UPDATED: SEPTEMBER 05, 2023 | 1 MIN READ

Vermont Health Connect is the state’s health insurance Marketplace. It’s available for its 623,251 residents and offers policies for individuals and families who want health insurance in Vermont.

The state’s Marketplace is one of the smallest in the country, with two insurance providers. This is despite it merging the individual and small group markets.

By law, all residents must have a minimum health insurance coverage. Yet, no penalty is imposed for not having health insurance coverage.

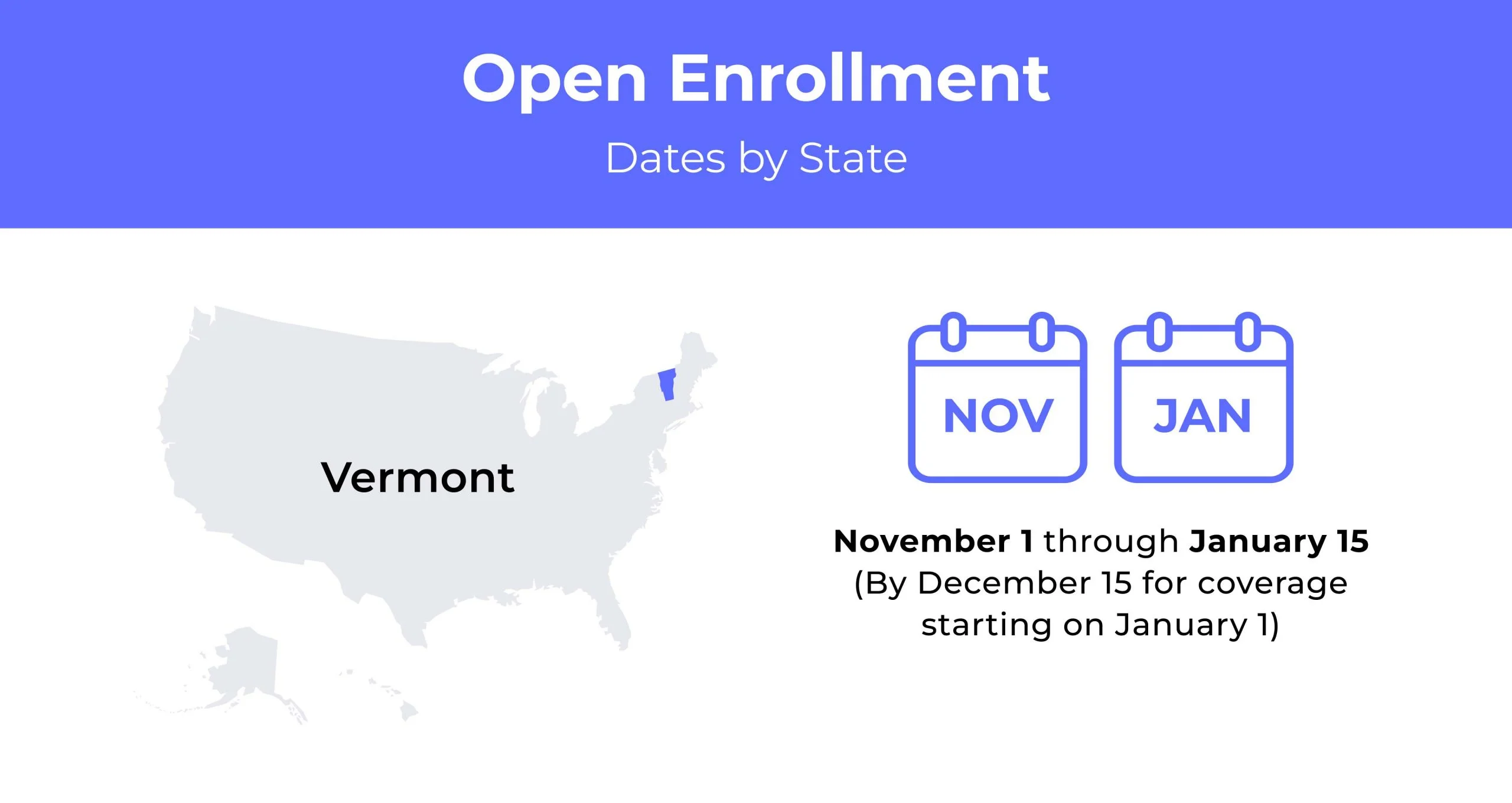

Vermont Open Enrollment dates for health insurance

Vermont’s health insurance Open Enrollment period runs annually from November 1st to January 15th.

