UPDATED: AUGUST 25, 2023 | 1 MIN READ

In recent years, Florida has been facing a home insurance crisis that has left property owners struggling to keep up with the rising costs of their home insurance policies. This crisis has become a significant concern for property owners across the state, and it is essential to understand how and when to expect rate increases.

Why is the Florida insurance crisis making homeowner’s rates increase?

Florida’s home insurance crisis is driven by various factors, causing rates to increase rapidly in recent years. One primary reason behind the problem is the high frequency of natural disasters in the state. Florida is vulnerable to hurricanes, tornadoes, and other weather events, making it a high-risk area for insurers.

Another significant factor is the increase in litigation related to insurance claims. According to WFLA News, “Because Florida has the highest loss ratio in the country, there are a lot of trial attorneys chasing those claims,” said Mark Friedlander, Director of Corporate Communications for the Insurance Information Institute. “And that litigation has driven up the cost of claims.”

As a result of these factors, homeowners in Florida are expected to see a significant increase in their insurance premiums in the coming years.

How and when can property owners expect rate increases

Insurance companies must notify policyholders before any rate increases, usually at least 45 days before the policy renewal date.

The notice should explain the rate increase and any policy coverage changes. If policyholders disagree with the rate increase, they can appeal the decision or shop for alternative insurance providers.

In Florida, homeowners insurance rates typically increase annually, with many providers proposing rate increases from 5% to 10%. However, some insurance companies offer much larger rate increases following the recent home insurance crisis.

For example, in June 2021, Citizens Property Insurance Corporation proposed an average rate increase of 7.2%, while some private insurance companies have requested rate increases of 15% to 50% or more.

The frequency and timing of rate increases can vary depending on several factors, including the insurer, the location of the property, and the policyholder’s claims history. Insurance companies may increase rates based on their claims experience in specific regions or due to changes in weather patterns.

Additionally, if a policyholder files a claim, their insurance rates may increase, as they may be considered a higher risk for future claims.

