UPDATED: SEPTEMBER 05, 2023 | 1 MIN READ

Health insurance costs in New York depend on the coverage you’re looking for. Private health insurance is available in New York in five different tiers. Whether you’re looking for personal insurance or insurance for low-income people, we have all the answers that you need.

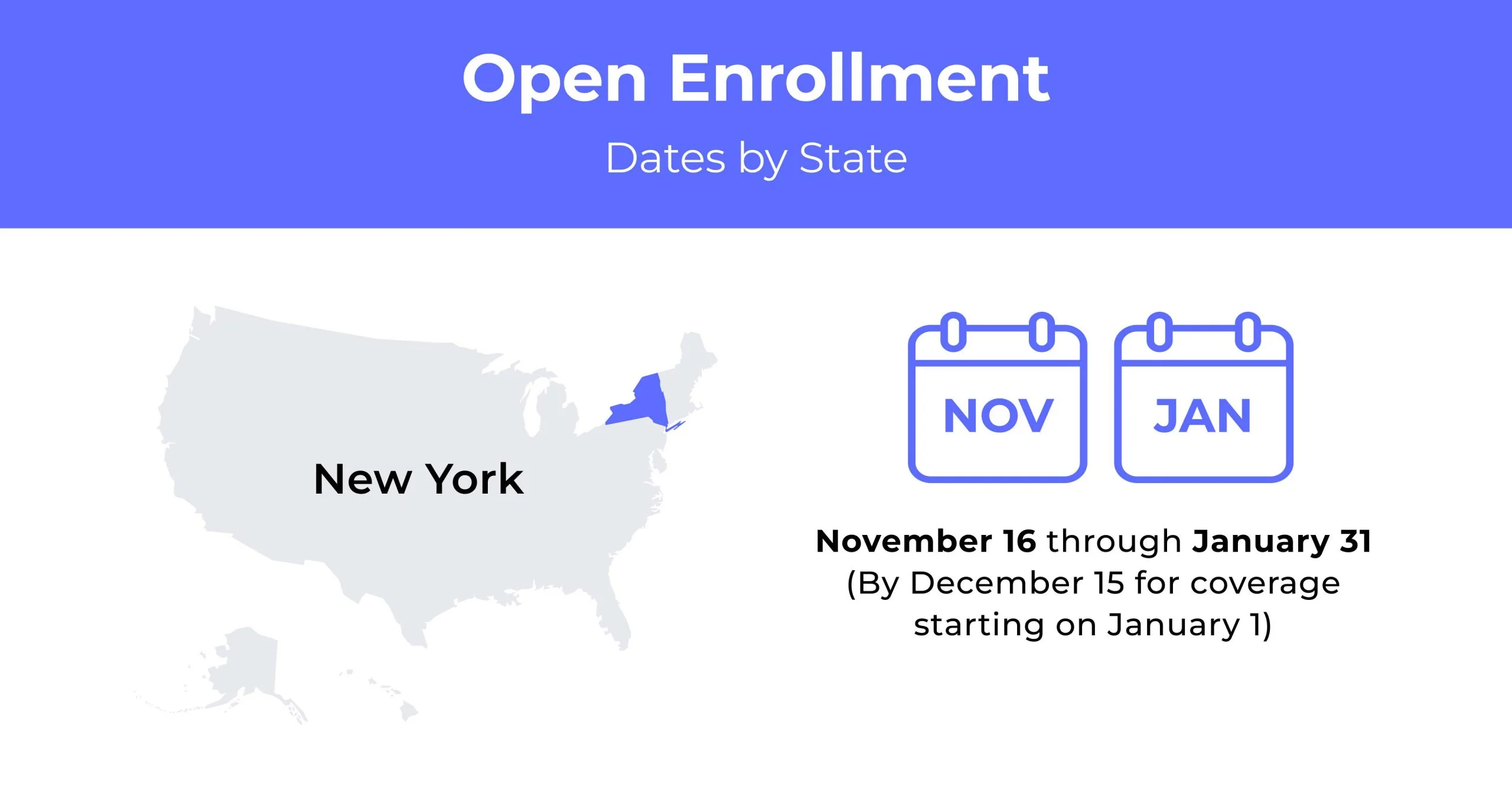

New York Open Enrollment dates for health insurance

In New York, the Open Enrollment period for health insurance runs annually from November 16th to January 31st.

New York demographics

Demographics come into consideration when obtaining a quote for health insurance in New York.

- Average Household Income: The average household income is $107,000. The median household income is $67,046.

- Median Age Range: The median age in New York is 36.9 years of age.

- Education: About 2.99 million residents over 25 in New York have a Bachelor’s degree as of 2020.

What type of health insurance Marketplace does New York have?

New York has one of the country’s most robust health insurance exchanges, with a dozen carriers offering plans. It’s a state-run program under the official name, NY State of Health (NYSOH), also known as the New York State Health Benefit Exchange.

How many people are insured through the New York health insurance marketplace?

More than 6.3 million residents of New York enrolled in private plans, Medicaid, Child Health Plus, and the Essential Plan in 2021. Most enrollees are in Medicaid, CHP, or the Essential Plan. Only about 237,000 people enrolled in private plans.

Did New York implement the ACA’s Medicaid expansion?

New York is part of the expansion of Medicaid under ACA. Medicaid covers more than 7.3 million New Yorkers. The guidelines for their program were already generous before the expansion.

When can you purchase ACA health insurance?

New York typically only has a 3.5-month Open Enrollment Period from November through January. The coverage was extended, however, through the end of the federal COVID public health emergency period but ended in mid-April 2022. Once open enrollment is over, you require a qualifying event to enroll or change your coverage.

Types of ACA plans in New York

There are different types of Affordable Care Act plans. The plans are broken up into different metal tiers. The higher the metal, the more you pay.

