UPDATED: MAY 02, 2023 | 1 MIN READ

If you have a leak in your house, you might be wondering if your home insurance covers that. While a leak is an event no homeowner wants to deal with, you may be able to avoid the financial impacts. Keep reading to learn when home insurance covers roof leaks and when it doesn’t.

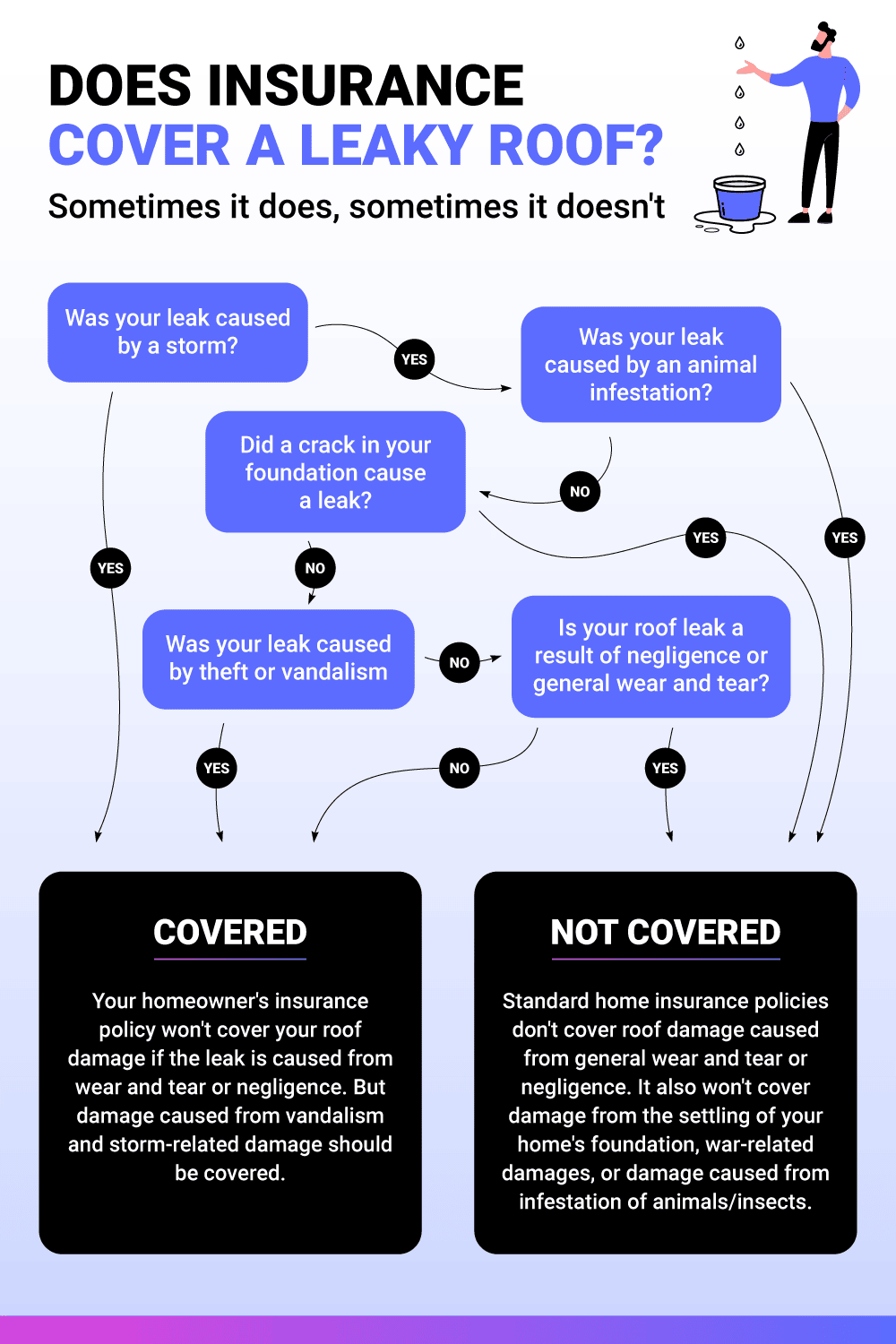

Does homeowners insurance cover roof leaks?

The answer’s not so easy: In some cases, home insurance does cover the expenses, and in other cases, it doesn’t. It all depends on what caused the leak in the first place.

When does your home insurance cover a roof leak?

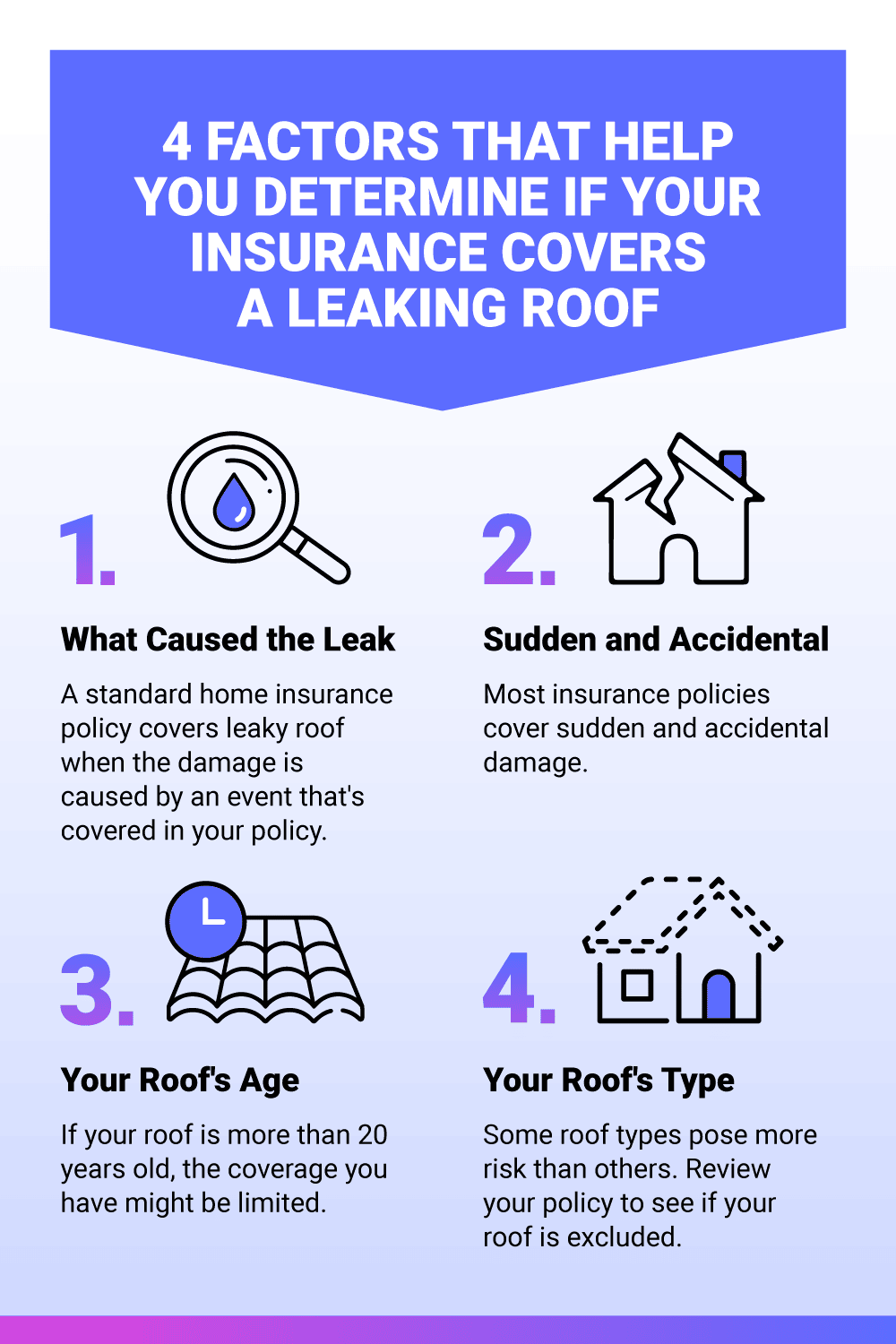

For most homeowners insurance policies, coverage is provided for roof leaks when a sudden event, such as a natural disaster, damages a moderately new roof.

For example, if a storm rips off some panels from your roof and the water leaks into your bedroom, your insurance company will cover it, even if you have a flat roof.