Vermont health insurance demographics

In 2021, 24,215 people enrolled for individual health coverage under Vermont Health Connect. This decreased almost 6,000 people from 2020, which had 34,000 people enrolled. The state has 23,232 uninsured people, accounting for 4.8% of the population in the state.

- Average Household Income: From 2016 to 2020, the average household income was $63,477.

- Median Age Range: The median age range of people in Vermont is 43 years, making it one of the oldest in the country compared to the national average of 38.

- Education: 93.5% of people 25 and over have an education level of high school or higher. While 39.7% of people aged 25 or more have a bachelor’s degree or higher.

What type of health insurance Marketplace does Vermont have?

The state runs its health insurance coverage marketplace. It’s mandatory to have health insurance in Vermont. However, the state has not set up any penalty for not having it. Vermont Health Connect offers premiums with two insurance providers.

The state has long been recognized as being forefront of health insurance reform. One of the latest pieces of legislation has been renewing the push for a single-payer system.

How many people are insured through the Vermont health insurance Marketplace?

When enrollment opened in 2021, 24,215 people signed up for coverage through Vermont Health Connect. This was down 7.4% from the previous year. Average premiums in 2021 increased by 3.5%. This is before any subsidies are applied.

Did Vermont implement the ACA’s Medicaid expansion?

With Vermont being one of the forerunners in health reform, it expanded ACA’s Medicaid. The state’s system used federal funds to expand Medicaid to 138% of the federal poverty line.

As part of its overall reform, the state has been looking closely at eligibility requirements and processes so people seeking health coverage get assigned the right plan.

Medicaid enrollment has increased by 5% since 2020, which aligns with the nationwide trend since the COVID-19 pandemic.

When can you purchase ACA health insurance in Vermont?

Residents in Vermont can apply for ACA during the Open Enrollment Periodod, which recently runs from November 1st to January 15th annually. Those uninsured or seeking a new plan in the state can find an ACA plan to suit their needs.

If any residents miss the open enrollment, they will need to wait for the Special Enrollment Period to open to get health insurance in Vermont. Special enrollment periods are suitable for major life events, including marriage, childbirth, or anyone moving to the state and needing coverage to cover them before applying under the ACA.

Types of ACA plans in Vermont

In 2022, residents of Vermont can choose from plans on the Marketplace offered by two insurance carriers. Both carriers offer plans that can be bought directly and off the Marketplace. However, subsidies are only available to those who buy a plan under ACA.

What carriers offer ACA health insurance in Vermont?

Two carriers offer ACA plans for Vermont health insurance. All plans under Obamacare are required to cover ten essential benefits. These must include emergency care, childbirth, pregnancy care, and prescription medication. They are:

- Blue Cross Blue Shield of Vermont

- MVP

How much does health insurance cost in Vermont?

In 2022, the average monthly health insurance premium is $581 for a bronze metal tier. The next best-priced metal tier is a silver plan for $760.

What makes Vermont different from other states is that it doesn’t use age to set premium prices. Monthly premiums are set to standard rates across adult groupings.

Cheapest health insurance by metal tier in Vermont

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | MVP VT Plus Bronze 1 | $575 | $7,250 | $8,400 |

| Silver | MVP VT Plus Silver 1 | $735 | $1,750 | $6,950 |

| Gold | MVP VT Gold 1 | $755 | $1,200 | $5,400 |

| Platinum | MVP VT Platinum 1 | $915 | $400 | $1,400 |

Cheapest health insurance by county

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 |

|---|---|---|---|

| Chittenden | MVP VT Plus Silver 1 | $735 | $1,465 |

| Franklin | MVP VT Plus Silver 1 | $735 | $1,465 |

| Rutland | MVP VT Plus Silver 1 | $735 | $1,465 |

| Washington | MVP VT Plus Silver 1 | $735 | $1,465 |

| Windsor | MVP VT Plus Silver 1 | $735 | $1,465 |

Are health insurance subsidies available in Vermont?

There are several subsidies available in the state. The state of Vermont provides help under the Vermont Premium Assistance program. Vermont state provides monies that reduce qualifying residents’ monthly health insurance bills. This assistance can reduce payments by up to 1.5% of a household income.

Tax credits are also available. Under the Advance premium tax credits system, you can lower your monthly premium based on income. Many use this insurance tax credit to lower their monthly premium or use it at the end of the year’s tax return.

Cost-sharing is also available to reduce out-of-pocket costs for health insurance in Vermont. However, this plan is only available on a silver metal tier plan.

Can you purchase off-exchange health insurance coverage in Vermont?

Purchasing off-exchange has only been allowed in Vermont since 2016. Then, the state introduced a full-cost individual direct enrollment system, which brought off-exchange plans to residents. Those who purchase off-exchange can’t access state subsidies, which can be beneficial.

In its first year, 5,662 people enrolled in this off-exchange program.

The state outlined that 1,000 of those who enrolled in this program in 2016 would have been entitled to subsidies. Vermont is one of few states that has outlined in greater detail that subsidies to help pay monthly premiums are not available off-exchange.

Health insurance options for low-income people in Vermont?

At present, there’s no short-term plan available for purchase. There are several reasons for this. It’s important to note that it’s permitted for providers to offer it in Vermont for a period of up to three months. However, it doesn’t appeal to insurance providers.

One of the reasons for this is the benefits the state offers to provide plans in the state-run Marketplace. Another reason is that short-term plans must cover pre-existing conditions.

Health insurance options for low-income people in Vermont

Two options are available to people on low income who are looking for health insurance in Vermont. Green Mountain Care is the state’s Medicaid option. People with children can opt for the CHIP program. This provides insurance coverage to children of minor age and pregnant women.

Green Mountain Care caters to people over 65, blind and disabled people, pregnant women, and people caring for children under 18. The Dr. Dyansaur program is available to residents not qualifying for Green Mountain Care. This program provides health insurance coverage to children aged 19 and under and women expecting a child. Its purpose is to provide an option for child health insurance coverage to those who struggle to pay for it.

What Medicare options are available in Vermont?

Vermont health insurance options include Medicare Original, Medicare A and B, and Medicare Advantage, often called Medicare C. Four plans are available under the Medicare Advantage program. They are:

- Health maintenance organization (HMO),

- Private Fee-for-Service (PFFS),

- Preferred Provider Organization (PPO)

- Special Needs Plan (SNP)

Vermont SHIP (State Health Insurance Assistance Program (SHIP) is also available. This provides help to Medicare subscribers who want to get counseling in Vermont. This is free.

Medicaid In Vermont

Medicaid in Vermont is called Green Mountain Care. It’s available to residents of Vermont who are:

- Over 65 years old

- Blind

- Disabled

- Pregnant

- Caring for children under 18 years of age.

Green Mountain Care can become available to a person who cares for someone with a disability. Medicaid in Vermont covers the following:

- In-patient hospital stays

- Tests and diagnosis

- Outpatient care

- Chiropractic appointments and treatments

- Mental health care

- Dental care

A person’s income must remain under a defined threshold to be eligible for Green Mountain Care. This threshold is calculated based on your household size.

For an individual, the threshold is $17,131 per year to qualify. If the household has three persons, the income threshold is $29,207. For adults, Green Mountain Care can also provide coverage to people who need ongoing care in a nursing facility or assisted care.

The state also offers a long-term Medicaid program. This allows residents to pay into a long-term care program that suits their health needs and preferences.