What carriers offer ACA health insurance in the state?

Twelve insurers offer exchange plans in New York for 2022:

- UnitedHealthcare of New York

- Capital District Physicians’ Health Plan (CDPHP)

- Healthfirst PHSP

- Emblem (Health Insurance Plan of Greater New York)

- Fidelis

- Oscar

- MVP Health Plan

- Excellus Health Plan

- Health Plus HP

- Metro Plus Health Plan

- Highmark Western and Northeastern New York

- Independent Health Benefits Corporation

How much does health insurance cost in New York?

Many different metal tier options have varying premiums and out-of-pocket maximums. The lower the premium, the higher the out-of-pocket costs, and vice versa. Depending on your situation, the lowest cost tier might not be the most cost-effective if you have high medical costs.

Cheapest health insurance by metal tier in New York

Health insurance in New York is divided into four metal tiers. Below are the cheapest individual plans for each tier.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | Independent Health thRed Bronze, Dep25 | $340 | $8,550 | $8,550 |

| Silver | Independent Health thRed Silver, Dep25 | $435 | $7,000 | $8,000 |

| Gold | Fidelis Care, Gold, Dep25 | $570 | $1,275 | $4,770 |

| Platinum | Independent Health thRed Platinum, Dep25 | $630 | $0 | $5,250 |

Cheapest silver-tier health insurance by county

Silver-tier plans are good mid-range options for both individual and family plans. Below is the cheapest Silver plan in the five largest counties in the state.

| County Name | Cheapest Plan | Individual, Age 40 |

|---|---|---|

| Bronx | Healthfirst Silver Leaf | $615 |

| Kings | Healthfirst Silver Leaf | $615 |

| New York | Healthfirst Silver Leaf | $615 |

| Queens | Healthfirst Silver Leaf | $615 |

| Suffolk | Fidelis Care | $600 |

Are health insurance subsidies available in NY?

The ACA brought significant changes to New York health insurance, keeping the guaranteed issue model but adding a limited enrollment period, individual mandate, and premium subsidies, making the coverage affordable for middle-class residents. As a result, premiums dropped significantly and have remained low since 2014.

Can you purchase off-exchange health coverage in New York?

New York policymakers opted to preserve an off-exchange option for New York health insurance. It allows for a flexible health plan with more consumer choices, including where they get coverage.

Can you purchase short-term insurance in New York?

No. Many states offer short-term health insurance, but New York is not one of them.

Health insurance options for low-income people in New York

There are many great options for cheap health insurance in New York. There are many options, whether you’re looking for private insurance or insurance for low-income people, such as Medicaid or Medicare.

What Medicare options are available in New York?

Medicare health insurance is available in New York if you’re over 65. Certain illnesses or disabilities may make you eligible for Medicare. There are different parts to Medicare. For example, Part D covers your prescriptions, while Medicare Advantage (Part C) covers typical medical care and procedures.

It’s not entirely free, so there is a portion of the premium you need to pay. However, it’s still much more affordable than private health insurance in New York.

Medicaid in New York

The cheapest health insurance in New York is Medicaid. It’s a free government program for those whose income exceeds 138% of the federal poverty level. In New York, you can qualify for Medicaid based on income alone.

Cheapest health plans in New York

There are many cheap health insurance options in New York to choose from. Below, we will look at plans with high out-of-pocket maximums, low premiums, and vice versa.

Cheapest health plan in New York with low out-of-pocket maximums

If you incur many medical expenses, opting for a plan with low out-of-pocket costs is something to consider. Once you reach your set limit, your insurer is responsible for covering your costs. You do have a high premium, but it evens out by the low out-of-pocket costs.

The cheapest health coverage in New York is Standard Premium ST OON IHC Network Dep25 by Independent Health at $789 monthly. The out-of-pocket max with the Platinum Plan from Independent Health is $2,000.

Cheapest health plan in New York with high out-of-pocket maximums

If you have few medical expenses, a low-cost plan with high out-of-pocket expenses is the best option. The premiums tend to be low, and you only have to pay the out-of-pocket costs if you need medical care.

The cheapest plan is Oscar Secure Catastrophic, ST3PCP, INN, Pediatric Dental, Dep25, Step Tracking Rewards by Oscar at $183 monthly. The high out-of-pocket max is roughly $8,250.

Cheapest health plan in New York with an HSA option

A health savings account (HSA) might be the best option if you rarely incur medical expenses. It allows you to build up a tax-free nest egg that you only have to use if you incur medical costs. The cheapest plan with an HSA is iDirect Bronze Coinsurance by Independent Health at $386 monthly.

Cheapest HMO/PPO/POS health plans in New York

The most common plan in New York is the Out-of-Network plan (OON). These types of plans don’t restrict you to a list of providers specified by your insurer. BlueCross BlueShield of Western New York offers the cheapest Silver plan at $491 monthly.

FAQs

How much is health insurance per month in NY?

The average cost of health insurance in New York is $713 monthly for a Silver plan.

How much is health insurance in NY for one person?

Residents of New York pay an average of $484 per person for individual health insurance.

Is healthcare free in NY?

Medicaid is a free government program available to low-income people in New York.

How can I get health insurance without a job in NY?

Medicare and Medicaid is available for low-income people in New York.

Why is health insurance so expensive in New York?

The state has a high cost of living, which is likely a factor. In addition, state policy drives up the premiums through heavy taxes on health insurance while adding to a long list of coverage mandates.

How to buy affordable individual and family health insurance plans in New York?

If you are looking for affordable health insurance in New York, get a quote online to compare rates. Our quote tool gives you multiple quotes to make shopping around simple. This way, finding the best health insurance plan for your needs and budget is easy.

Related Content