When doesn’t your home insurance cover roof leaks?

If your roof leaks because of age, rot, wear-and-tear, or not maintaining your roof, then that’s not covered by your homeowners insurance.

For example, if your gutters are clogged, and a big rainstorm causes interior water damage, your insurance won’t cover it. They will claim it’s not their responsibility to cover it because the issue could’ve been prevented if proper maintenance had been done.

The same thing goes for old roofs that haven’t been maintained well. This is one reason it’s so important to know whether a house has a good or bad roof before you purchase it.

Roof insurance coverage

Most homeowners insurance policies will provide you with new interior materials (such as furniture, carpets, appliances, and personal property) if a roof leak damages them. If your roof is younger than ten years old and gets damaged, your insurance will most likely cover the full amount.

For example, if a healthy tree falls onto your home and damages your moderately new roof, your homeowners insurance policy should cover the full cost of damages.

What type of roof insurance coverage does your home insurance include?

Your home insurance covers any damage that couldn’t have been prevented. For example: If your roof shingles were blown off in a wind storm and water leaked into your attic and ruined, that type of incident would be covered in your roof insurance coverage policy.

What type of roof damage isn’t covered by home insurance?

If you could have prevented the leak, then it isn’t covered by your home insurance. For example: If your roof has mold and water leaks through it, causing a leak in the bathroom, your home insurance policy will not cover that because the leak was due to the mold.

Are losses caused by roof leaks covered by your home insurance?

Yes, damage to the interior of your home does get covered if the leak causes it. But the cause of the leak has to have valid reasoning, such as a windstorm with a moderately new roof.

However, if your roof is covered in mold, unmaintained, or over ten years of age, then when a storm causes damage, you will not be covered by your home insurance.

What to do if you have a roof leak

Knowing what to do if you have a roof leak is important. Filing an insurance claim for a damaged roof by a leak is key. It’s best to do it right away when there is an issue, so a professional can fix it before it gets any worse. Many insurance companies won’t accept claims filed too far after the event.

Here are three things to always do right away when a leak occurs:

- Take photos of the damage

- Get an estimate for the repairs

- File a claim with your insurance company

How to protect your roof from leaks

It’s better to prepare and prevent than repair and repent. Luckily, there are some ways you can protect your roof from leaks. Here are some tips for keeping your roof maintained:

- Perform routine home inspections to detect roof leaks

- Check for mold

- Check for missing shingles and clogged gutters

How to make a home insurance claim for roof damage

Dealing with roof leaks can be stressful. It’s important to follow these four steps when filing a home insurance claim to make the process a whole lot easier:

- Identify the source

- Document the water damage (take pictures and write a summary)

- Make temporary repairs to minimize further damage

- Contact your insurance company

FAQs

Does my homeowners insurance cover water damage?

Yes, your homeowners insurance will cover water damage due to a leak, as long as your roof is younger than ten years old and is well maintained.

When will my home insurance pay for a new roof?

Your home insurance will pay for a new roof when a windstorm comes and rips off all of your shingles.

Is hail damage on my roof covered by my homeowners insurance?

Yes, if hail damages your moderately new roof and causes leakage, then your homeowners insurance will cover the cost of repair.

Does my home insurance cover wind damage to my roof?

Absolutely. When a windstorm strikes, it’s often sudden and unpreventable, making insurance responsible for the coverage.

Does home insurance cover roof leaks?

Home insurance covers roof leaks if the leaking was caused by a peril named in your policy. For example, if a windstorm damaged your roof and caused it to leak, your home insurance would cover it. However, if normal wear and tear causes your roof to start leaking, your insurance company won’t pay for the repairs.

Does my home insurance policy include roof insurance?

Yes, most homeowners insurance policies include roof insurance. However, if a roof issue is deemed preventable, your insurance won’t cover it.

Find home insurance that covers roof leaks

Whether or not your home insurance covers roof leaks depends on what caused the leak. If it was preventable and you weren’t keeping up with roof maintenance, your home insurance won’t cover it. If the storm was sudden and unpreventable, your home insurance would cover it.

In either case, it helps to have the best insurance possible — for the lowest cost. We can help you find the best option for you. Compare insurance rates today.

Related Articles: