UPDATED: JULY 10, 2023 | 1 MIN READ

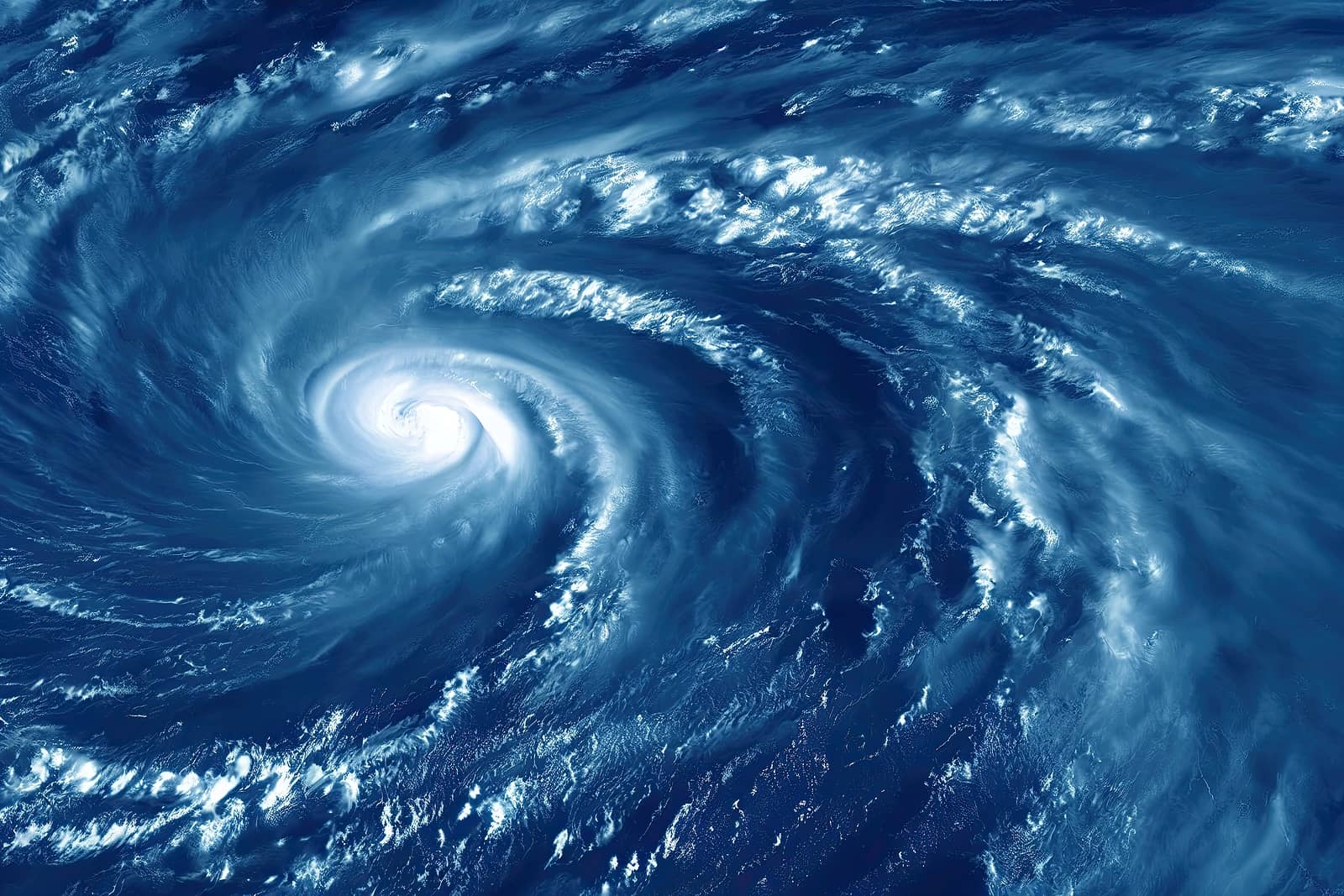

The annual hurricane season in Florida runs from June 1 to November 30 and marks the highest risk for tropical activity in the Atlantic Basin. While hurricanes occur outside this period, 97% of tropical activity falls from June to November.

As a potential or current Florida homeowner, you must recognize how Florida hurricane season can affect your home. Let’s look at what the season involves and how it poses a risk to Floridians’ homes.

Understanding Florida hurricane season

When the Gulf of Mexico and the Atlantic Ocean are warm, hurricane activity creates an ideal environment. The warm waters combine with moist air in a low-pressure area, becoming clouds of the storm. Hurricanes start as tropical disturbances.

When a tropical disturbance increases in strength, it becomes a tropical depression, a tropical storm, and finally, a hurricane. Even a tropical storm may bring severe weather and storm surges. The Saffir-Simpson Hurricane Wind Scale uses wind speeds to classify storms.

- Category 1 – 74 mph to 95 mph

- Category 2 – 96 to 110 mph

- Category 3 – 111 to mph

- Category 4 – 130 to 156 mph

- Category 5 – Winds greater than 157 mph

Weather alerts

When a hurricane is in the area, officials may issue a hurricane watch. This means hurricane conditions may be possible. Hurricane warnings are more severe, as officials expect hurricane conditions.

What month has the most hurricanes?

Historically, September brings the most hurricanes. Conditions in the Atlantic are highly favorable for storms thanks to warm waters, low winds, and moist air. The average hurricane season sees four named storms during September.

Where do Florida hurricanes hit the most?

Hurricanes in Florida hit Northwest Florida, or the Panhandle, the most. A total of 66 hurricanes have hit Northwest Florida since 1851.

