for medical, nursing, and long-term care services for people who meet certain eligibility requirements.

This type of Medicaid coverage became available in Rhode Island in 2014 due to the Affordable Care Act. The state expanded its Medicaid program. Now, provide health insurance to children under 19 with a family income at or below 133% of the federal poverty level.

When can you purchase ACA health insurance in Rhode Island?

The ACA Open Enrollment period for health coverage begins on November 1st and ends on January 31st.

You can also enroll outside the Open Enrollment period if you experience a ‘qualifying life event.’ You can also purchase health insurance up to 60 days after this event. These events include:

- Marriage

- Divorce

- Birth

- Adoption

- Loss of employer-provided coverage

Types of ACA plans in Rhode Island

The Bronze Plan is the cheapest health insurance plan in Rhode Island. It offers high out-of-pocket maximums and low premiums. Younger people can pay higher premiums for a cheaper bronze plan than older people. The platinum plan is the most expensive option but has high deductibles.

What carriers offer ACA health insurance in Rhode Island?

Two insurance providers are offering ACA health insurance coverage in Rhode Island. These two insurance companies are:

- Blue Cross Blue Shield

- Neighborhood Health Plan

How much does health insurance cost in Rhode Island?

The cost of health insurance in Rhode Island depends on how much money you earn, your age, and your plan type.

The average cost of health insurance is $413 per person each month, based on a 40-year-old with a Silver plan.

Cheapest health insurance by metal tier in RI

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum-Out-of-Pocket |

|---|---|---|---|---|

| Bronze | Neighborhood INNOVATION | $240 | $6,825 | $8,550 |

| Silver | Neighborhood COMMUNITY | $345 | $2,950 | $6,750 |

| Gold | Neighborhood PLUS | $350 | $1,250 | $6,750 |

| Platinum | VantageBlue Direct Plan 750/1500 Modified | $630 | $750 | $1,800 |

Cheapest health insurance by county

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 |

|---|---|---|---|

| Bristol | Neighborhood COMMUNITY | $345 | $685 |

| Kent | Neighborhood COMMUNITY | $345 | $685 |

| Newport | Neighborhood COMMUNITY | $345 | $685 |

| Providence | Neighborhood COMMUNITY | $345 | $685 |

| Washington | Neighborhood COMMUNITY | $345 | $685 |

Are health insurance subsidies available in Rhode Island?

Health insurance is expensive, and not everyone can afford it. Therefore, the government subsidizes premiums for some people by paying them directly. The subsidies are also available for people who buy their coverage through the Marketplace.

Can you purchase off-exchange health insurance coverage in Rhode Island?

An insurer sells off-exchange health insurance plans outside of the government’s public healthcare system. Off-exchange plans are also known as “non-group” or “individual” health insurance.

In Rhode Island, it is possible to buy off-exchange insurance, although the plans available may differ.

Can you purchase short-term health insurance in Rhode Island?

It’s not illegal in Rhode Island for insurers to sell short-term health plans. However, the state does have strict regulations about its marketing. This has caused no insurers to focus on the state, meaning it’s currently unavailable to buy in RI.

Health insurance options for low-income people in Rhode Island

Health insurance is a vital part of life for all Americans. The Affordable Care Act has helped millions of people get health insurance. It has also made it easier for people to find affordable health insurance plans.

There are many options for low-income people to get health insurance. Some available options include Medicaid, Medicare, and the Affordable Care Act.

What Medicare options are available in Rhode Island?

The Medicare Advantage program has different plans for people living in Rhode Island. These include:

- Health maintenance organization (HMO)

- Preferred provider organization (PPO)

Medicaid In Rhode Island

To be eligible for Rhode Island Medicaid, you must be a resident of RI, meet the income requirements, and be one of the below.

- Pregnant

- Be responsible for a child 18 years of age or younger

- Blind

- Have a disability or a family member in your household with a disability

- Be 65 years of age or older

If your financial situation doesn’t qualify and you require health care assistance, you could consider contacting a social services office in RI to inquire about other assistance.

Cheap health insurance in Rhode Island

Rhode Islanders can choose from several available plans through the state’s health plan marketplace. Some private employers offer their employees health insurance plans.

It’s important to note that the plan with the cheapest premium may not be the best plan for you overall. You should compare plans to ensure you get the best deal for your circumstances.

Low out-of-pocket maximums

The cheapest plan in Rhode Island is the VantageBlue Direct Plan 750/1500, Modified from Blue Cross Blue Shield of Rhode Island.

High out-of-pocket maximums

The cheapest plan in Rhode Island is the Bronze Neighborhood Innovation Plan from Neighborhood Health Plans.

HSA plan options

The cheapest plan in Rhode Island is the Neighborhood Economy Plan from the Neighborhood Health Plans.

HMO/PPO/POS

- The cheapest HMO plan in Rhode Island is the Neighborhood Community Plan from Neighborhood Health Plans of Rhode Island..

- The cheapest PPO plan in Rhode Island is the BlueSolutions for HSA Direct 4100/8200 plan from Blue Cross Blue Shield of Rhode Island.

- The cheapest POS plan in Rhode Island is the BlueCHiP Direct Advance 4650/9300 from Blue Cross Blue Shield of Rhode Island.

FAQs

How much does Rhode Island health insurance cost?

This depends on many factors, but an individual on the silver plan should expect to pay around $413 monthly. The national average monthly cost of health insurance is $541.

Does Rhode Island have free healthcare?

Depending on your eligibility, you may be able to access free healthcare in Rhode Island through Medicaid.

Who is eligible for HealthSource RI?

People who do not receive affordable insurance through their jobs are eligible for HealthSource RI.

What is the penalty for not having health insurance in Rhode Island?

Rhode Island requires all residents to have a health insurance plan, if they don’t, they might end up paying a penalty when they file taxes.

Who is eligible for Medicaid in RI?

You must meet several eligibility criteria to be approved for Medicaid in Rhode Island. These include being a resident of Rhode Island, a U.S. national, a citizen, a permanent resident, or a legal alien needing health care. You also need to have a financial situation categorized as low income.

How to shop health insurance plans in Rhode Island

If you are looking for individual or family health insurance plans in Rhode Island, it is important to note that many options are available.

The key to finding affordable health insurance is to know your needs and shop around. You should be familiar with the different types of coverage available under each type of plan. This will help you determine which plan best meets your needs and budget.

Related Content