How to offset the additional costs

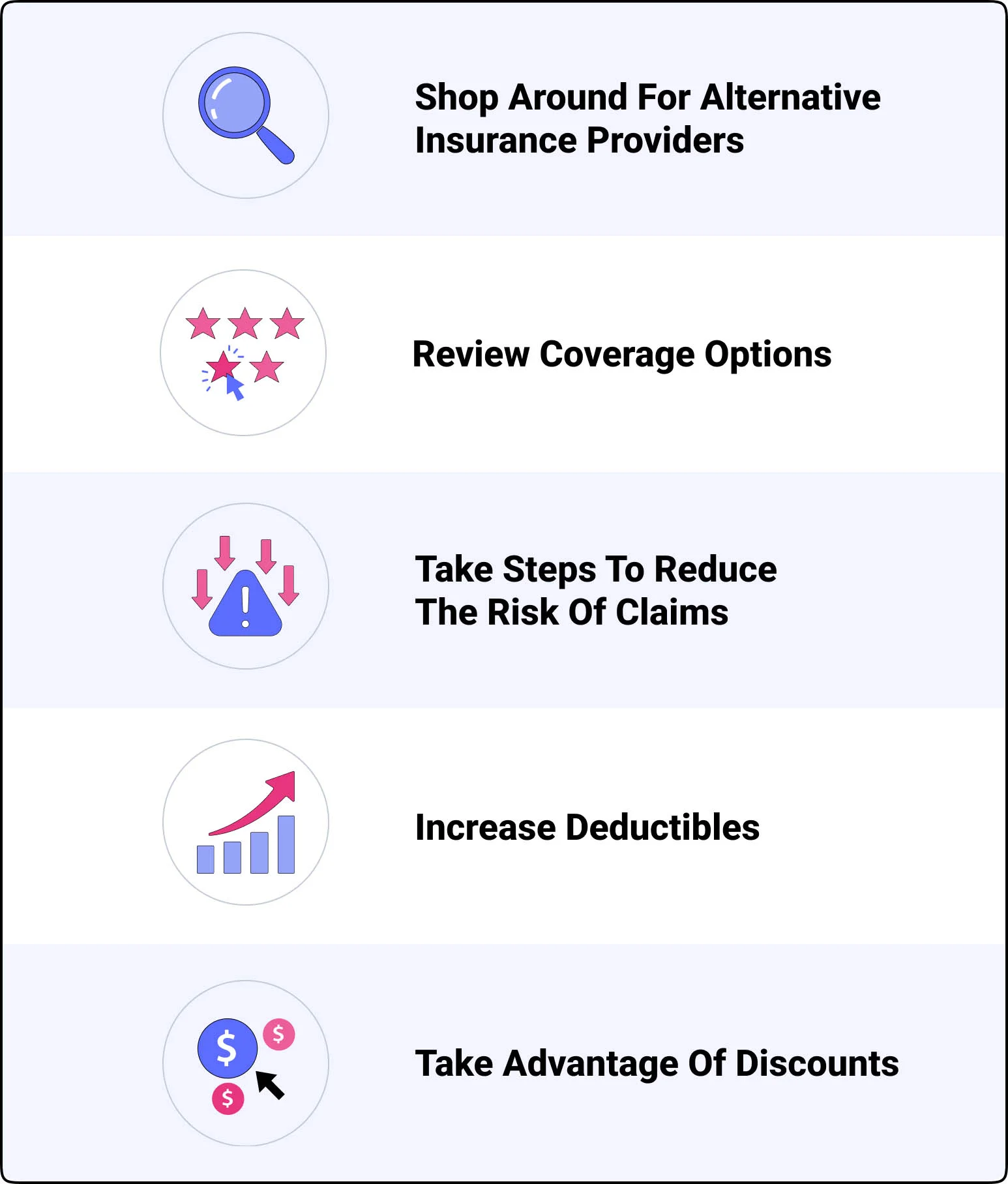

While rate increases can be challenging for property owners, they can take steps to offset the additional costs.

Shop around for alternative insurance providers

Comparing quotes from different insurance providers can help property owners find the best deal. It is essential to review the coverage options carefully and make sure they meet the policyholder’s needs before switching providers.

Review coverage options

Property owners can review their insurance coverage to ensure they are not overinsured or underinsured. Some policyholders may be paying for coverage they don’t need or may need to increase their coverage if they’ve made significant home improvements.

Take steps to reduce the risk of claims

Insurance rates can be affected by claims history, so property owners can take steps to reduce the risk of claims. For example, they can install impact-resistant windows and doors, add a new roof, or install a security system. These upgrades can’t only reduce the risk of claims but may also lead to lower insurance rates.

Increase deductibles

Policyholders can increase their deductibles to lower their insurance premiums. However, ensuring that the deductible is still affordable in case of a claim is essential.

Take advantage of discounts

Insurance providers may offer discounts for various reasons, such as bundling home and auto insurance policies or installing a security system. Property owners should ask their insurance provider about available discounts that can help reduce their insurance costs.

FAQs

Why are Florida homeowners insurance rates going up?

Florida homeowners insurance rates are going up due to several factors. This includes the high frequency of natural disasters in the state, an increase in litigation related to insurance claims, the rising cost of reinsurance, and changes in state laws and regulations. Florida is prone to hurricanes, tornadoes, and other weather events, making it a high-risk area for insurers.

Additionally, the high volume of litigation related to insurance claims in the state has driven up the cost of claims. Furthermore, the cost of reinsurance has also increased significantly, and this cost is often passed on to policyholders through higher premiums.

Lastly, changes in state laws and regulations, such as requiring insurers to provide more extensive coverage for hurricane-related roof damage, have also increased insurance rates.

How much is homeowners insurance increasing in Florida?

Homeowners insurance rates in Florida have increased significantly in recent years due to the state’s home insurance crisis. Insurance providers have proposed rate increases ranging from 7.2% to 50%, depending on the location and the insurance company. These increases are much higher than the annual increases of 5% to 10% that were common in the past.

Is there a homeowners insurance crisis in Florida?

Yes, there is a homeowners insurance crisis in Florida. The state has been facing a significant increase in insurance rates for homeowners in recent years, making it challenging for property owners to afford adequate insurance coverage.

Who is the largest home insurer in Florida?

The largest home insurer in Florida is Citizens Property Insurance Corporation. Citizens is a non-profit, tax-exempt government corporation created to provide insurance to homeowners who can’t find coverage in the private market. As of 2021, Citizens insured over 448,000 policies, making it the state’s largest insurer of residential and commercial properties.

Find home insurance amidst the Florida insurance crisis

Even though the Florida insurance crisis is troublesome, it’s not impossible to find home insurance. Use our online quoting tool to find the best coverage for the best possible rates.

Related content: