UPDATED: SEPTEMBER 05, 2023 | 3 MIN READ

South Carolina is a state that has many health insurance options available to its residents. People need to be aware of the coverage they have and what options are available. Read more to learn how to find cheap health insurance in South Carolina.

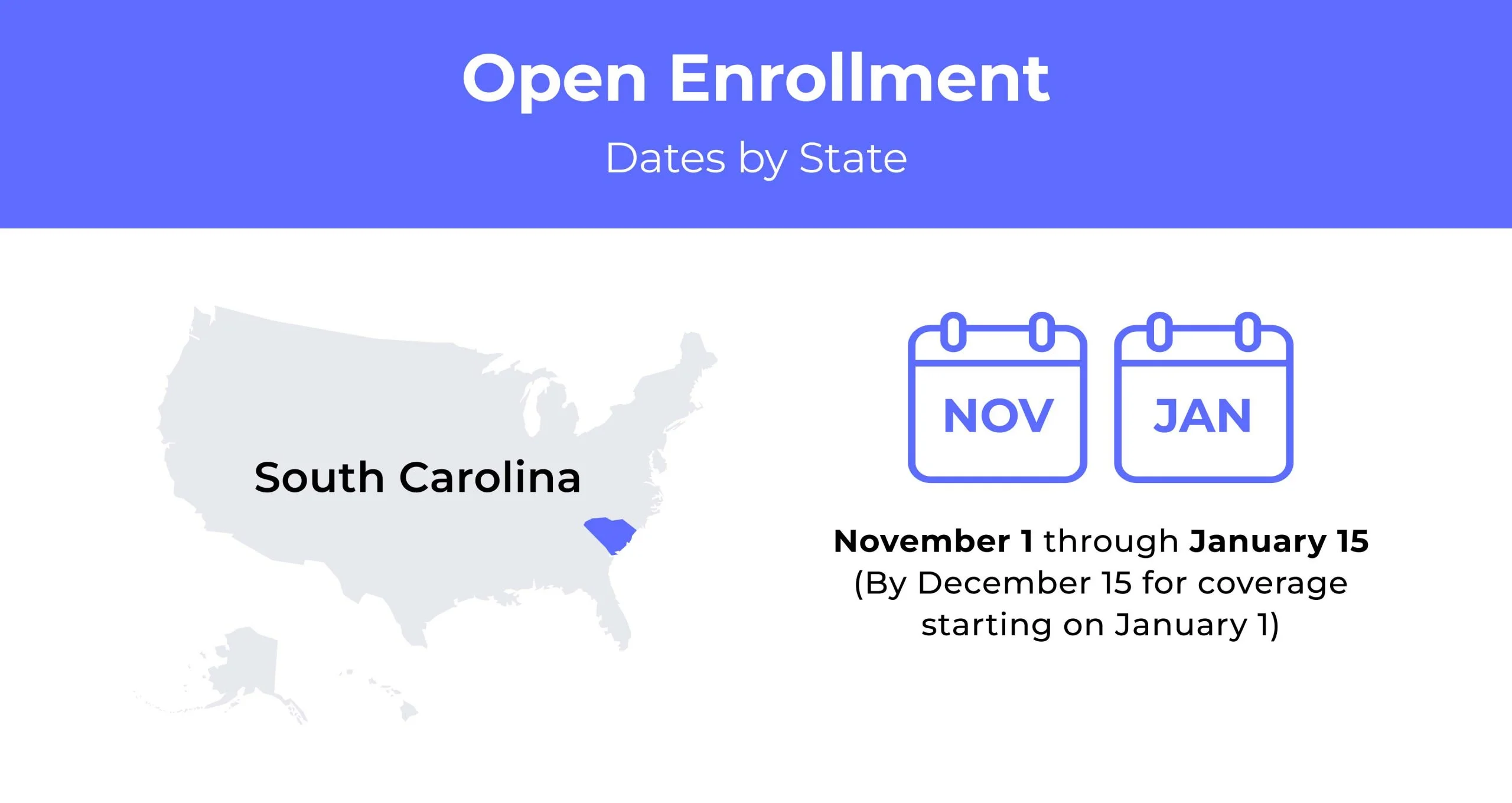

South Carolina Open Enrollment dates for health insurance

In South Carolina, the Open Enrollment period for health insurance runs from November 1st to January 15th each year.

South Carolina health insurance demographics

South Carolina is a state with a large population and diverse demographics. This makes it difficult to establish an average rate for insurance. However, some factors can determine the cost of insurance — gender, age, and location.

- Average Household Income: The median household income in South Carolina is $54,864. This is slightly less than the United States median household income of $64,994.

- Median Age Range: The median age of South Carolina residents is 38.8.

- Education: More than 88% of South Carolina residents have graduated high school, with 29% having college degrees. The state has about 5% of residents working through college.

What type of health insurance Marketplace does South Carolina have?

South Carolina uses the federally run health insurance exchange. People living there typically enroll through HealthCare.gov.

How many people are insured through the South Carolina health insurance marketplace?

230,050 people enrolled in health plans through the South Carolina health insurance marketplace during the Open Enrollment Period for 2021 coverage?

Did South Carolina implement the ACA’s Medicaid expansion?

South Carolina has been one of the few states that have not expanded Medicaid under the ACA. The state’s Republican-led government opposes Obamacare and has refused to expand the program.

When can you purchase ACA health insurance in South Carolina?

The enrollment period for 2022 coverage in South Carolina ran from November 1, 2021, until January 15, 2022.

People can enroll outside this period if they experience a ‘qualifying life event.’ Such as a marriage, birth, adoption, or losing insurance from their employer.

Types of ACA plans in South Carolina

The types of plans in South Carolina are divided into different types:

- Catastrophic

- Bronze

- Bronze Expanded

- Silver

- Gold

The plans with lower monthly premiums tend to have higher deductibles and higher out-of-pocket maximums. The reverse is also true of the plans with higher premiums.

What carriers offer ACA health insurance in South Carolina?

Four insurance providers are offering ACA health insurance coverage in South Carolina. These four companies are:

- Ambetter/Absolute Total Care

- BlueCross BlueShield of South Carolina

- Bright

- Molina

How much does health insurance cost in South Carolina?

On average, South Carolina residents can expect to pay $544 per person monthly for a silver plan.

Cheapest health plan by metal tier in South Carolina

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Catastrophic | BlueEssentials Catastrophic 1 | $215 | $8,700 | $8,700 |

| Bronze | Ambetter Essential Care 1 | $250 | $8,600 | $8,600 |

| Bronze Expanded | Ambetter Essential Care 10 | $260 | $7,200 | $8,400 |

| Silver | Ambetter Balanced Care 30 | $320 | $6,100 | $6,100 |

| Gold | Ambetter Secure Care 5 | $380 | $1,450 | $6,300 |

Cheapest health insurance by county

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 | Couple, Age 40 & Child |

|---|---|---|---|---|

| Charleston | Ambetter Balanced Care 30 | $320 | $635 | $825 |

| Greenville | Constant Care Silver 2 | $365 | $725 | $945 |

| Horry | Ambetter Balanced Care 30 | $320 | $635 | $825 |

| Richland | Constant Care Silver 2 | $365 | $725 | $945 |

| Spartanburg | Constant Care Silver 2 | $365 | $725 | $945 |

Are health insurance subsidies available in South Carolina?

South Carolina is one of the states that offer health insurance subsidies. You can get a subsidy to help cover your premiums if you are eligible.

If you are not eligible for a subsidy, you can still get health insurance through the state’s healthcare exchange.

Around 93% of South Carolinians who enrolled in Marketplace coverage through the Affordable Care Act (ACA) in 2020 use federal government subsidies to make premiums more affordable.

Can you purchase off-exchange health coverage in South Carolina?

The short answer is yes; you can purchase insurance on the exchange. However, if you are looking for coverage outside of the exchange, there are a few things to consider before purchasing.

The plans offered ‘off-exchange’ may differ from those available on the exchange. They may provide different levels of coverage, and some things may not be covered.

Can you purchase short-term health insurance?

It is possible to purchase short-term health insurance in South Carolina.

A short-term health insurance policy is a type of health insurance that lasts for a specific period, typically between three months and one year. It does not offer the same coverage as a standard policy.

Short-term policies are generally cheaper than standard policies. They do not cover pre-existing conditions or offer the same level of coverage. However, they can be more expensive if you have a history of medical problems or require extensive medical care.

Health insurance options for low-income people

There are many options for low-income people who want to buy health insurance. They can choose between the Affordable Care Act (ACA) marketplace, Medicaid, and Medicare.

There are also state-based exchanges that provide subsidized plans. The ACA marketplace offers subsidies for people with incomes up to 400% of the federal poverty level.

What Medicare options are available in South Carolina?

Medicare is a federal insurance program that provides healthcare for people over 65 and disabled. It’s a government-funded program covering hospital care, doctor visits, and prescription drugs.

Medicaid in South Carolina

The U.S. government provides Medicaid for poor and low-income Americans. It’s one of the largest health insurance programs in the United States.

Medicaid is a social insurance program that provides healthcare coverage to low-income individuals. It’s one of the largest health insurance programs in the United States.

Cheapest health insurance plans in South Carolina

To find the cheapest health insurance plan, compare plans from different providers. You must compare with like as some providers offer more benefits than others.

Cheapest health plan in South Carolina with low out-of-pocket maximums

The cheapest health plan in South Carolina with a low out-of-pocket maximum is the BlueEssentials HD Gold 3 from BlueCross BlueShield of South Carolina.

Cheapest health plan in South Carolina with high out-of-pocket maximums

The cheapest health plan available in the state with high out-of-pocket maximums is BlueEssentials Catastrophic 1 from BlueCross BlueShield of South Carolina.

Cheapest health plan in South Carolina with an HSA option

South Carolina has the HSA plan, commonly called a health savings account.

The HSA is an account that allows you to put money in and use those funds for medical expenses. It’s similar to a 401k but used for medical expenses. The idea of this type of account is that you put money in and don’t have to pay taxes on the interest or dividends.

- Expanded Bronze: BlueEssentials HD Bronze 3 from BlueCross BlueShield of South Carolina.

- Silver Plan: Ambetter Balanced Care 25 HDS from Ambetter from Absolute Total Care.

- Gold Plan: BlueEssentials HD Gold 3 from BlueCross BlueShield of South Carolina.

Cheapest HMO/PPO/POS health plans in South Carolina

In addition, the state provides Exclusive Provider Plans (EPO).

- The cheapest HMO plan is the Constant Care Silver 4 from Molina Healthcare.

- The cheapest EPO plan is the BlueExclusive Cooper Silver 2 from BlueCross BlueShield of South Carolina.

FAQs

How much does SC state health insurance cost?

People living in South Carolina can expect to pay around $544 per person monthly for a silver plan.

Does South Carolina have free healthcare?

Medicaid provides health coverage to eligible people needing free or low-cost healthcare in South Carolina.

Is health insurance mandatory in South Carolina?

There is no penalty for not having health insurance in South Carolina as of 2019.

Does South Carolina have UnitedHealthcare?

Yes, UnitedHealthcare does offer plans to residents of South Carolina.

What is the maximum income to qualify for Medicaid in SC?

The income limit for a family of four is $27,750 (before taxes), or $13,590 for a single person.

How to buy affordable individual and family health insurance plans in South Carolina?

South Carolina has many individual and family health insurance plans for purchase. However, there are some things to consider when looking for affordable plans.

- The deductible amount

- The copay amounts

- The premiums

- If the plan covers preventative care

- If the plan covers prescription drugs

Use our health insurance quote tool today to get an affordable plan with comprehensive coverage.

Related Content