Common types of hurricane damage

When hurricanes strike, four types of damage often occur. The wind is one of the most destructive parts of a hurricane, as are tornadoes. For coastal areas, a hurricane‘s storm surge may pose a threat. Flooding from rain is also possible, with typical hurricane rainfall ranging from 6 to 12 inches.

Exterior and Roof Damage

Exterior damage from hurricanes can range from a few blown shingles to ripping off the entire roof. Your gutters might also blow away and could cause damage to your property or your neighbor’s home. High winds may cause a tree or debris to fall into your roof.

Interior Damage

As the storm hits your home, its windows or doors may break or blow away. Various debris and rain may fly into your home and ruin your belongings.

Structural Damage

Hurricanes are brutal to the home structure. They may cause shifted or cracked foundations or weaken other structural supports.

How to prepare your home for a hurricane

Start your hurricane preparedness routine by looking at your home‘s exterior. Clear the yard of loose objects such as:

- Patio Furniture

- Grills

- Outdoor toys

- Potted plants

- Trash cans

- Yard ornaments

- Pool equipment

When hurricane winds increase, they may create flying projectiles that can break your windows. Remove these objects from the outside and bring them inside, or place them safely in a garage.

Heavy sustained winds may blow out windows or doors. If your home doesn’t have wind shutters, board up your windows and doors with thick plywood.

Trim any loose limbs, dead branches, and other weaknesses. Tree branches are also potential projectiles, so remove them properly if twisted, loose, or broken.

If you have a shed, gazebo, or pergola, ensure it‘s securely anchored.

Don’t neglect your pool during hurricane preparedness.

- Turn off the power source

- Remove covers, blankets, and toys

- Don’t drain the water completely, only a bit to accommodate rain

- Secure pool equipment with plastic covers or disconnect them if there’s a high risk of flooding

- Add extra chlorine to your pool

Does home insurance cover hurricane damage?

Yes. A standard policy isn’t a one-size-fits-all approach to covering hurricane damage so it may have exclusions. Your policy will specify coverage. A standard policy does not cover flood damage. You will need a separate flood policy, and your area may require a wind policy.

Is there such a thing as hurricane insurance?

Insurance companies don’t offer a policy for “hurricane insurance,” and a homeowners standard policy won’t always apply to hurricane damage. Destructive winds and water pose the most threat to your home.

What does your home insurance cover during a hurricane?

A typical policy covers wind damage and rain associated with a hurricane. Coverage for your home may vary according to your area, but your policy will include dwelling coverage and p personal property coverage.

What is a hurricane deductible?

Homes in hurricane-risk areas are subject to hurricane deductibles. A hurricane deductible is an amount you must pay for damage to your home before the insurance company pays.

Unlike other insurance policy types with flat-rate deductibles, deductibles for hurricane damage are a percentage of your home’s value. These rates range from 2% to 10%, depending on where you live.

Florida statutes state that hurricane deductibles are triggered by ”windstorm losses resulting only from a hurricane declared by the National Weather Service.”

It’s for any damage sustained during a hurricane watch or warning for any area of Florida and lasts up to 72 hours after the watch or warning ends. The deductible applies once during hurricane season.

Flood insurance in Florida

Florida homeowners must purchase a separate policy for flooding unless their policy specifically states flooding coverage. All of Florida is at risk for flooding, even homes not located in a coastal area. A policy may not cover structural damage or personal property loss from flooding.

Windstorm insurance in Florida

Windstorm insurance covers Florida homeowners against damage from hurricane winds. Some Florida homeowners may have windstorm insurance within their home insurance policy. Coastal homeowners may need a separate policy specifically for windstorms.

The state of Florida doesn‘t require windstorm insurance. Whether you need a separate policy depends on your home‘s location and mortgage lender.

FAQs

What month does Florida have the most hurricanes?

Historically, September brings the most hurricanes. It also sees more Cat 5 hurricanes than any other month during the hurricane season. Research shows the first two weeks of September mark the peak of the Atlantic Hurricane Season.

What part of Florida gets hit the most by hurricanes?

Hurricanes hit the Florida Panhandle, or Northwest Florida, the most. This region includes Panama City, Fort Walton Beach, and Pensacola.

What’s the best place in Florida to avoid hurricanes?

The inland area of Florida on the north side of Georgia sees the fewest hurricanes. Tornadoes from a hurricane may pose a threat when hurricanes form near other areas of Florida.

What’s the difference between a hurricane and a tropical storm?

Hurricanes have winds greater than 74 mph, and tropical storm winds range from 39 to 73 mph. A tropical storm develops into a hurricane as it grows in strength and size.

What are the chances that a hurricane won’t hit Florida this year?

Low. The National Oceanic and Atmospheric Administration (NOAA) predicts an “above-normal“ season with seven hurricanes, including three major hurricanes.

How to get home insurance for Florida hurricane season

Even a low-grade tropical storm can pose a dangerous risk to your Florida home. As we prepare for hurricane season in Florida, look over your policy and ensure you’re well-protected against hurricane damage.

Forecasts show the Sunshine State will see above-normal tropical activity this year. Add the proper protection to your home with flood insurance and other policy options from a Florida home insurance company. See rates in the state by completing our form.

Related content:

- Top-Rated Homeowners Insurance Companies in Florida for 2023

- Find Cheap Renters Insurance In Florida

- Florida Homeowners Insurance Rate Increases

- Wind Mitigation Inspection: Save on Home Insurance Premiums

- Are Property Insurance Companies Failing Florida Consumers?