Cheap health insurance plans in Vt

Vermont health insurance is available in four metal tiers. They tiers are bronze, silver, gold, and platinum. The platinum tier offers the cheapest plan at a monthly price of $915 from the insurance provider MVP VT Platinum 1. It has a small deductible of $400 and maximum out-of-pocket expenses of $1,400.

Low out-of-pocket maximums

The platinum tier is the cheapest health insurance plan in Vermont. The monthly premium is the highest at $915. However, in keeping with most platinum premiums, it has a low deductible expense of $400 and a low maximum out-of-pocket expense of $1,400.

Cheapest health insurance plan in Vermont with high out-of-pocket maximums

The bronze metal tier is the cheapest insurance plan available in Vermont. The MVP VY Plus Bronze 1 plan has a monthly premium of $575. It has the highest maximum out-of-pocket expenses at $8,400 with high deductibles of $7,250.

Plans with an HSA option

An HSA plan is worth considering if a person is in good health and doesn’t foresee spending much on medical expenses. An HSA plan allows a resident to make pre-tax contributions, build up an amount, and opt to save it if it’s not used for medical needs. The bronze plan is the cheapest one available for health insurance in Vermont. These are all the plans offered per metal tier:

- MVP VT Bronze 3 HDHP with MVP Health Care: $503 monthly.

- Cheapest HSA Silver plan: MVP VT Silver 4 HDHP with MVP Health Care: $669 monthly.

- Cheapest HSA Gold plan: MVP VT Plus Gold 3 HDHP with MVP Health Care: $683 monthly.

HMO/PPO/POS

The most common type of plan taken out by residents in Vermont is an HMO (Health Maintenance Organization). It has the most competitive costs. The only downside is that the insured person must stick with the provider offered except in the case of emergencies. With an HMO plan, the insured person needs a referral to see a medical specialist.

An EPO option has a similar clause to an HMO plan in that the person insured must stick with the insurance provider offered. However, someone insured under an EPO plan doesn’t need a referral letter to see a specialist in a medical field. Vermont health insurance offers these plans for HMO and EPO:

- Cheapest HMO Silver plan: MVP VT Plus Silver 1 with MVP Health Care: $666 monthly

- Cheapest EPO Silver plan: BCBSVT Vermont Preferred Silver Plan with Blue Cross and Blue Shield of Vermont: $725 monthly.

FAQs

How much does health insurance cost per month in Vermont?

In 2022, Vermont health insurance will have an average monthly cost of $581. This is for a Bronze plan. A Silver plan can be bought for $760 on average per month. It’s possible to get good value in Vermont as it doesn’t use the insured person’s age as a determining factor.

Does Vermont have free health insurance?

Medicaid is the best option for adults seeking free or low-cost health coverage in Vermont. There’s also the option of applying for coverage under the Dr. Dynasaur program.

This offers free or low-cost health coverage for children, teenagers aged 19 and under, and women expecting a child. The state offers a long-term Medicaid program that helps residents pay into a long-term care program that suits their health needs and preferences.

Why is Vermont health insurance so expensive?

While age isn’t a determining factor in getting insurance, the state has one of the oldest populations in the country. This contributes to increased healthcare costs with more medical problems as people age.

The state has the second-oldest population, which means that healthcare costs are spread across all residents regardless of their age. This tends to increase the price.

Do I qualify for Vermont Medicaid?

These are the qualifying criteria to become eligible for Medicaid in Vermont. You must be a state resident, a US national, citizen, or permanent resident of the state.

To qualify, the annual household income must be below certain thresholds calculated based on the income inputted into a calculator. Other criteria that can make you eligible include:

- An income level is regarded as low-income or very low-income

- Being pregnant

- Responsible for a child under the age of 18

- Being blind having a disability, or having someone in your household with a disability

- Being 65 years of age or older

How many people are uninsured in Vermont?

The state has 23,232 uninsured people in the state. This accounts for 4.8% of its population.

How To Buy Affordable Health Insurance Plans In Vermont

Vermont health insurance has many options to suit a person’s budget and health insurance coverage preferences. Looking at your health concerns and shopping for plans to get the best coverage for your specific needs is important.

Related Content