UPDATED: AUGUST 07, 2023 | 1 MIN READ

Slab leaks can cause structural damage to the building and lead to expensive repairs. Slab leaks are often excluded from homeowners insurance policies because they happen outside the building. However, homeowners insurance policies cover some of these damages caused by an act of nature or a covered peril such as fire or windstorm.

What Causes Slab Leaks?

A slab leak is when water seeps through the concrete foundation and gets into the home. There are many causes for these leaks, but in most cases, it’s due to an improperly installed drainage system or an improperly sealed foundation.

Slab leaks can be caused by a variety of factors, such as:

- Poor construction practices

- Inadequate drainage systems

- Faulty pipe joints or fittings

- Water pressure that’s too high for the building’s plumbing system

Slab leaks often go undetected for long periods before the damage becomes too severe. Due to this, homeowners insurance may not cover the damage caused by it. However, there are some instances where homeowners insurance does cover these costs.

Burst Pipes

Burst pipes are the most common cause of slab leaks in older homes. They’re often caused by settling: the older the house is, the more it has settled. Dry weather can also cause slab pipes to burst. During a drought, moisture in the soil evaporates, which can accelerate the settling of your home.

Pinhole Leaks

Pinhole leaks occur when plumbing pipes have corroded, usually due to standard wear and tear. They are tiny holes in the pipework that may leak water.

How to Know You Have a Slab Leak

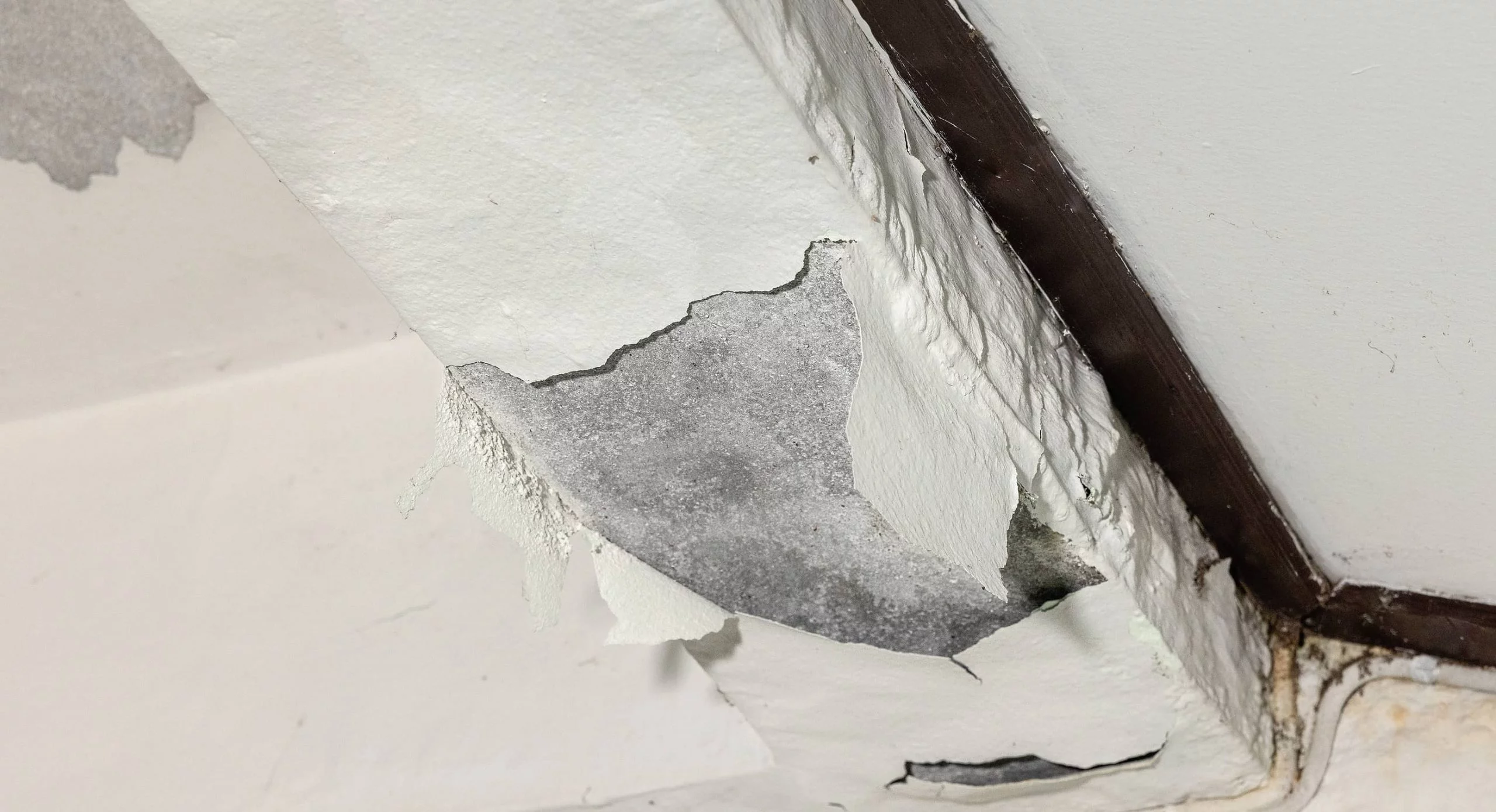

A slab leak is a plumbing leak that occurs in the water pipes below the concrete floor of a building. These leaks can be challenging to detect and are often only discovered once they have caused significant damage to the property. Some of the signs of a foundation leak are water pooling around your property or at your home’s foundation, water stains on your walls, ceilings, and floors, or soil erosion around your home’s foundation.

If you have a slab leak, it can be challenging to determine its location.

Here are some signs that you might have a leak in your foundation:

- If your water bill is higher than normal

- If the outside of your home is wet and there are puddles in the yard or on the driveway

- If there is a persistent damp or musty smell

- If you hear water running when everything should be turned off

What to Do if You Have a Slab Leak

Keep in mind where the leaking pipe is located. To get to it, you must identify its exact location and go through the flooring, subfloor, and concrete slab. This is not a DIY project; you want to get it done right the first time.

If you have a slab leak, it’s essential to take immediate action. You’ll need to contact a professional to find the source of the leak and fix it as soon as possible.

When you notice a symptom, call a professional plumber to inspect the entire first floor — not just where you suspect the leak is. It may turn out your home does have a leak, but it’s not under the concrete foundation. That would be great news.

The plumber can explain your options if you have a slab leak and recommend plumbing repairs. If you’re lucky, you can use a technique called relining to fix the pipe without trenching the entire line.

Does Home Insurance Cover Water Damage from Slab Leaks?

The answer to this question is maybe. It all depends on your specific insurance coverage contract. The best person to consult with about water damage is your insurance agent. They should be able to tell you what your policy covers and if your policy covers the damage.

If a covered peril caused the leak, damage to the dwelling and personal belongings would be covered (after you pay the deductible). It’s usually necessary to tear out a floor or install a new one to repair the plumbing. However, if a homeowner has standard homeowners insurance coverage, it will often cover the cost of doing this for you.

FAQs

Do homeowners insurance policies cover slab leaks?

A slab leak is a leak that occurs in the concrete foundation of a home. Homeowners insurance policies might cover the damage if a covered peril caused it. Unfortunately, these leaks can be caused by plumbing problems. Some examples are a corroded or improperly installed pipe or a poorly-installed water heater, which your homeowners policy may not cover.

What do you do if you have a slab leak?

A slab leak is a water leak from your home’s concrete foundation pipes. When this happens, the pipes will break, and running water will come from them. The first thing that you need to do if you have a slab leak is to turn off your main water supply. This is typically done at the meter outside of your house or building. Once that’s done, you should call a professional plumber to assess the damage and provide an estimate for repairs.

What happens if you don’t fix a slab leak?

Leaking water can cause significant damage to your home. It can cause mold, mildew, and rust. Fixing a slab leak is a challenging task. It requires a lot of work and some time to correct the problem. If you don’t fix the leak, it will eventually worsen and cost you more money in the long run.

How do I make a successful water leak claim?

When making a water leak claim, the first thing to do is to contact your insurance company and tell them about the leaking pipe. You will need to provide them with as much information as possible about the leak and how it occurred so they can investigate it. If you can, take photos or videos of the damage and send them to your insurance provider.

What is a slab leak?

The slab is the bottom layer of concrete on which the structure of your home stands. When it starts to leak, it can cause expensive damage to the building and its surroundings. Slab leaks happen when water seeps through cracks in the slab or pipes inside the concrete foundation. They also occur when water from rain or faulty gutters drains down into cracks too small for it to escape, causing pressure on the slab and causing it to crack open.

Is there a timeline for submitting a claim?

The time limit for submitting a homeowners insurance claim can vary between insurance companies. You may have anywhere between 30 days and a year to file a claim. However, you should contact your insurance company as soon as you notice a slab leak or water damage.

What are some signs of a slab leak?

A slab leak is a plumbing leak that occurs in the water pipes below the concrete slab of a building. Slab leaks can be complicated to detect and are often only discovered once they have caused significant damage to the property. Some of the signs of a slab leak are water pooling around your property or at your home’s foundation, water stains on your walls, ceilings, and floors, soil erosion around your home’s foundation, or even higher than usual water bills.

What is the average cost to repair a slab leak?

A slab leak repair could cost, on average, around $2,500. Before you claim a foundation leak, it’s worth checking your policy deductible amount. Suppose the repair cost is slightly higher than your deductible. In that case, you might be better off paying out of pocket instead of making a claim.

What are the best ways to prevent slab leaks?

There are a few things you can do to prevent slab leaks. You can ensure an annual inspection of all emergency shut-off valves and water supply lines in your areas. You should also regularly check your water pressure and keep it between 65 and 80 psi.

How To Get Rates for Home Insurance That Covers Slab Leaks

Slab leaks are a common problem that homeowners face. They can lead to severe damage and sometimes even the loss of your home. If you’re one of those homeowners struggling with this issue, there is good news for you – you can get rates for home insurance covering slab leaks.

Please call us or fill out our online rate form to see carriers in your area now. We can even put you in touch with a licensed professional to answer any questions you may have.